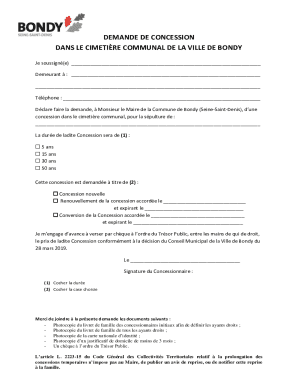

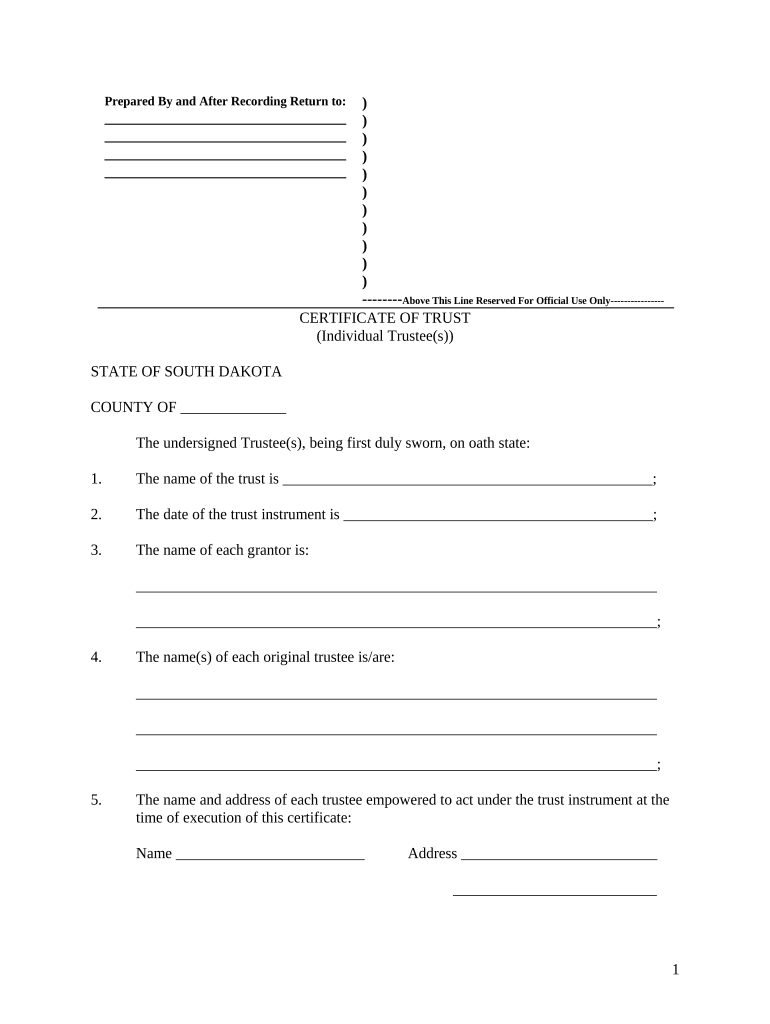

Get the free South Dakota Certificate of Trust by Individual template

Show details

This is a certificate of trust for filing evidence of a trust without having to record the entire trust document. The individual trustee may present a certification of trust to

any person in lieu

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

pdfFiller scores top ratings on review platforms

Great!

I have had a good experience so far, I would improve the signature and some features

I am new to your website

just what i needed

ITS JUST AWESOME

Easy to use, satisfactory result.

Mastering the South Dakota Certificate of Trust: A Comprehensive Guide

How do you define a South Dakota Certificate of Trust?

A South Dakota Certificate of Trust is a legal document that outlines the existence of a trust and provides essential information about the trust, including details about trustees, grantors, and beneficiaries. This certificate plays a crucial role in estate planning and asset management, ensuring that all parties involved understand their rights and responsibilities under the trust's terms.

-

The Certificate of Trust serves as proof that a trust exists and outlines its key components.

-

It is essential for effective estate planning and assists in managing assets held in trust.

-

Trustees, grantors, and beneficiaries must be clearly identified within the trust document.

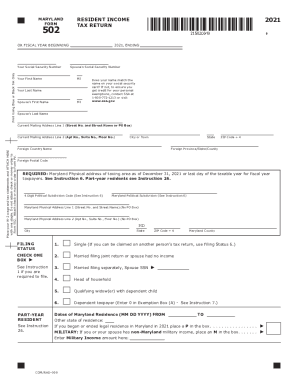

What are the key components of the Certificate of Trust?

The Certificate of Trust includes several critical components, ensuring that all necessary information is provided for legal compliance and clarity among all parties involved. It typically begins with a section detailing who prepared the document and when it was recorded.

-

This section identifies the individual or entity preparing the certificate and the date of documentation.

-

Complete documentation must include the state, county, and trust name for valid identification.

-

Specific details about grantors and trustees must be included, ensuring all parties are clearly identified.

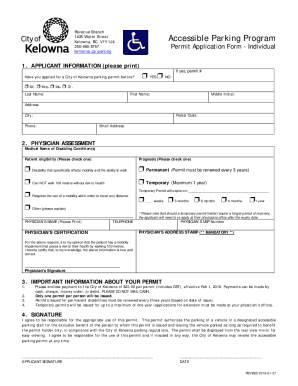

How do you fill out the Certificate of Trust?

Filling out the Certificate of Trust is a meticulous process that requires collecting detailed information about the trust and its representatives. Accurate completion of each section is essential to avoid potential issues or misunderstandings down the line.

-

Ensure you have all pertinent information about the trust and all involved trustees prior to filling out the form.

-

Follow a detailed guide to accurately fill each section of the certificate.

-

Be aware of common mistakes, such as missing signatures or incorrect trustee names, to ensure validity.

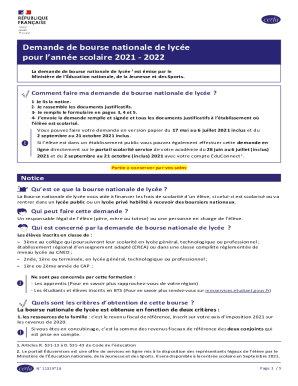

What online tools can help in creating a Certificate of Trust?

There are several online tools available, such as pdfFiller, that streamline the process of creating a Certificate of Trust. These platforms allow for easy document creation, modification, and management, making compliance hassle-free.

-

This platform simplifies document creation and edits with an intuitive interface.

-

pdfFiller offers eSign capabilities, collaborative options, and secure cloud-based access.

-

Easily save and manage completed certificates within the pdfFiller platform for future reference.

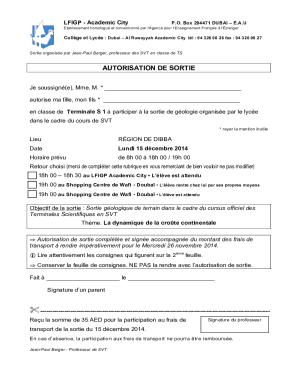

What are the legal implications of the Certificate of Trust in South Dakota?

The Certificate of Trust has significant legal implications, as it must comply with South Dakota state laws. Understanding the rights and responsibilities of trustees and beneficiaries is key to ensuring seamless trust administration.

-

Trusts must meet certain compliance standards set forth by South Dakota law.

-

Both parties have specific rights and responsibilities that must be upheld to maintain the integrity of the trust.

-

The Certificate of Trust holds significant legal weight in transactions involving trust-owned assets.

How do you handle changes to the Certificate of Trust?

Any changes or updates to the Certificate of Trust must be properly documented to maintain its validity. This can include updates related to trustee changes, amendments, or other significant alterations.

-

Documenting changes accurately is crucial to safeguard the trust's legitimacy.

-

Make sure updates align with legal requirements to prevent future disputes.

-

For complex trust modifications, seeking legal advice may be necessary to navigate potential issues.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.