Get the free North Dakota UCC1 Financing Statement Addendum template

Show details

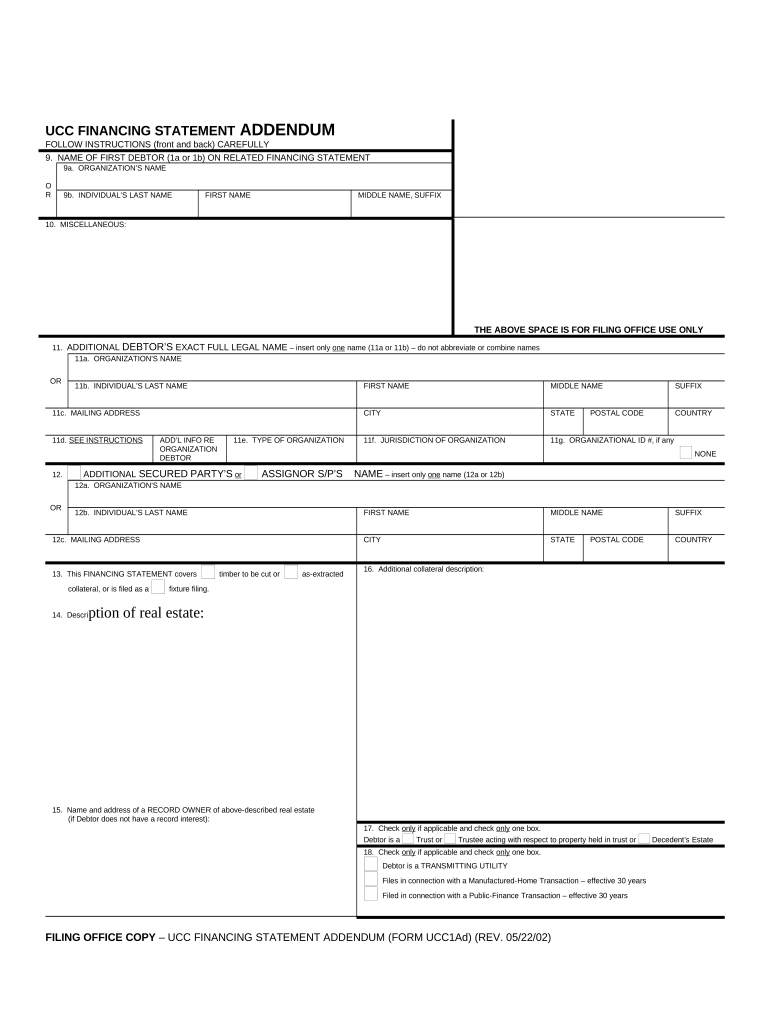

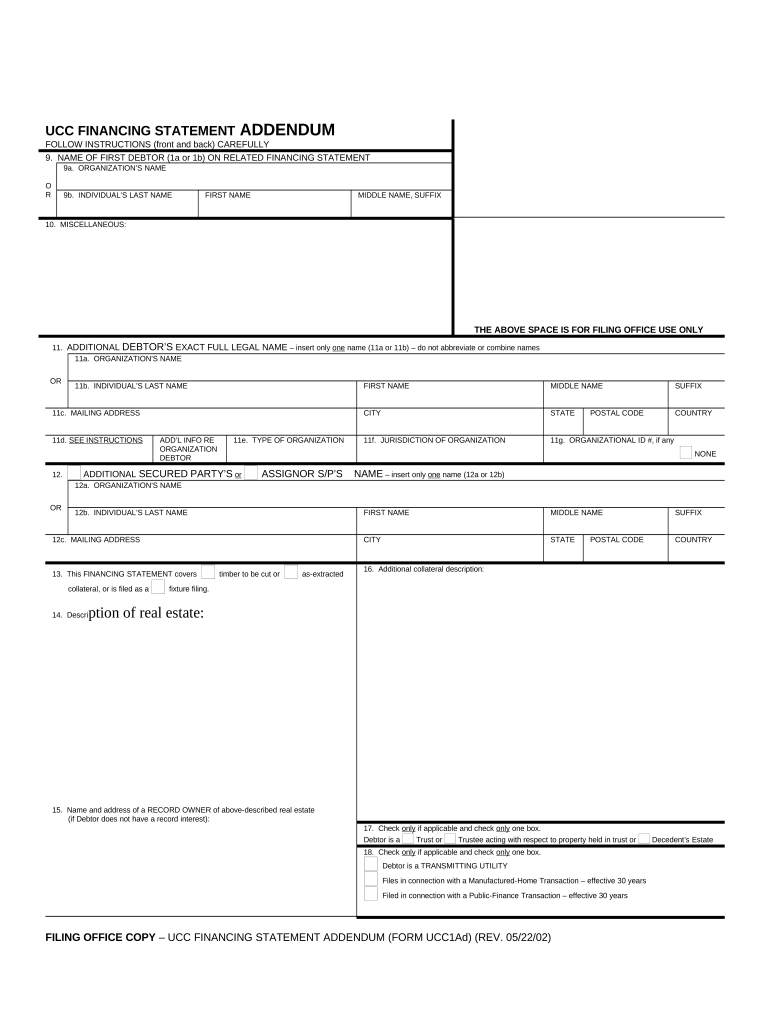

UCC1 - Financing Statement Addendum - North Dakota -For use after July 1, 2001. This form permits you to add an additional debtor if necessary to cover collateral as specified in the statement.

pdfFiller is not affiliated with any government organization

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is north dakota ucc1 financing

The North Dakota UCC1 financing statement is a legal document used to secure interest in personal property under the Uniform Commercial Code in North Dakota.

pdfFiller scores top ratings on review platforms

so far very good. I'll attend webinar later. No time now.

Overall very positive. Easy to use. Has met or exceeded my expectations.

This is a great tool for a good price. Thank you!

Allows me to neatly fill job and college applications.

great except when i want to email something sometimes the other party can't view it as a pdf. i dont get why. I want an option to save my new document in my own hard drive but can't figure out how to other than emailing it to myself. add that option or help me find it.

NOT AT THIS TIME. I AM VERY BUSY AND CANNOT DEDICATE A TIME FOR A WEBINAR RIGHT NOW.

Who needs north dakota ucc1 financing?

Explore how professionals across industries use pdfFiller.

How to fill out a north dakota ucc1 financing form

Understanding the UCC financing statement

A UCC Financing Statement is a legal document used to secure loans or other transactions. It provides public notice that a creditor has rights to a debtor's assets as collateral. The UCC, or Uniform Commercial Code, facilitates these transactions across states, ensuring clarity and consistency.

-

It’s a document that states a creditor's claim on collateral provided by the borrower.

-

The UCC provides a framework to standardize commercial transactions, enhancing trust and reducing disputes.

-

Includes debtor and secured party information, collateral description, and filing details.

Determining who the debtors are

Identifying the correct debtor is crucial for the accuracy and enforceability of the UCC filing. Whether dealing with organizations or individuals can influence the information needed for filing.

-

Debtors can be legal entities or individuals, requiring distinct identification processes such as business registration details or personal identification.

-

Collect pertinent details, such as names, addresses, and type of entity. Use official documents for verification.

-

List co-debtors if they also assume responsibility for the obligation, which can affect the security interest.

Completing collateral descriptions

Collateral description is pivotal as it defines what the secured party can claim in the event of default. Clear and accurate descriptions enhance the enforceability of the lien.

-

Collaterals can include various assets, and each type has specific description requirements under the UCC.

-

Descriptions should be specific enough to identify the collateral and not overly broad to avoid confusion.

-

In North Dakota, relevant examples include descriptions of real estate located in specific counties or types of timber by their general location.

Filing procedures and requirements

Filing a UCC Financing Statement in North Dakota requires adherence to specific procedures to ensure compliance with state laws. Failure to follow these procedures may result in rejection or inefficient protection.

-

In North Dakota, filings can be made online, by mail, or in person at the Secretary of State's office.

-

Be sure to include complete debtor names, correct collateral descriptions, and any applicable fees.

-

Filing fees vary depending on the method and urgency, with standard filings taking several days to process.

Extending and maintaining the lien

Once filed, maintaining a lien is crucial to ensure continued protection. This involves knowing how to extend or update the statement as needed.

-

A UCC lien typically lasts for five years unless renewed through a continuation statement.

-

To renew, a continuation statement must be filed within six months prior to the expiration of the original filing.

-

Avoid confusion by not updating the collateral description or failing to renew the statements in a timely manner.

Using pdfFiller to manage UCC forms

Utilizing pdfFiller for your UCC forms ensures a smooth workflow in preparing and submitting documents. Its cloud-based platform simplifies collaboration and document management.

-

Log in, upload your UCC form, edit as needed, and use the eSignature feature for quick submission.

-

Access your documents anywhere, collaborate with team members, and keep everything organized in one place.

-

Share the form with team members for real-time feedback and edits, streamlining the filing process.

Compliance notes and local specifics

Understanding local regulations is vital when filing a UCC statement in North Dakota. Familiarity with state-specific rules can prevent costly errors.

-

Compliance with the North Dakota Century Code is mandatory for proper UCC filings.

-

Certain local jurisdictions may have additional requirements, so checking with local offices is advisable.

-

Neglecting to verify debtor names or failing to file continuation statements before expiration can lead to complications.

Additional lien filing actions

After the initial filing, knowing the next steps is essential for managing your lien effectively. Changes in collateral or debtor status may require adjustments to your filing.

-

If collateral is sold, a new UCC filing might be necessary to secure future interests.

-

Consult with legal counsel if a claim is filed to understand your rights and obligations.

-

Filing varies depending on whether it's a secured loan or a lease; each has distinct requirements and outcomes.

How to fill out the north dakota ucc1 financing

-

1.Access the pdfFiller platform and log in to your account.

-

2.Search for the North Dakota UCC1 financing statement template.

-

3.Open the template and review the fields that need to be filled out.

-

4.Enter the name and address of the debtor in the designated sections.

-

5.Fill in the name and address of the secured party (lender) as per the requirements.

-

6.Complete the description of the collateral being secured in detail.

-

7.Double-check all entered information to ensure accuracy and completeness.

-

8.Use the 'Save' option to keep a copy of your document on pdfFiller.

-

9.Once satisfied with the filling, proceed to 'Print' or 'Download' the document.

-

10.Finally, sign the UCC1 and file it with the appropriate state office for public record.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.