Last updated on Feb 17, 2026

Get the free Chapter 13 Plan template

Show details

The debtor may use the chapter 13 plan to disclose when the payment of funds will be made by the debtor to the trustee for distribution to the creditors. The form also contains a plan analysis and

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is chapter 13 plan

A Chapter 13 plan is a proposed repayment plan that allows individuals to pay off their debts over a period of three to five years under the protection of bankruptcy court.

pdfFiller scores top ratings on review platforms

its awesome

its awesome...................

A really great and efficient way of…

A really great and efficient way of editing your pdf.

Stop looking, this is it!

Great product, makes creating fillable pdf forms a breeze!

illiant app

brilliant app. Very versatile indeed and easy to use!

Super easy PDF Editor

Super easy, intuitive and let me get the task done I wanted to edit my existing PDF document and add signable features.

I found PDFfiller intuitive and very…

I found PDFfiller intuitive and very user friendly.

Who needs chapter 13 plan template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Chapter 13 Plan Form (Chapter 13 Bankruptcy)

TL;DR: How to fill out a chapter 13 plan form

To fill out a Chapter 13 plan form, start by gathering personal and case information, including details about debts and creditors. Follow the outlined steps to ensure accurate completion and legal compliance and ensure timely submission to the bankruptcy court.

What is Chapter 13 Bankruptcy?

Chapter 13 Bankruptcy is designed to allow individuals with regular income to create a repayment plan to pay off their debts over three to five years. The purpose is to help debtors maintain their property while repaying creditors in a structured manner. This type of bankruptcy can protect individuals from foreclosure and offers a more manageable way to address financial difficulties.

-

A legal process that enables individuals with a regular income to propose a repayment plan to settle their debts over a specified timeframe.

-

The plan helps individuals restructure debts while keeping their assets and providing legal protection against creditors.

-

Debtors must have a regular income and their unsecured debts must be below a certain limit, which varies annually.

What are the key components of the Chapter 13 plan form?

The Chapter 13 plan form consists of essential sections to ensure that all necessary information is captured effectively. Completing this form thoroughly is crucial for the successful submission of a bankruptcy case.

-

Details such as name, address, and contact information for the individuals filing for bankruptcy.

-

The location and details of the bankruptcy court where the case is being filed.

-

The unique number associated with the bankruptcy case, allowing for easy tracking and reference.

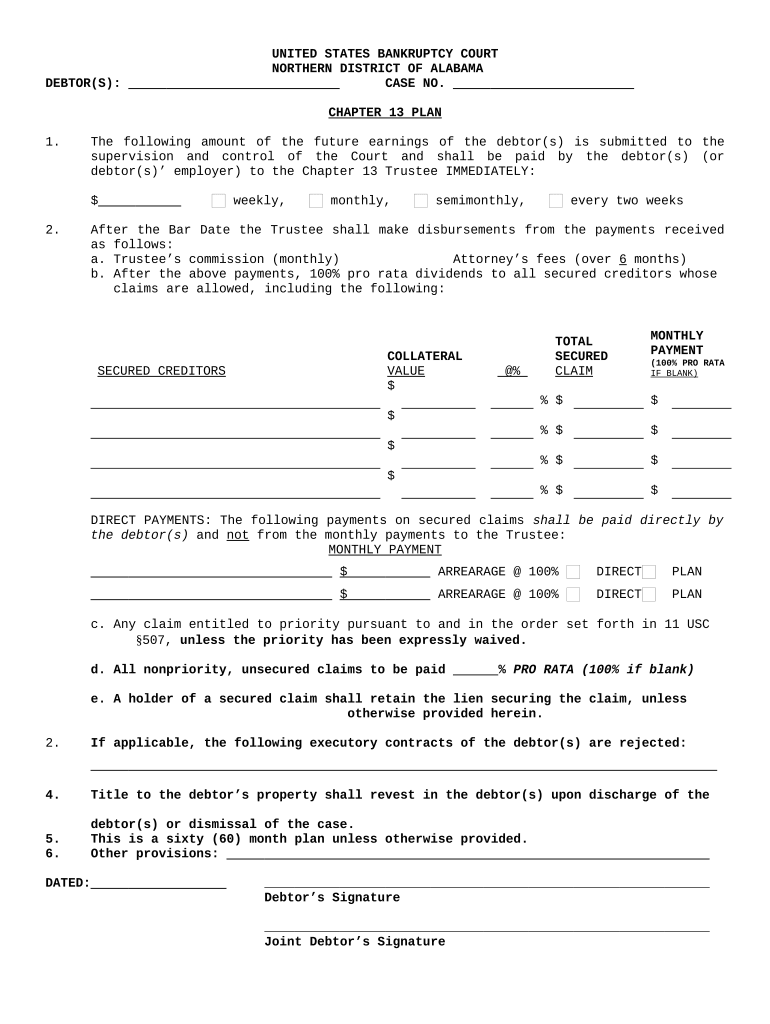

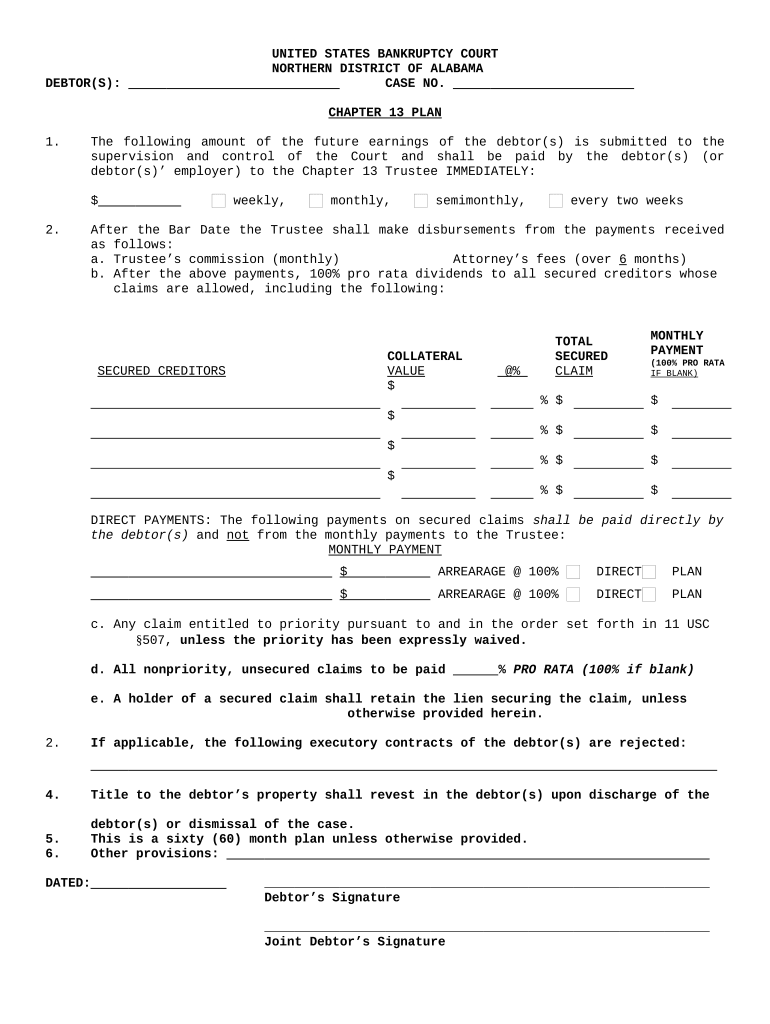

How does submitting future earnings to the court work?

In a Chapter 13 plan, debtors commit a percentage of their future earnings to be submitted to the bankruptcy court. This is structured based on the repayment plan agreed upon by the debtor and the creditors.

-

The percentage depends on the total debt and the individual's disposable income.

-

Debtors can choose payment intervals, such as weekly, monthly, semimonthly, or every two weeks.

-

Meeting payment deadlines is critical for maintaining the Chapter 13 plan and avoiding dismissal of the case.

What are trustee disbursements and payments?

After the Chapter 13 plan is confirmed, the Trustee manages disbursements to creditors according to the terms of the plan. Understanding how these payments are calculated is crucial for debtors.

-

Payments are disbursed as per the confirmation order and follow the specified payment schedule.

-

The Trustee collects a fee for their service, which is deducted from the payments made to creditors.

-

Calculations depend on the secured claims and the specific repayment plan setup.

How do secured creditors and claims get detailed?

Secured creditors play a vital role in Chapter 13 cases as they hold an interest in a debtor’s specific properties. Properly detailing these creditors and claims in the plan form helps ensure fair treatment.

-

These are creditors who have a legal claim to specific property in the event of nonpayment.

-

Collateral should be clearly identified along with a fair market value to calculate obligations.

-

Debtors must accurately compute the amounts owed to secured creditors based on the overall claims.

What are direct payments and arrearages?

Direct payments occur when debtors make payments directly to secured creditors. Understanding how these relate to arrearages is critical for maintaining accurate records throughout the bankruptcy process.

-

Clear documentation of direct payments is essential to avoid confusion during disbursements.

-

Arrearages are overdue payments; mismanagement can affect the bankruptcy case outcomes.

-

Direct payments impact the amount available for Trustee disbursements, complicating the repayment process.

What are priority and non-priority claims?

In Chapter 13 bankruptcy, claims are classified as priority or non-priority, influencing the order of repayment. Knowing these classifications helps debtors understand their responsibilities.

-

Priority claims are those that, by law, must be paid first in the event of a Chapter 13 bankruptcy.

-

These claims are paid only after priority claims are settled and include most credit card debts.

-

Debtors may be required to pay all their disposable income to creditors, influencing overall payment amounts.

What is the process for rejection of executory contracts?

In Chapter 13, debtors can reject executory contracts, which can significantly impact their financial obligations. Understanding the criteria for rejection is key to managing debts.

-

Debtors may reject contracts if they are burdensome and not beneficial to their bankruptcy plans.

-

Rejecting a contract may release the debtor from the obligation, but it could also lead to litigation.

When does revesting of property title occur?

Revesting of property title occurs when the bankruptcy plan is completed successfully, allowing debtors to regain full ownership. Knowing when this happens can guide debtors toward financial recovery.

-

Title generally revests to the debtor upon successful completion of all payments under the plan.

-

A discharge clears debts, while dismissal may leave the debtor with continued liability for the property.

How do you complete and submit the Chapter 13 plan form?

Completing the Chapter 13 plan form requires careful attention to detail. A step-by-step approach simplifies the process and enhances accuracy.

-

Follow each section methodically to ensure all required information is included and accurate.

-

Utilize editing and signing features available on the platform for efficient form management.

-

Ensure submission is made to the designated bankruptcy court by the specified deadlines.

How to fill out the chapter 13 plan template

-

1.Download the Chapter 13 plan form from the official bankruptcy website or use pdfFiller to access a fillable template.

-

2.Start by filling in your personal information, including your name, address, and the case number if applicable.

-

3.Outline the debts you are addressing in the plan, listing secured and unsecured debts separately.

-

4.Determine your disposable income and propose a monthly payment amount that fits within your budget while satisfying creditor claims.

-

5.Detail how long you plan to make payments, specifying whether it will be three or five years.

-

6.Include any special provisions, such as prioritizing certain debts over others or addressing mortgage arrears.

-

7.Review the completed plan for accuracy, ensuring all required details are included and calculations are correct.

-

8.Save the document and prepare for filing with the bankruptcy court, ensuring to follow any additional local rules or requirements.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.