Last updated on Feb 17, 2026

Get the free Kentucky Installments Fixed Rate Promissory Note Secured by Commercial Real Estate t...

Show details

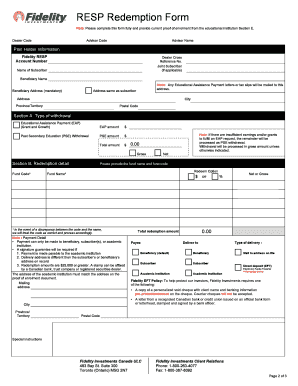

This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is kentucky installments fixed rate

Kentucky installments fixed rate refers to a loan structure in which the borrower repays the borrowed amount in fixed monthly payments over a set period.

pdfFiller scores top ratings on review platforms

So far it's been great, I don't have to travel anywhere to sign a document. so that has been helpful.

Great experience - easy to use & intuitive. Thank you!

Just a little problem with getting the text in the right spot or the right size. I am old, but I finally figured it out.

Great service and product. I find it easy to use.

I really like it so helpful lol I have a big smile on my face thank u

It took me a few minutes to figure out how to find you and to find the form I needed. But had no trouble after figuring out the ins and outs of what I needed to do. Thanks

Who needs kentucky installments fixed rate?

Explore how professionals across industries use pdfFiller.

Kentucky Fixed Rate Installment Note: A Comprehensive Guide

Navigating the Kentucky Fixed Rate Installment Note form is essential for both borrowers and lenders, enabling clear terms of repayment. This guide will break down the key components, helping you to fill out and manage the form seamlessly.

What are Kentucky fixed rate installment notes?

A Kentucky fixed rate installment note is a legal document that defines a loan agreement between a borrower and a lender, outlining the repayment terms. The primary components of this note include the principal amount borrowed, the interest rate, and the schedule for payments.

-

These notes serve as a formal acknowledgment of debt and ensure both parties are aware of the payment structure.

-

Essential elements include the total loan amount (principal), the interest charged, and the payment timeline.

-

Kentucky law governs the conditions of these notes, ensuring compliance and protection for both lenders and borrowers.

What should borrowers know when filling out the form?

-

Ensure you have all necessary personal information and financial details before starting.

-

Provide your complete residential address to avoid any processing delays.

-

Accurate names and addresses of lenders help in validating the loan agreement and establishing communication.

How are interest rates specified in Kentucky notes?

-

Interest is typically calculated based on the outstanding principal amount, influencing total repayment cost.

-

A higher annual interest rate can significantly affect total repayment and monthly obligations.

-

Conditions such as late payments may trigger increased interest rates, adding to the total cost of the loan.

What is the monthly payment structure like?

-

Payments are often required monthly, with specific due dates outlined in the note.

-

Be sure to calculate total expenses, including interest, to accurately establish your monthly payment.

-

The maturity date signifies when the final payment is due, marking the completion of the loan agreement.

What are the options for making payments?

-

Common forms of payment include cash, check, or money orders, which ensure flexibility for borrowers.

-

The individual or institution holding the note is responsible for processing payments appropriately.

-

Know where to make your payments, whether via mail, in person, or online to avoid delays.

What steps should follow to complete the Kentucky fixed rate note?

-

Access the form on pdfFiller and follow the provided instructions to fill it out correctly.

-

Make use of editing and signing tools offered by pdfFiller for efficient document handling.

-

Utilize collaborative features to work with teams, ensuring thoroughness in completion.

What common errors should you avoid?

-

Common errors include incorrect personal details or failing to sign the document, which complicates validation.

-

Confirm that all information adheres to Kentucky regulations to prevent legal issues.

-

Double-check all entries for accuracy to ensure a smooth approval process.

Where can you find additional resources?

-

Don’t hesitate to reach out to lenders for any clarifications regarding the form or terms.

-

Explore various legal resources to better understand your rights and obligations under the note.

-

Take advantage of pdfFiller’s customer support for any document management concerns you may have.

How to fill out the kentucky installments fixed rate

-

1.Open the PDF document for the Kentucky installments fixed rate.

-

2.Begin by entering your personal information in the designated fields, including your name, address, and contact details.

-

3.Next, provide the loan amount you wish to request; ensure it aligns with your financial needs.

-

4.Select the desired repayment term, which defines how long you will take to repay the loan, typically in months or years.

-

5.Indicate your preferred fixed interest rate for the loan, which determines your monthly payments.

-

6.Add details about your income and employment to assess your repayment capacity; include employer name and duration of employment.

-

7.Review all entered information for accuracy before proceeding.

-

8.Sign and date the document at the specified area to authorize the application.

-

9.Finally, save the completed form and submit it as instructed, either electronically or via mail, depending on lender requirements.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.