Last updated on Feb 20, 2026

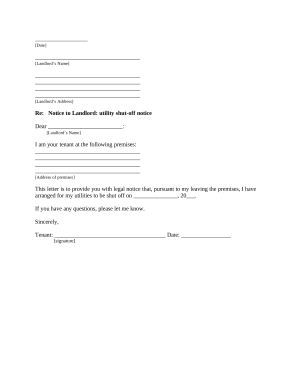

Get the free Chapter 13 Plan template

Show details

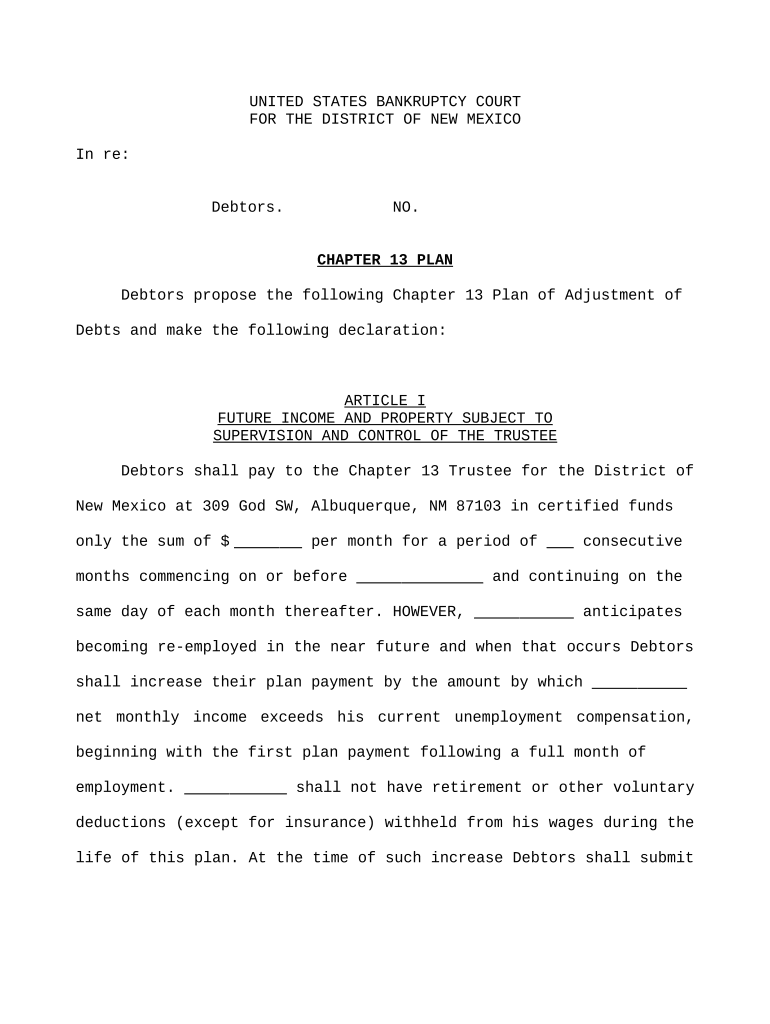

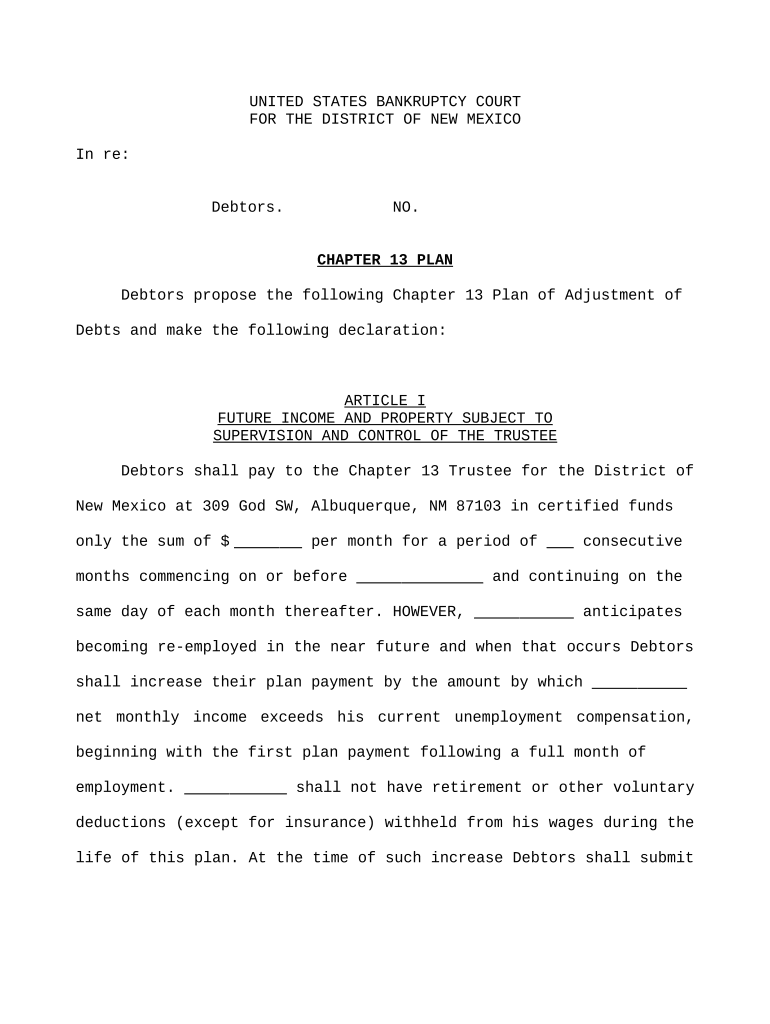

The chapter 13 plan lists in detail information concerning future income and property subject to the supervision and control of the trustee, classification and treatment of claims from funds submitted

pdfFiller is not affiliated with any government organization

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is chapter 13 plan

A Chapter 13 plan is a proposed repayment plan filed in bankruptcy court to repay creditors over a specified period, typically three to five years.

pdfFiller scores top ratings on review platforms

Best PDF Filler out there.

excellent

The curser was more stable this use time

very good program . recomended for enterprisesor private

PDF filler is easy and convenient to use.

This is a super good program, it helped me all along with my university applications, it's really fast and intuitive. Thanks, team PdfFiller :) Totally worth the money

Who needs chapter 13 plan template?

Explore how professionals across industries use pdfFiller.

How to fill out a chapter 13 plan form: A comprehensive guide

Understanding Chapter 13 bankruptcy plans

Chapter 13 bankruptcy is a legal process designed to help individuals with a regular income to reorganize their debts. The purpose of this type of bankruptcy is to create a repayment plan that allows filers to keep their property while paying down debts over a set period, typically three to five years. The Chapter 13 Plan Form is a crucial element of this process, detailing how the individual intends to repay their creditors.

-

It provides a structured way for debtors to repay creditors while maintaining possession of their assets.

-

This form outlines the repayment strategy and is essential for court approval.

-

While Chapter 7 involves liquidating assets to pay debts, Chapter 13 focuses on repayment over time.

What are the key components of the Chapter 13 plan form?

-

Includes details about the debtor, the trustee, and current contact information.

-

Outlines projected income and how property will be handled during the repayment plan.

-

Specifies the length of the repayment period and monthly payment amounts.

-

Provides a mechanism for making adjustments to the plan as necessary.

How do you fill out the chapter 13 plan form?

Filling out the Chapter 13 plan form requires careful attention to detail. Begin by accurately entering all debtor and trustee information. Next, project your future income, taking into account any changes you anticipate during the repayment period. Documenting plan duration and the amount you will pay each month is also crucial, so review your financial situation thoroughly.

-

Follow each section carefully and fill in the required information accurately.

-

Double-check numbers and ensure all relevant information is included to prevent court rejection.

-

Leverage features like form editing, signing, and cloud storage for greater efficiency.

What is the role of the Trustee in Chapter 13 plans?

The Chapter 13 Trustee oversees the repayment plan, ensuring compliance and proper disbursement of payments to creditors. Payments made to the Trustee are then allocated according to the approved plan, so it's essential to understand the implications of this role, including how failure to comply can affect your bankruptcy case.

-

The Trustee manages the administration of the bankruptcy case and ensures payments are made in accordance with the plan.

-

Payments can often be made directly through payroll deductions or electronic funds transfers for efficiency.

-

Trustees require that debtors remain in good standing with tax return filings, adding a layer of obligation.

When should you adjust your Chapter 13 plan?

Adjustments to your Chapter 13 plan may be necessary under various circumstances, such as a significant change in income. Understanding the process for proposing amendments ensures that your repayment plan remains feasible and aligns with your current financial situation.

-

Submit proposed changes when income fluctuates or unexpected expenses arise.

-

Alterations in income can adjust payment amounts or plan duration, necessitating a revision of the plan.

-

Consult your Trustee for guidance on how to properly submit amendments for court approval.

What are common issues with Chapter 13 plans?

Debtors often face challenges when submitting their Chapter 13 plans, including rejection by the court. Awareness of these common issues, alongside strategies for resolution, can help filers navigate potential pitfalls successfully.

-

Errors in documentation or failure to meet legal requirements can lead to plan rejection.

-

Ensure accurate documentation and follow up with the Trustee for clarification on expectations.

-

Non-compliance can lead to dismissal of the bankruptcy case, making timely and correct filings critical.

How can interactive tools help manage your Chapter 13 plan?

Using interactive tools, like those available on pdfFiller, can streamline the management of Chapter 13 plans. These tools facilitate document management, collaborative options, and a user-friendly interface that helps you easily edit, sign, and store documents.

-

Ensure efficient document management with an extensive range of tools aimed at simplifying the filing process.

-

Work with legal professionals or team members remotely to manage your documents easily.

-

Intuitive design aids in navigating document editing and signing processes effortlessly.

What should Chapter 13 filers in New Mexico keep in mind?

Individuals filing Chapter 13 in New Mexico should be aware of specific legal considerations unique to the state. Familiarizing yourself with these nuances, along with available resources for local legal advice, is critical to successfully navigating the Chapter 13 filing process.

-

Understanding state laws can affect repayment terms, exemptions, and local court procedures.

-

Local legal aid organizations can provide guidance tailored to New Mexico residents.

-

Keep track of key dates for filings and payments to ensure compliance with the court's requirements.

How to fill out the chapter 13 plan template

-

1.Gather necessary documentation including income statements, monthly expenses, and a list of debts.

-

2.Download a Chapter 13 plan form from a reliable source, preferably in a fillable PDF format.

-

3.Fill in your personal information at the top of the form, including your name, address, and case number.

-

4.Detail your income sources and amounts in the appropriate section to provide an overview of your financial situation.

-

5.List all secured and unsecured debts, ensuring to include account numbers and amounts owed.

-

6.Outline the repayment terms, specifying how much you can afford to pay each month.

-

7.Consider any priority debts that must be addressed first, like child support or tax obligations.

-

8.Review your plan for accuracy, making sure it adheres to legal guidelines for Chapter 13 cases.

-

9.Obtain any necessary signatures from a bankruptcy attorney or financial advisor if required.

-

10.Submit the completed plan electronically through pdfFiller or as instructed by your bankruptcy court, and keep a copy for your records.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.