Free Bankruptcy Word Templates

What are Bankruptcy Templates?

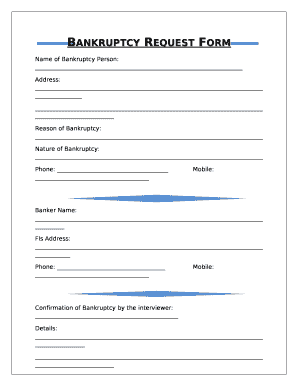

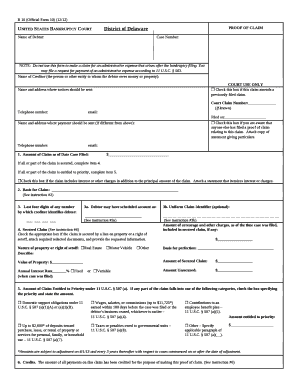

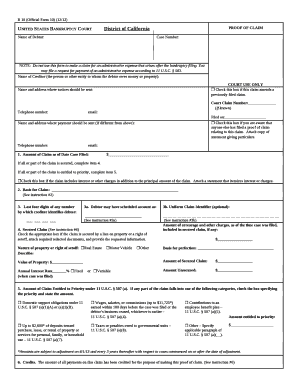

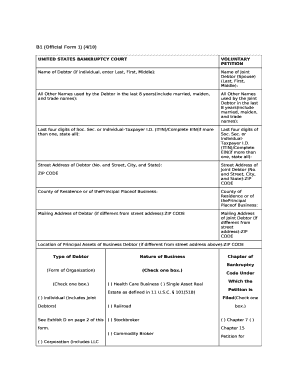

Bankruptcy templates are pre-designed forms and documents that individuals or businesses can use when filing for bankruptcy. These templates help streamline the process by providing a framework for organizing and presenting financial information to the court.

What are the types of Bankruptcy Templates?

There are several types of bankruptcy templates available, including:

Chapter 7 Bankruptcy templates

Chapter 13 Bankruptcy templates

Chapter 11 Bankruptcy templates

How to complete Bankruptcy Templates

Completing bankruptcy templates is a straightforward process that involves filling in the required information accurately. Here are some steps to help you complete bankruptcy templates:

01

Gather all necessary financial documents, including income statements, debt statements, and asset information.

02

Carefully review the instructions provided with the bankruptcy template to ensure you understand how to fill it out correctly.

03

Fill in all required fields on the template accurately and completely.

04

Review the completed template for any errors or missing information before submitting it to the court.

05

Consider using a platform like pdfFiller to create, edit, and share your bankruptcy templates easily online.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Bankruptcy Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Does bankruptcy affect my job?

Bankruptcy is a legal proceeding carried out to free individuals or businesses from their debts. Creditors still have an opportunity for repayment with the bankruptcy process. Bankruptcy is handled in federal courts, and rules are outlined in the U.S. Bankruptcy Code. Bankruptcy Explained: Types and How It Works - Investopedia investopedia.com https://.investopedia.com › terms › bankruptcy investopedia.com https://.investopedia.com › terms › bankruptcy

What happens when a person declares bankruptcy?

When you file for bankruptcy protection, a discharge from the court will relieve you of your obligation to repay your creditors for certain debts. As noted, once your debt is discharged, your creditors cannot contact you or attempt to collect the debt in any way.

What is the Downside of Filing for Bankruptcy?

Disadvantages of Declaring Bankruptcy Doesn't discharge all debts. Bankruptcy excludes alimony, child support, fines & some student loans. Loss of non-essential assets. Bankruptcy affects what assets you lose or keep. Impact on credit. Employment considerations. Advantages and Disadvantages of Declaring Bankruptcy hoyes.com https://.hoyes.com › personal-bankruptcy › declarin hoyes.com https://.hoyes.com › personal-bankruptcy › declarin

Does it hurt to file bankruptcy?

Bankruptcy may help you get relief from your debt, but it's important to understand that declaring bankruptcy has a serious, long-term effect on your credit. Bankruptcy will remain on your credit report for 7-10 years, affecting your ability to open credit card accounts and get approved for loans with favorable rates.

Is bankruptcy better 7 or 13?

Chapter 7 stays on your record for 10 years, while Chapter 13 stays for seven years. That would seem to suggest that Chapter 7 is worse for your credit score, but with Chapter 7, your debt, or at least the unsecured debt, will be gone. That means you can try to start rebuilding it immediately.

Is Chapter 13 as bad as Chapter 7?

Chapter 7 stays on your record for 10 years, while Chapter 13 stays for seven years. That would seem to suggest that Chapter 7 is worse for your credit score, but with Chapter 7, your debt, or at least the unsecured debt, will be gone. That means you can try to start rebuilding it immediately.

Related templates