Last updated on Feb 20, 2026

Get the free Small Estate Affidavit for Estates under $100,000 template

Show details

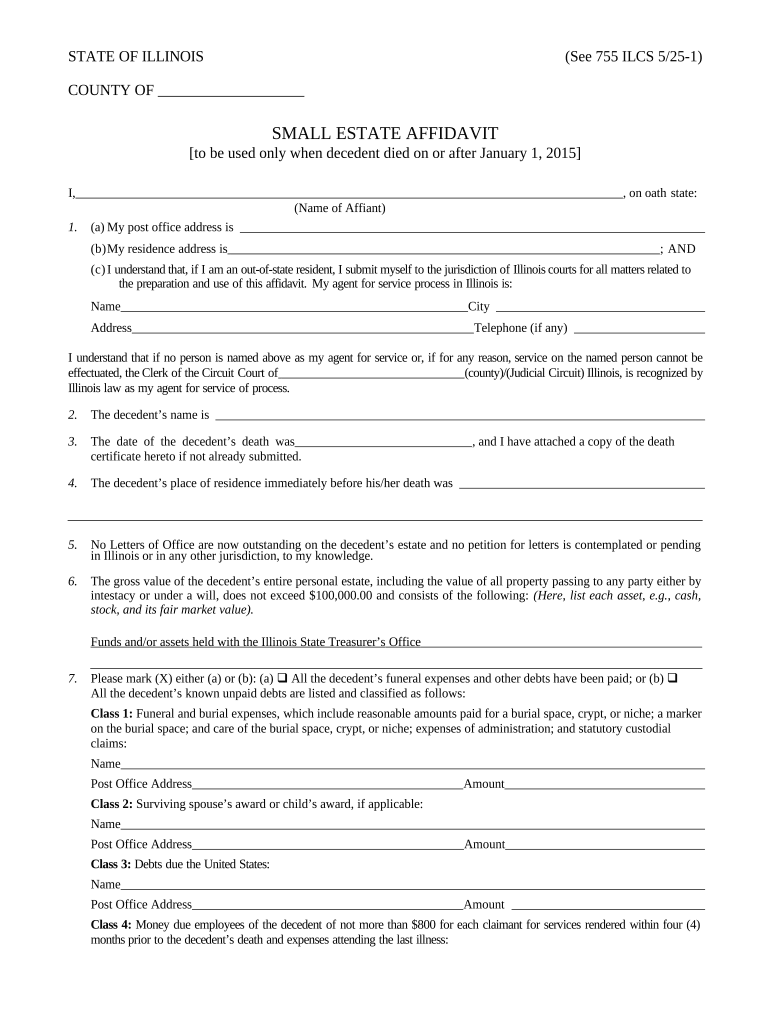

Under Illinois statute, where as estate is valued at less than $100,000, an interested party may, issue a small estate affidavit to collect any debts owed to the decedent.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is small estate affidavit for

A small estate affidavit is a legal document used to expedite the transfer of assets from a deceased person's estate that qualifies as a small estate under state law.

pdfFiller scores top ratings on review platforms

Just starting - so far so good, I'll let you know!

I just wanted to fill one document but I don't have full adobe on this machine. Then I wanted to print and I had to buy it to print which was okay as I need a system. It works great now that I am learning how it flows.

So far it has worked for what I need. I wish there was a better price for non profit corporations. AZ Exotic Bird Rescue, Inc. is a 501c3 charity but I had to buy myself because of the cost.

I use it for filling out work related forms. The forms look much better when filled out online rather than writing in all of the data. I'm able to save a copy online or on my computer, rather than filing a hard copy. It's very convenient and the forms look good too.

Most new software takes a bit of time to get used to it.

een great. This frequent pop up is the worst though

Who needs small estate affidavit for?

Explore how professionals across industries use pdfFiller.

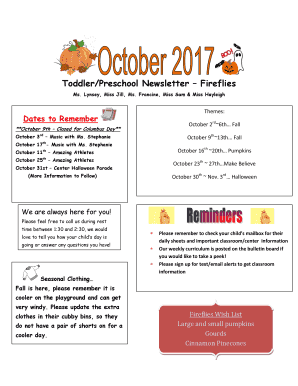

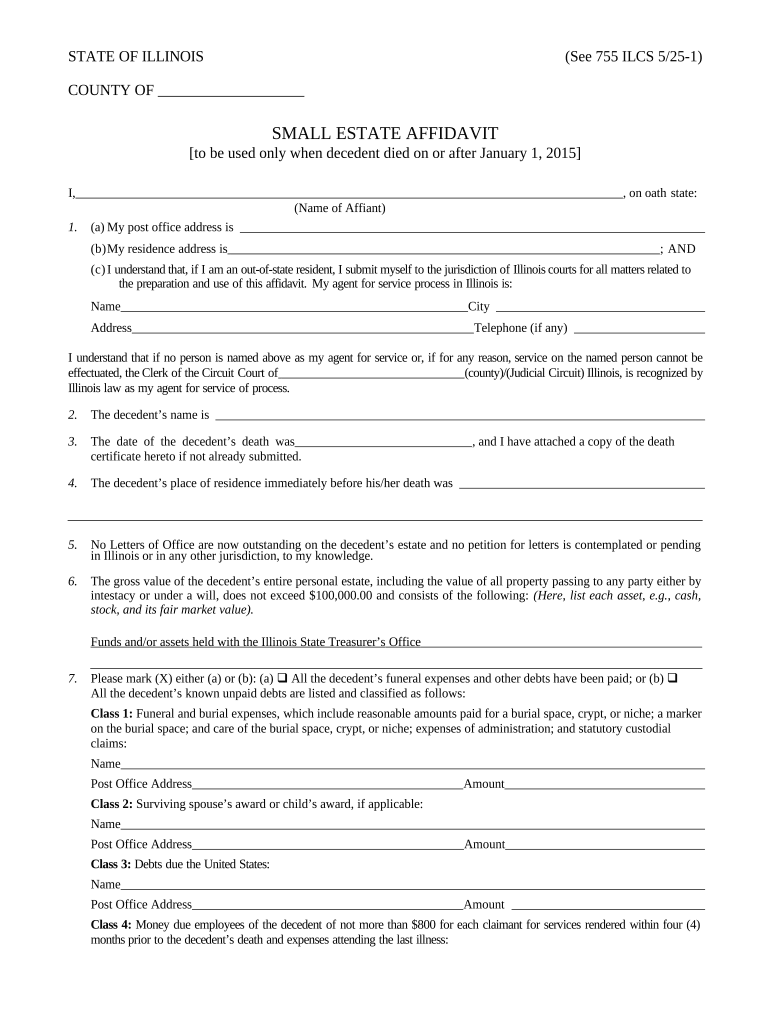

Complete Guide to Small Estate Affidavit for Form in Illinois

Navigating the small estate affidavit process can seem daunting, but with a clear understanding, you can efficiently manage the estate of a loved one. This guide aims to simplify the steps required to fill out a small estate affidavit form in Illinois, allowing you to take control of the process.

In Illinois, a small estate affidavit is used to bypass lengthy probate proceedings for estates that meet certain criteria. Obtaining this affidavit expedites the distribution of assets to heirs, making it a vital instrument for estate management.

What is a small estate affidavit?

A small estate affidavit is a legal document that allows a person to collect and distribute the assets of a deceased person without going through the formal probate process. The affidavit serves as proof for financial institutions and other entities that the affiant has the right to access and manage the deceased’s assets.

-

It simplifies the process of transferring property without lengthy court proceedings.

-

Helps ensure that the decedent's estate is settled efficiently, reducing costs associated with probate.

-

In Illinois, the small estate affidavit is governed by specific state laws detailing the value thresholds and eligible assets.

Who qualifies to use a small estate affidavit?

The eligibility to file a small estate affidavit is crucial in determining if this streamlined process is applicable. Generally, the decedent's estate must not exceed $100,000 in value, and certain criteria must be met for the affiant.

-

The total value of the decedent's estate must be under Illinois’s small estate threshold.

-

Typically, an immediate family member or an individual named in the will may act as the affiant.

-

Affiants must ensure they meet the specified qualifications before filing the affidavit.

How to complete the small estate affidavit?

Completing the small estate affidavit requires careful attention to detail and the gathering of essential documents. Each step is imperative to ensure the affidavit is valid and accepted by relevant parties.

-

Collect vital paperwork, including the death certificate and asset descriptions.

-

Ensure that all required fields are filled out correctly, and account for common errors.

-

Having the affidavit notarized is necessary to validate the document legally.

-

Submit the completed affidavit to the relevant financial institutions or courts.

What should be considered regarding debts and expenses?

Addressing outstanding debts and funeral expenses is a crucial part of managing an estate. Properly reporting these within the small estate affidavit can prevent complications later on.

-

Include these costs in the affidavit to ensure they are factored into the estate's settlement.

-

Adhere to guidelines on managing known debts, as they can impact the estate distribution.

-

Understanding how debts are categorized can influence their priority in settlement.

How to resolve issues with the small estate affidavit?

Despite careful preparation, issues may arise once the small estate affidavit is submitted. Knowing how to address these can save time and resources.

-

Learn about the typical problems faced, such as insufficient documentation.

-

Understand what the court can do to assist in affirming claims surrounding the affidavit.

-

Have a clear plan for addressing rejections, including gathering more evidence or documentation.

How to fill out the small estate affidavit for

-

1.Obtain the small estate affidavit form from pdfFiller or a local court.

-

2.Complete the header with your name, contact information, and the estate's details.

-

3.Provide the name of the deceased, their date of death, and last known address.

-

4.List all assets belonging to the deceased that fall under the small estate threshold as per your state laws.

-

5.Identify the heirs or beneficiaries that are entitled to the deceased's assets and their relationship to the deceased.

-

6.Sign and date the affidavit in front of a notary public as required.

-

7.Upload your completed affidavit to pdfFiller, ensuring all information is clear and legible.

-

8.Submit the affidavit to the relevant court or institution holding the deceased's assets, if necessary.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.