Last updated on Feb 17, 2026

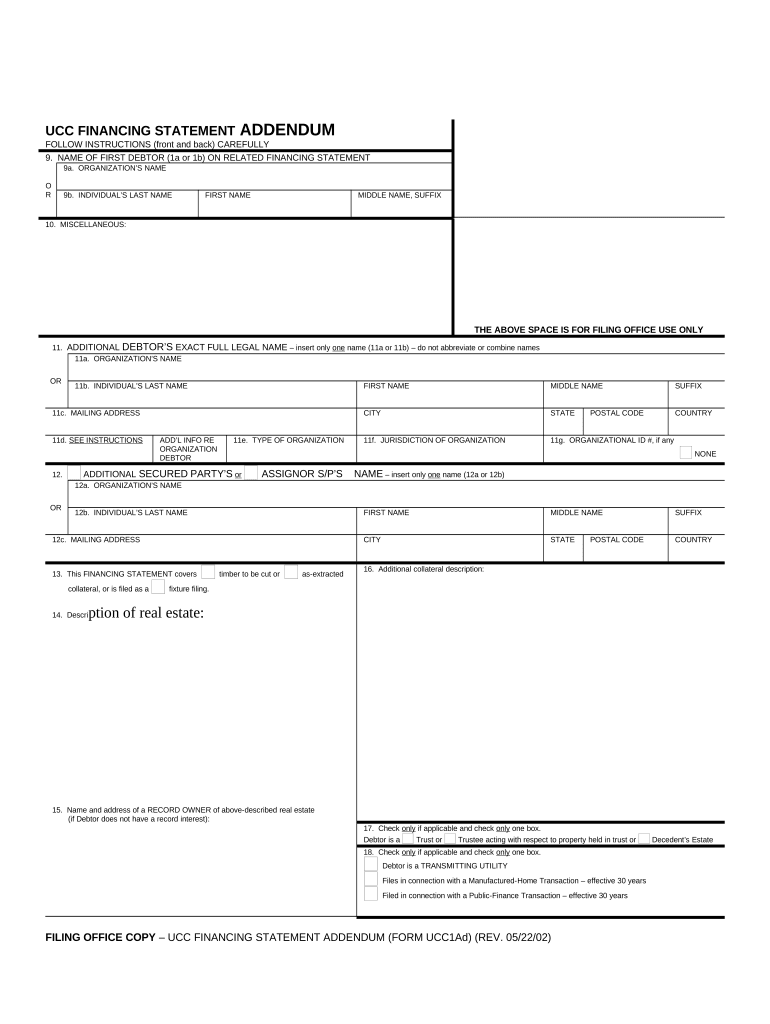

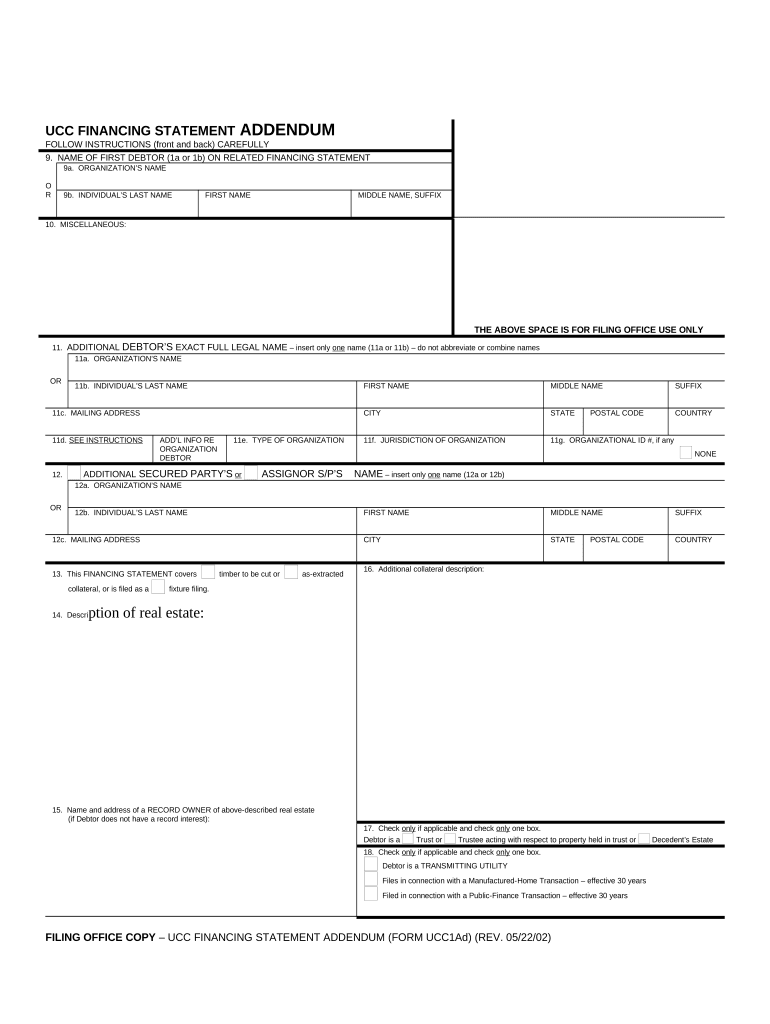

Get the free Indiana UCC1 Financing Statement Addendum template

Show details

This form is an official UCC form which complies with all applicable Federal codes and statutes. USLF updates all Federal forms as is required by Federal statutes and law.

pdfFiller is not affiliated with any government organization

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is indiana ucc1 financing statement

The Indiana UCC1 financing statement is a legal document used to secure a lender's interest in personal property offered as collateral for a debt.

pdfFiller scores top ratings on review platforms

I DON'T HAVE TIME TO LEAVE A PROPER REVIEW BUT I LOVE THIS SITE

Although I'm not exactly sure what I am doing....I have been able to easily edit documents as needed. I like the ease of use!

Went reasonably well. Very quick responses to my questions.

PDFfiller was simply and easy to use. I love it.

OK SO FAR, NOT COMPLETELY USER FRIENDLY.

I am a first time user and I am thrilled. This is making my job so much easier and I am more efficient.

Who needs indiana ucc1 financing statement?

Explore how professionals across industries use pdfFiller.

Your Guide to the Indiana UCC1 Financing Statement Form

Filling out an Indiana UCC1 financing statement form is essential for securing transactions that involve collateral. In this guide, you will learn everything necessary to navigate the form efficiently, understand its components, and ensure compliance with Indiana's legal requirements.

What is a UCC1 financing statement?

A UCC1 financing statement is a legal document used to secure a lender's interest in collateral. The UCC stands for the Uniform Commercial Code, which standardizes commercial transactions across states. It plays a critical role in secured transactions, allowing creditors to establish their rights to borrowers' assets.

The filing process involves submitting the completed UCC1 form to the appropriate state office, where it becomes a public record. This serves to notify other potential creditors about the existing claims on collateral, ensuring transparent transactions.

What are the key components of the UCC1 financing statement form?

-

The debtor's name and address must be accurate to avoid issues that could invalidate the filing.

-

This section identifies the creditor and must clearly state their name to establish legitimacy.

-

This is critical; the description must sufficiently identify the collateral to secure the debt properly.

How do you complete the UCC1 financing statement?

-

Enter the complete name and address for accurate identification.

-

Ensure to include a comprehensive description to cover all secured assets.

-

Add jurisdiction details and identification information in accordance with state regulations.

-

Leverage pdfFiller's digital tools for easy completion and management of your form.

What common mistakes should you avoid when filing UCC1 statements?

-

Any errors in debtor details can lead to a rejection or an ineffective filing.

-

Failure to describe the collateral can result in legal disputes or loss of security rights.

-

Each state has its specific filing regulations; ensuring compliance is essential to uphold your security interest.

How can pdfFiller enhance your document management experience?

pdfFiller provides seamless PDF editing, signing, and collaboration features, making it an excellent tool for individuals and teams managing financial documentation.

-

Modify your UCC1 form effortlessly and apply electronic signatures without hassle.

-

Work collectively on documents, ensuring everyone is on the same page during the filing process.

-

Manage and access your documents from anywhere, providing the flexibility needed for today’s working environment.

How to maintain compliance with state regulations?

Understanding the specific filing requirements in Indiana is critical for maintaining compliance. Each state has laws governing the UCC filings that require timely submission and updates when necessary.

-

Familiarize yourself with Indiana’s filing rules to ensure your UCC1 statement is valid.

-

Be aware of deadlines to keep your filings active and enforceable.

-

Failure to comply may result in legal complications and loss of secured status.

When and how should you amend a UCC1 filing?

Amending a UCC1 financing statement may become necessary due to changes in debtor information, collateral descriptions, or updates in secured party details.

-

Changes in collateral or any inaccuracies noted during the original filing are prime reasons for amendments.

-

Follow the state's prescribed process for amendments to ensure legality.

-

Utilize pdfFiller’s tools to simplify the amendment process and maintain document integrity.

How do you navigate the filing office and access resources?

Knowing how to interact with the state filing office can streamline your UCC filing experience. Understanding its role and available resources is crucial.

-

Identify the office's duties to gain insight into their administrative processes.

-

Research online or consult state resources to find contact information for assistance.

-

Submit your filings smoothly through integrated services offered by pdfFiller.

What additional services are available for UCC1 filings?

-

Consult an attorney for complex UCC cases that may require professional navigation.

-

Financial professionals can facilitate proper UCC filings and offer strategic advice.

-

Easily create and edit various legal forms using pdfFiller's comprehensive toolkit.

How to fill out the indiana ucc1 financing statement

-

1.Access pdfFiller and log in or create an account.

-

2.Select the UCC1 financing statement template.

-

3.Begin filling out the section for Debtor information, including the name and address of the debtor.

-

4.Proceed to fill out the Secured Party information, providing the name and address of the lender or entity securing the interest.

-

5.Include a description of the collateral being financed, making sure to be as specific as possible to avoid disputes.

-

6.Review all information for accuracy and completeness, ensuring there are no typographical errors.

-

7.If applicable, include any additional attachments that may be required for your specific case.

-

8.Once completed, save the document and proceed to submit it to the appropriate state office for filing, which can be determined on the Indiana Secretary of State website.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.