MD Comptroller 502 2021 free printable template

Show details

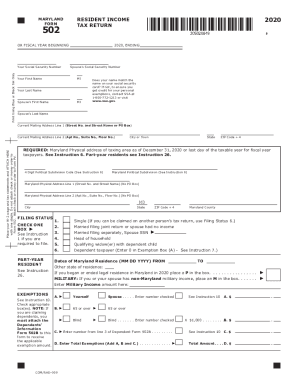

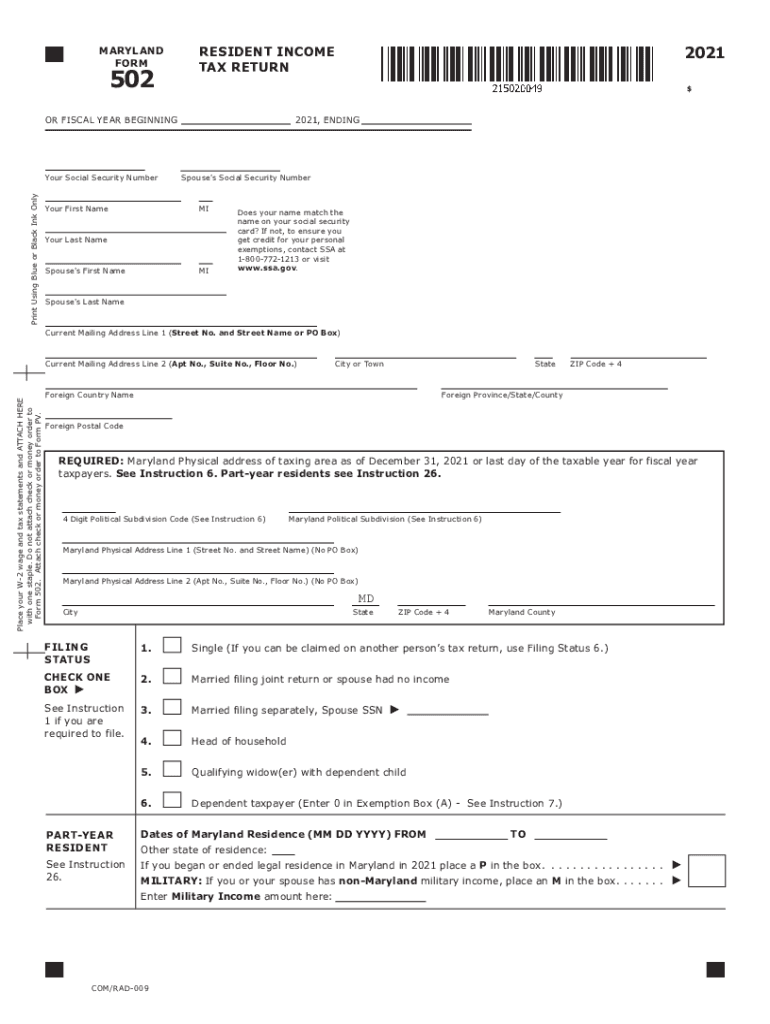

MARYLAND FORM$502OR FISCAL YEAR BEGINNINGPrint Using Blue or Black Ink OnlyYour Social Security Numerous First Name2021RESIDENT INCOME TAX RETURN2021, ENDINGSpouse\'s Social Security NumberMIDoes

pdfFiller is not affiliated with any government organization

Instructions and Help about MD Comptroller 502

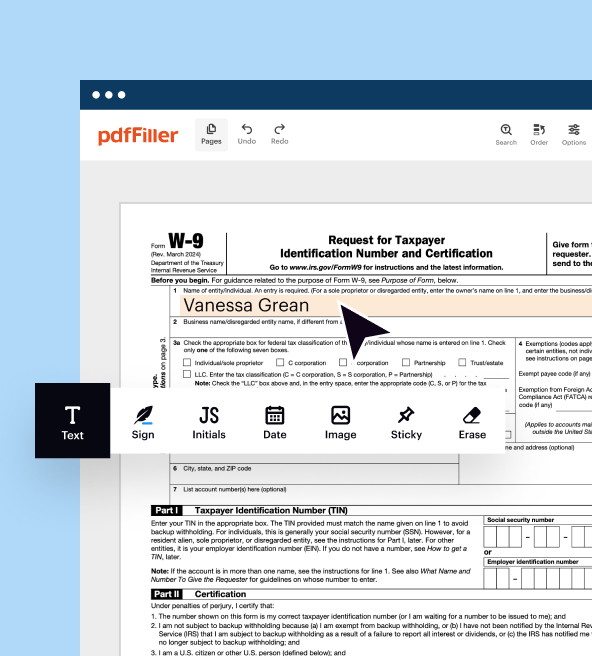

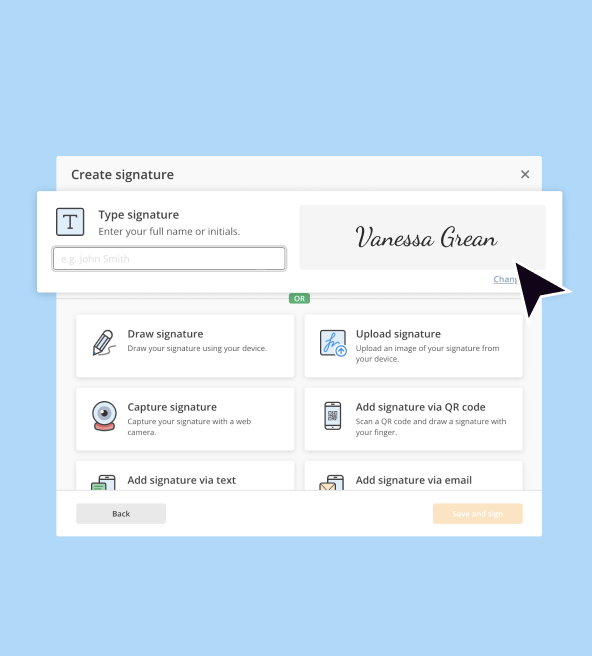

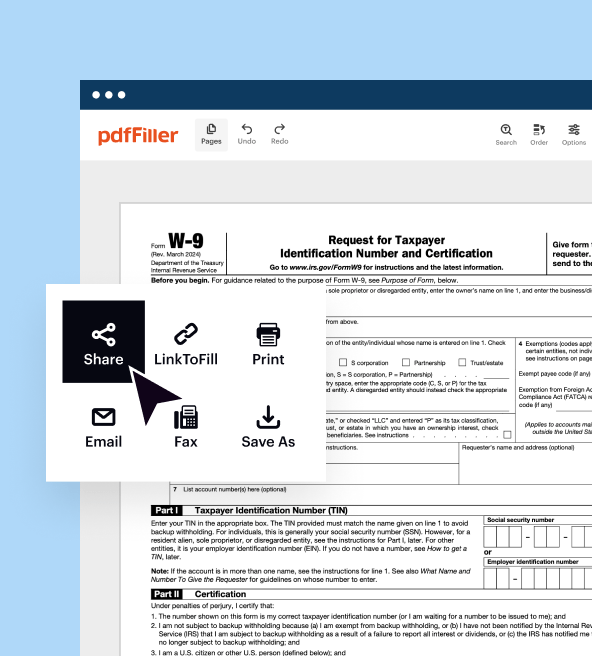

How to edit MD Comptroller 502

How to fill out MD Comptroller 502

Instructions and Help about MD Comptroller 502

How to edit MD Comptroller 502

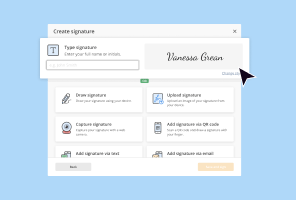

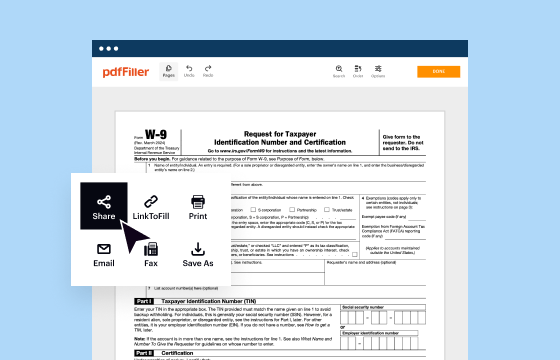

To edit the MD Comptroller 502 form, access the document through a reliable platform such as pdfFiller. Ensure you have a copy of the form available in a digital format. Use editing tools provided by the platform to make your changes. Verify that all edits do not alter the form's legal requirements.

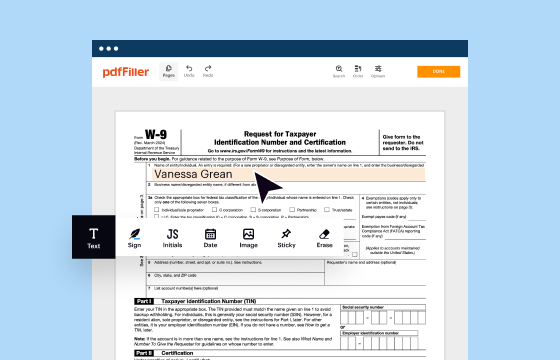

How to fill out MD Comptroller 502

To fill out the MD Comptroller 502 form, follow these steps:

01

Gather necessary personal information including your name, address, and tax identification number.

02

Enter the relevant financial data accurately as required by the form.

03

Review all entries for accuracy before finalizing the form.

04

Use a platform like pdfFiller if you need to save or electronically sign the form.

About MD Comptroller previous version

What is MD Comptroller 502?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About MD Comptroller previous version

What is MD Comptroller 502?

MD Comptroller 502 is a tax form used in the state of Maryland for reporting certain income and payments to the Comptroller's office. It typically pertains to payments made to businesses and individuals who provide services in the state.

What is the purpose of this form?

The purpose of the MD Comptroller 502 form is to report and ensure compliance with state tax regulations. It helps the Comptroller track income reported by service providers and ensure that appropriate taxes are collected and remitted.

Who needs the form?

Individuals and businesses that make payments for services rendered within Maryland may need to file the MD Comptroller 502 form. This includes payments to independent contractors, as well as to entities for services provided during the tax year.

When am I exempt from filling out this form?

You may be exempt from filling out the MD Comptroller 502 if the total payments made to a service provider are less than the specified threshold set by the Comptroller's office. Additionally, certain types of payments, such as those to corporations, may also be exempt.

Components of the form

The MD Comptroller 502 form contains sections for the payer's information, payee's information, the total amount paid, and the nature of the services provided. It is essential to provide accurate details in each section to avoid penalties.

What are the penalties for not issuing the form?

Failure to issue the MD Comptroller 502 form may result in penalties imposed by the state. These can include fines or additional charges that accumulate based on the percentage of the payment amount. It is important for filers to comply to avoid these consequences.

What information do you need when you file the form?

When filing the MD Comptroller 502 form, you will need the following information:

01

Payer's name and address.

02

Payee’s name, address, and tax identification number.

03

Total amount paid for services rendered during the tax year.

04

Description of services provided.

Is the form accompanied by other forms?

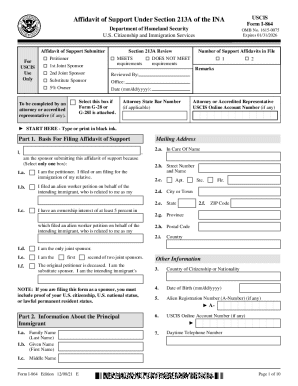

The MD Comptroller 502 form may need to be submitted alongside other supporting documents, depending on the specifics of your payments and the requirements set by the state. It’s advisable to check with the Comptroller’s office or their official website for any specific requirements.

Where do I send the form?

The completed MD Comptroller 502 form should be sent to the Maryland Comptroller’s office. The exact mailing address can vary, so it is important to verify the correct address as listed on the state Comptroller's official website.

See what our users say