Get the free 13 f template

Show details

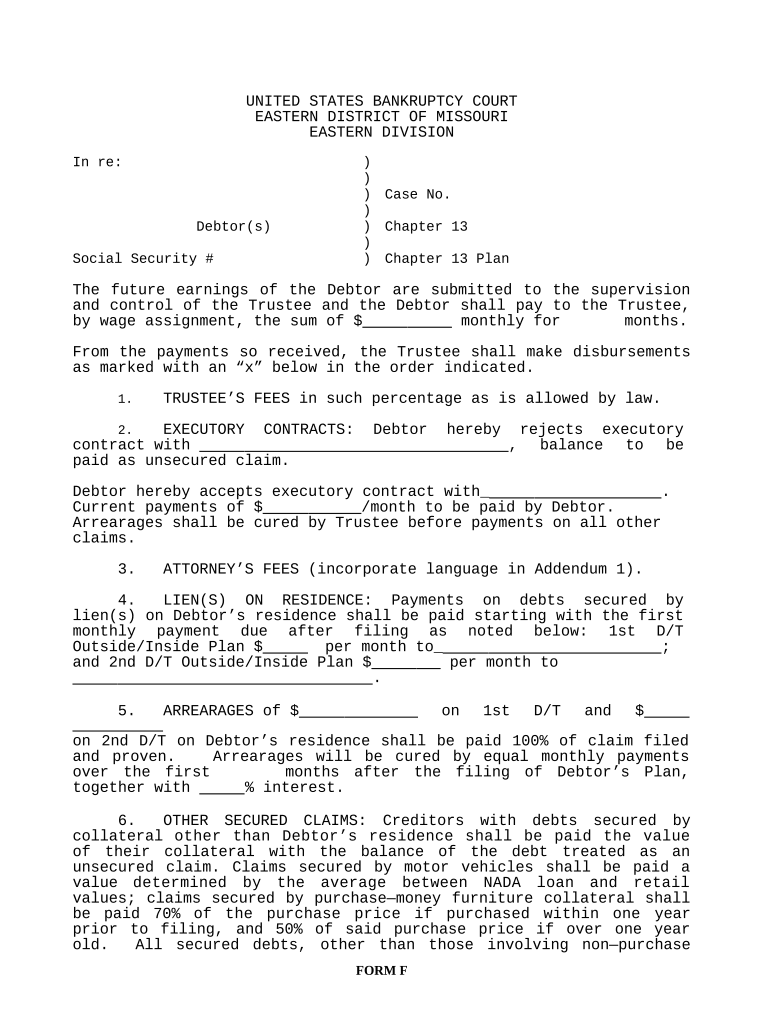

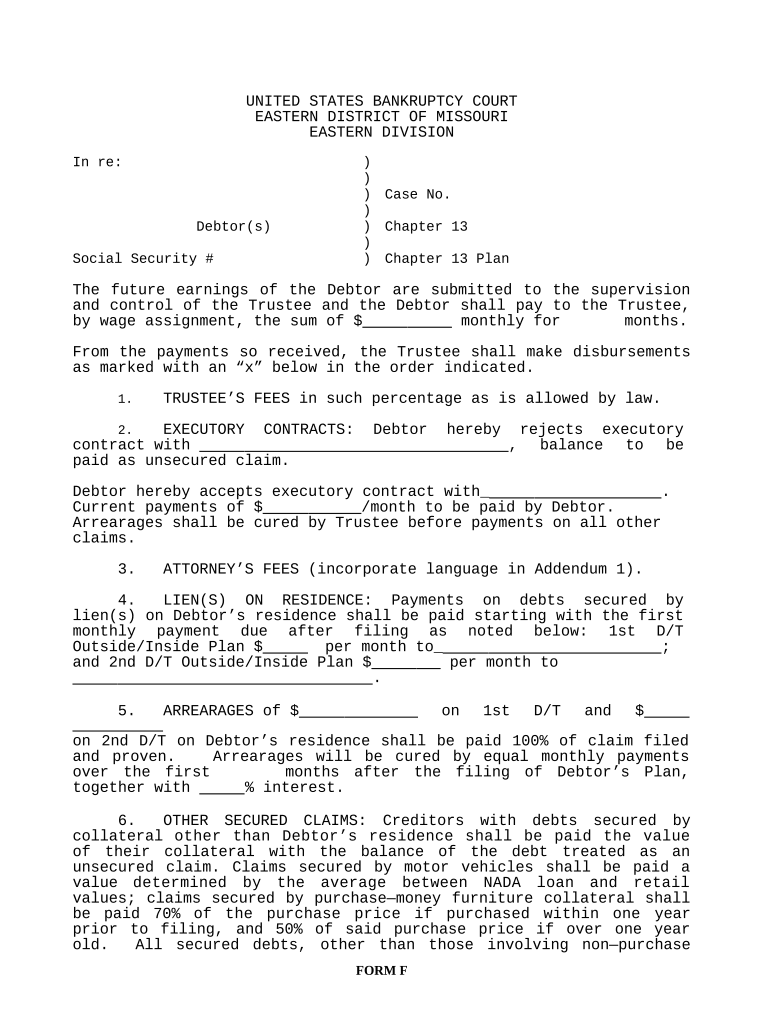

UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MISSOURI EASTERN DIVISION In re:))) Case No. )Debtor(s)) Chapter 13)Social Security #) Chapter 13 Plan The is future earnings of the Debtor are submitted

pdfFiller is not affiliated with any government organization

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is 13 f form

The 13-F form is a regulatory filing required by the SEC for institutional investment managers to report their holdings in publicly traded securities.

pdfFiller scores top ratings on review platforms

So far my experience has been good and self taught myself without using how to guide so easy to learn and do

In my line of work (payroll) it's a lot easier to be able to fill out some of the paperwork that I need to send to employees/managers and attach it via email instead of handwriting it and scan it to them.

i would like there to be more options to fill in and draw

So far it has been great, and it works on MAC too!

Very consistent and reliable program. Best on line program I have used.

I've been using a short time, but this has improved my productivity 3 fold!

Who needs 13 f template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to SEC Form 13F on pdfFiller

How to fill out a 13F form?

Filling out a 13F form involves understanding its requirements, accurately reporting your securities holdings, and adhering to SEC deadlines. Utilize platforms like pdfFiller to simplify this process as they offer tools that support electronic filing and collaboration.

What is SEC Form 13F?

SEC Form 13F is a quarterly report that institutional investment managers who manage over $100 million in securities must file with the U.S. Securities and Exchange Commission (SEC). The purpose is to provide transparency around institutional investments, allowing regulators and investors to scrutinize the holdings of these entities.

-

Definition and purpose: SEC Form 13F helps monitor the trading activities of large institutional investors, contributing to overall market transparency.

-

Regulatory importance: It is crucial in ensuring that institutional investment activities remain compliant with SEC regulations.

-

Reporting requirements: The form requires detailed disclosures about security holdings, including information on specific securities owned.

Who needs to file SEC Form 13F?

The SEC requires institutional investment managers with discretionary authority over $100 million or more in securities to file Form 13F. It is imperative that these entities understand the filing criteria and any potential exemptions to avoid penalties.

-

Filing criteria: Only institutional investment managers meeting the asset threshold are mandated to file.

-

Asset threshold: Investment firms managing $100 million in securities are obligated to submit this form.

-

Exemptions: Certain categories, including smaller private funds or existing exemptions, may qualify for non-filing.

What information is required on SEC Form 13F?

Form 13F requires a detailed report of equity security holdings, including the name of the security, the number of shares owned, and their value at the end of the reporting period. Proper categorization and accurate representation of these holdings are vital.

-

Securities holdings: The form requires a complete list of all securities owned, including stocks and bonds.

-

Accurate reporting: Managers must follow specific guidelines for reporting these holdings to ensure compliance.

-

Compliance tips: Keeping meticulous records and seeking assistance from compliance experts can streamline this process.

What are the filing deadlines for Form 13F?

Filing deadlines for SEC Form 13F are set quarterly, typically 45 days after the end of each calendar quarter. Late submissions can incur significant penalties, making adherence to these deadlines critical.

-

Key deadlines: Managers should take note of the quarterly deadlines, marking their calendars to ensure timely submissions.

-

Penalties: Late filing or omission can result in hefty fines and regulatory scrutiny.

-

Electronic filing: Utilizing platforms like pdfFiller offers an efficient way to submit documents electronically, reducing the risk of errors.

What are the implications of non-compliance?

Failing to file or filing inaccurate information can result in severe penalties, including fines and reputational harm. Case studies exemplifying past compliance failures emphasize the importance of diligent reporting.

-

Potential penalties: Non-compliance can lead to monetary fines and severe repercussions for businesses.

-

Legal ramifications: Incorrect filings may lead to additional legal scrutiny from authorities.

-

Case studies: Reviewing past scenarios can inform investment managers of the potential dangers associated with non-compliance.

How to streamline SEC 13F compliance?

Utilizing resources like pdfFiller can significantly enhance compliance with SEC Form 13F by automating and simplifying the filing process. Tools offered by pdfFiller aid in efficient data input and collaboration among teams.

-

Automation: pdfFiller can automate many tedious tasks associated with Form 13F filing, reducing errors.

-

Interactive tools: Utilize pdfFiller’s features for seamless data management and reporting compliance.

-

Team collaboration: Working together within pdfFiller can expedite the preparation and review process.

How to engage with the SEC post-filing?

After filing Form 13F, it’s essential to stay engaged with SEC officials by responding promptly to any inquiries. Maintaining meticulous records of all filings ensures that your organization is prepared for any additional requests.

-

Post-filing interactions: Understand how to navigate SEC inquiries in a professional manner.

-

Response strategies: Develop efficient strategies for responding to SEC requests for information.

-

Best practices: Maintain organized records and documentation to support ongoing communications with the SEC.

How to secure your filing process?

Engaging with compliance experts through pdfFiller can enhance your filing process and ensure thoroughness in document management. Their customer support is readily available to assist users in navigating the complexities of 13F filings.

-

Engage with experts: Collaborate with compliance professionals for tailored advice.

-

Access to support: pdfFiller offers robust support systems to guide you through the filing process.

-

Explore efficiencies: Look into additional functionalities within pdfFiller that can enhance document management.

How to fill out the 13 f template

-

1.Access the pdfFiller website and log in to your account or create a new account if you don't have one.

-

2.Search for the 13-F form template in the search bar and select it from the results.

-

3.Click on the form to open it in the pdfFiller editor.

-

4.Begin filling out the form by entering your name, address, and contact information in the appropriate fields.

-

5.Provide details about your institutional investment management activities, including the names and values of the securities held.

-

6.List each security in the allocated section, ensuring accurate and complete information for each entry.

-

7.Review your entries for accuracy, ensuring all required fields are filled and double-checking the security details.

-

8.Once you have completed the form, click on the 'Save' button to save your changes.

-

9.To submit the 13-F form, click on the 'Send' or 'Submit' option and follow the prompts to electronically file with the SEC.

-

10.Download a copy of the submitted form for your records and ensure you meet the filing deadlines.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.