CA-DE-101 free printable template

Show details

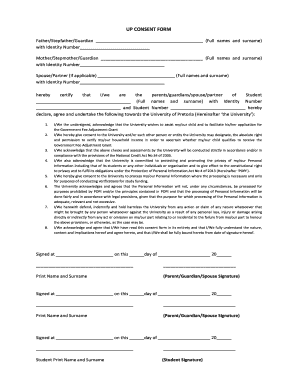

This form is an Affidavit of Surviving Spouse used to establish the right of the surviving spouse to succeed to the title of Community Property. The form is pursuant to California Probate Code Sections

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is CA-DE-101

The CA-DE-101 is a form used in California to document a financial disclosure statement for individuals undergoing a divorce or separation.

pdfFiller scores top ratings on review platforms

PDFfiller does everything I need. There is definitely a learning curve to use, but through experience it is amazing to have an app that does it all.

Gostei muito e tem sido muito útil para o que desejo.

Very good. Took a little getting used to but, I think I did it.

Been a God Send for my Realty Business .Thank You Bonnie Stutes

Great product and reasonably inexpensive.

All good. However it would be nice to be able to move the type up and down when placed on the page rather than have to keep placing the type symbol in a spot where you think it will fit on the line.

Who needs CA-DE-101?

Explore how professionals across industries use pdfFiller.

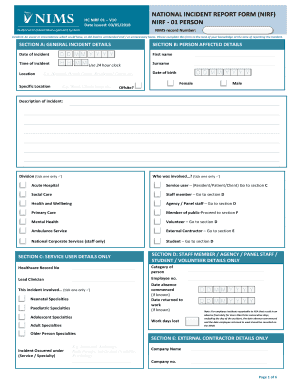

Comprehensive Guide to the CA-DE-101 Form on pdfFiller

Filling out a CA-DE-101 form is essential for those involved in California probate processes as it provides a structured way to declare the decedent's assets and debts. The CA-DE-101 form is used to report the value of the estate to the court, assisting in ensuring proper administration.

What is the CA-DE-101 form and why is it important?

The CA-DE-101 form, known as the 'Inventory and Appraisal' form, is a crucial document in California probate law. It serves to inventory the decedent's assets and liabilities, providing the court and interested parties with a clear financial picture of the estate. The accuracy of this form is vital, as it impacts the distribution of the estate and the responsibilities of the personal representative.

-

A form that details the inventory and appraisal of a decedent's estate during probate.

-

Ensures transparency and accuracy in estate administration, vital for legal proceedings.

-

Information on assets, their appraised values, and any debts owed by the decedent.

How can you complete the CA-DE-101 form efficiently?

Completing the CA-DE-101 form requires careful attention to detail and organization of necessary information. By following these steps, you can ensure compliance and ease during the filling process.

-

Gather details about the estate, including property values and liabilities.

-

Locate the CA-DE-101 form on pdfFiller's platform for ease of use.

-

Utilize pdfFiller’s editing tools to input data seamlessly.

-

Double-check all entered information to avoid errors that may lead to legal complications.

-

Make sure you save the final document for your records and any necessary submissions.

How can you manage your CA-DE-101 form using pdfFiller?

Managing your CA-DE-101 form effectively is essential for streamlined communication and documentation. pdfFiller offers various features tailored for this purpose.

-

You can easily make changes to your CA-DE-101 form as needed to reflect new information or corrections.

-

Invite others to review or contribute to the form, enhancing accuracy through collective input.

-

Ensure the legal acceptance of your form by using pdfFiller's eSignature feature.

-

Maintain organization by documenting changes and keeping track of different versions of your form.

What are common challenges faced when completing the CA-DE-101 form?

Like any legal document, completing the CA-DE-101 form can present some challenges. Recognizing these issues upfront can help mitigate potential pitfalls.

-

Mistakes in filling out the form often stem from miscalculated asset values or omitted liabilities.

-

Problems can occur with the way fields are structured in PDF format; utilizing pdfFiller can alleviate this.

-

Ensure thorough understanding and adherence to California's probate requirements to avoid delays or legal issues.

What legal considerations should be noted regarding the CA-DE-101 form?

While the CA-DE-101 form is a vital tool for estate administration, it is essential to understand its limitations and the need for legal counsel.

-

The form provides a framework but cannot address every specific legal circumstance of an estate.

-

For complex estates, seeking legal advice is crucial to navigate potential legal challenges.

-

Legal disclaimers regarding the form's use must be acknowledged to protect one's interests.

How to fill out the CA-DE-101

-

1.Start by downloading the CA-DE-101 form from pdfFiller or the California court website.

-

2.Open the form in pdfFiller and begin by entering your personal information in the designated fields, such as your name, address, and contact details.

-

3.Fill out the financial disclosure section accurately, detailing your income, expenses, assets, and debts as required.

-

4.Ensure that all numbers are clearly written and double-check for any errors or omissions.

-

5.Review the completed form for accuracy, making sure each section is filled out completely.

-

6.Use the 'Save' function in pdfFiller to keep your progress, or print it out if necessary.

-

7.Once finished, you can either submit the form electronically through pdfFiller or print it for mailing or physical submission to the court.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.