Get the free Final Notice of Default for Past Due Payments in connection with Contract for Deed t...

Show details

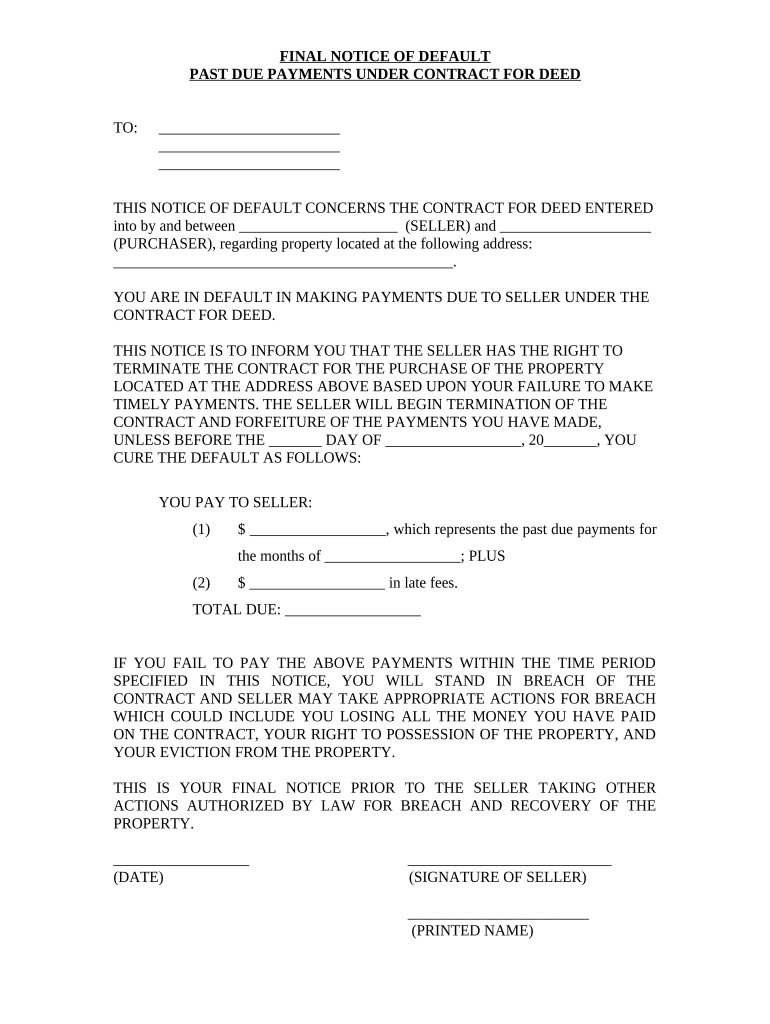

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is final notice of default

A final notice of default is a formal document informing a borrower that they are in breach of their mortgage agreement and must rectify the situation to avoid foreclosure.

pdfFiller scores top ratings on review platforms

So far it is doing everything I need it to do

lots of unnecessary extra work. Need better options for repeating lines of data without having to manually fill them in

I like being able to work with pdf files and save them to my computer.

Need to learn more on how to use it, but overall it fits my needs

Very confusing. Not able to search guidelines to find needed info.

Just started. Good so far. I wish it connected with our online storage so that completed forms could be automatically added to our storage instead of having to download them.

Who needs final notice of default?

Explore how professionals across industries use pdfFiller.

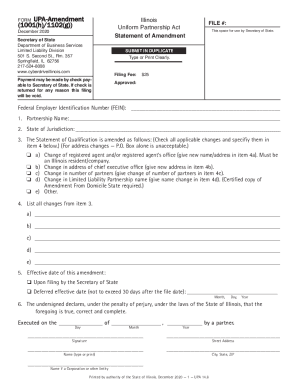

Final Notice of Default Form Guide

What is a final notice of default?

A final notice of default form serves as the last formal communication from a lender or seller indicating that a borrower has failed to meet the terms of their agreement, such as missed payments. Understanding this document is crucial for both parties involved. It signifies that legal action may be imminent if the default is not resolved.

Understanding the purpose and implications of receiving a notice of default

-

A notice of default can initiate legal proceedings, including foreclosure.

-

Receiving a notice can severely affect a borrower's credit score.

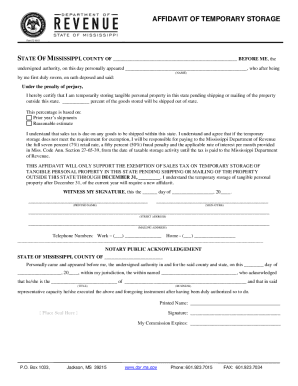

What are the components of the final notice of default?

The final notice of default form typically includes several essential elements that provide clarity on both the transaction and the obligations of the borrower. It generally outlines key details such as seller and purchaser information, property description, and payment terms.

-

Includes names and addresses to identify the parties involved.

-

A comprehensive description of the property subject to the agreement.

-

Specifics of payments, including any late fees that may apply.

How to fill out the final notice of default form?

Filling out the final notice of default form can be straightforward if you follow these step-by-step instructions. It is crucial to avoid common mistakes to ensure the form is legally valid.

-

Ensure all information is correct to prevent disputes.

-

Double-check for any omissions or errors.

What details should be included in the 'Details of Default' section?

The 'Details of Default' section is where you specify what led to the notice being issued. It is vital to use clear and concise language, as this section can have significant legal repercussions if not filled properly.

-

Clearly define the nature of the default, such as missed payments.

-

Indicate when the payment default first occurred.

What are the consequences of ignoring the notice?

Ignoring a final notice of default can lead to serious consequences including potential legal actions, loss of property, and lasting damage to one’s credit score. Understanding these risks is crucial for any borrower.

-

Potential lawsuits or foreclosure proceedings may commence.

-

Failure to address the notice could result in losing ownership of the property.

How to approach the notice in the context of local regulations?

Each region may have specific regulations and documentation requirements regarding the final notice of default. It's important to adapt your approach based on local laws and industry practices to ensure compliance.

How can you edit and manage the final notice of default form online?

Using online tools like pdfFiller makes it easy to edit, sign, and manage your final notice of default form. These tools provide a streamlined way to ensure your documents are both compliant and secure.

-

Utilize advanced editing features to fill out your form accurately.

-

Apply digital signatures that are legally valid.

What common challenges might arise?

Some common challenges include disputes over payment details, previous warnings, and understanding the legal ramifications of defaults. Seeking legal advice when in doubt is a best practice to avoid further complications.

-

Recognizing prior warnings can help contextualize defaults.

-

Consulting with an attorney can provide clarity on rights and obligations.

How to fill out the final notice of default

-

1.Open pdfFiller and log into your account.

-

2.Search for the 'final notice of default' template using the search bar.

-

3.Select the template and click on 'Fill' to start editing.

-

4.Enter the name and address of the borrower in the designated fields.

-

5.Input the loan number and relevant dates related to the mortgage agreement.

-

6.Clearly state the reason for the notice of default in the appropriate section.

-

7.Specify the total amount of payments missed and any applicable fees.

-

8.Include a deadline for the borrower to respond or correct the default.

-

9.Review the document for accuracy and completeness before proceeding.

-

10.Save the completed final notice of default and choose your printing or sending options.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

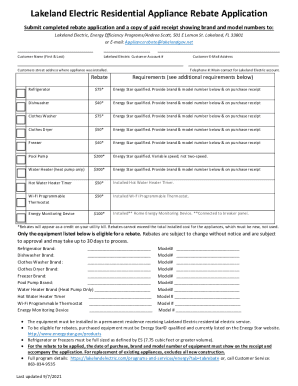

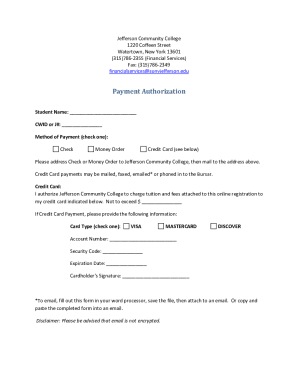

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.