Get the free Business Credit Application template

Show details

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is business credit application

A business credit application is a formal request made by a business to obtain credit or financing from a lender.

pdfFiller scores top ratings on review platforms

Its very flexible. I miss a tool to merge several PDF docs together in a single file

I'm getting frustrated with the Robot thing.

My experience was very good. With PDFfiller I got the job done perfectly.

very useful in creating documents that need to be filled or signed

Gilbie was very helpful and professional!

This program saved me hours and hours...as well as supporting my purchase of a new home.

Who needs business credit application template?

Explore how professionals across industries use pdfFiller.

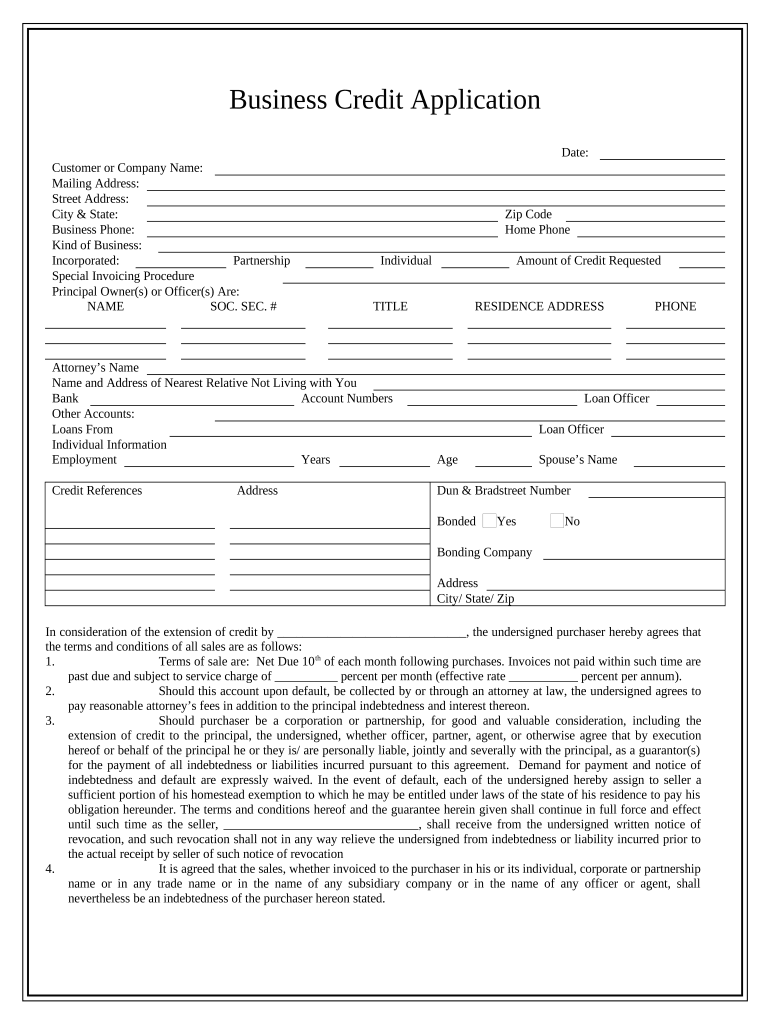

Comprehensive Guide to Business Credit Application Forms on pdfFiller

A business credit application form is an essential document used by businesses to obtain credit from suppliers or financial institutions. Understanding this form is crucial for a smooth application process.

What is a business credit application form and why is it important?

The business credit application serves as a formal request for credit. Its purpose is not only to evaluate a business's reliability and creditworthiness but also to facilitate provided goods or services.

What essential components should include in a business credit application?

-

The official name of the business requesting credit, ensuring accurate identification in records.

-

Providing the correct address and contact details is critical for communication regarding credit decisions.

-

Clarifying the legal structure helps lenders understand the liability aspects of the business.

-

Detailed information on how invoices should be processed, which can prevent future payment misunderstandings.

How do fill out the business credit application form step-by-step?

Filling out the application involves several precise steps to ensure all necessary information is provided.

-

Start by filling in fundamental data such as the business name and address.

-

Detail your business’s financial status and employment numbers, which contribute to creditworthiness.

-

Include solid references and bank details to provide a clearer picture of your credit history.

-

Review and comprehend the terms offered, ensuring alignment with your business practices.

What editing and management options are available for your business credit application form?

Editing your application is vital for updating information or correcting errors.

-

Make necessary changes easily using pdfFiller’s intuitive editing features.

-

Save or export your application in various formats for convenience and sharing.

-

Work collaboratively in real-time with your team to track changes and ensure accuracy.

What legal considerations should be aware of in credit applications?

-

Recognize the binding nature of the credit agreement and its potential legal ramifications.

-

Ensure that your application adheres to regional and local lending regulations.

-

Utilize pdfFiller’s secure e-signing capabilities to enhance document management and security.

What common mistakes should avoid when completing a business credit application?

-

Double-check all fields are filled in correctly to avoid delays in processing.

-

Ensure you fully comprehend the terms to avoid unfavorable agreements.

-

Consider professional guidance to enhance your application success rate.

What additional features does pdfFiller provide for document management?

-

Work seamlessly with your team from anywhere, enhancing collaboration.

-

Connects with various tools to streamline your workflow.

-

Protect sensitive documents with high-level security protocols.

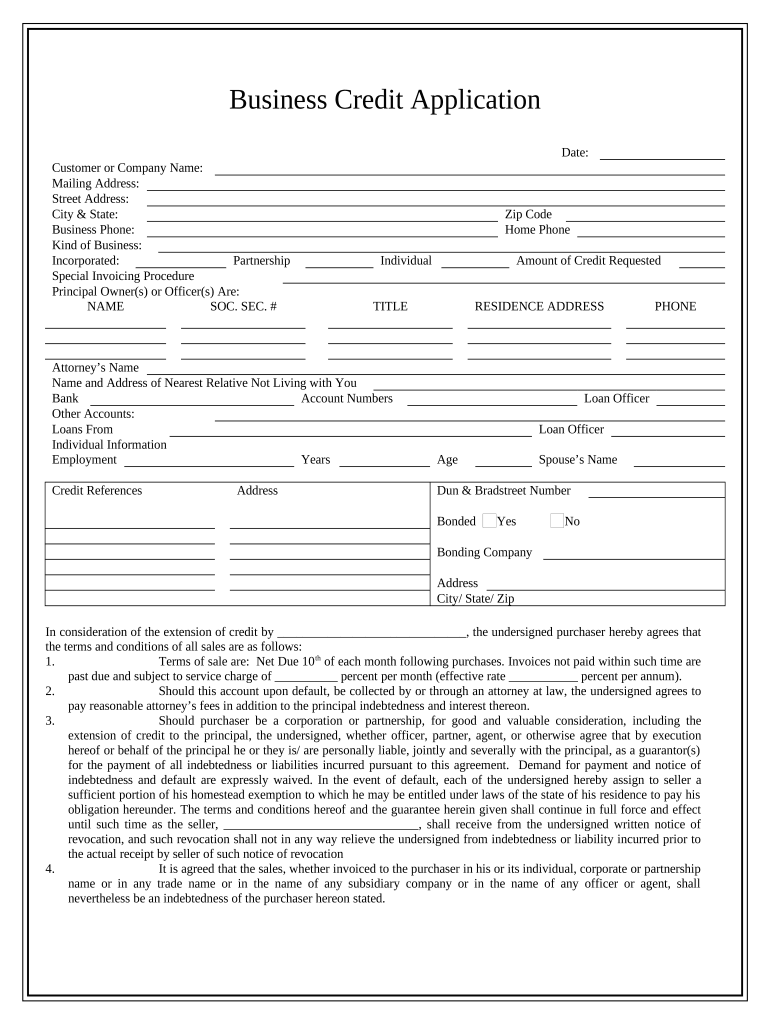

How to fill out the business credit application template

-

1.Open the business credit application PDF in pdfFiller.

-

2.Begin by entering your business's legal name in the specified field.

-

3.Fill out the business address and contact information accurately.

-

4.Provide the business structure type (e.g., LLC, corporation) and date of establishment.

-

5.Input your Employer Identification Number (EIN) or Social Security Number (if applicable).

-

6.List the owners or key stakeholders of the business with their personal details.

-

7.Fill in the requested financial information, including revenue and expenses.

-

8.Review the application for accuracy and completeness.

-

9.Sign the application electronically using pdfFiller's signature tool.

-

10.Submit the completed application to the lender as per their instructions.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.