Last updated on Feb 20, 2026

Get the free Reaffirmation Agreement template

Show details

The reaffirmation agreement is used to reaffirm a particular debt. Once the debtor signs the agreement, the debtor gives up any protection of the bankruptcy discharge against the particular debt.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is reaffirmation agreement

A reaffirmation agreement is a legal document that allows a debtor to retain certain secured property while reaffirming their obligation to pay the debt.

pdfFiller scores top ratings on review platforms

Found my way here to create a W2...seems like the easiest choice!

Very easy to use. Quickly filled out 32 forms.

Made sending out 1099's really simple and easy.

Have been pleased with ability to complete forms and submit them.

so far so good, I thought the price was discounted, but I guess 120/year is the discount?

S far pretty good. Have not done a whole lot with it , but what I did use was very good

Who needs reaffirmation agreement template?

Explore how professionals across industries use pdfFiller.

Reaffirmation Agreement Form Guide

What is a reaffirmation agreement?

A reaffirmation agreement is a legal document that allows a debtor in bankruptcy to retain certain assets while reaffirming their obligation to repay a debt. By entering into this agreement, the debtor agrees to repay the debt despite the bankruptcy, which can protect important creditor relationships. However, it's crucial to understand that this can also result in the loss of bankruptcy discharge protections.

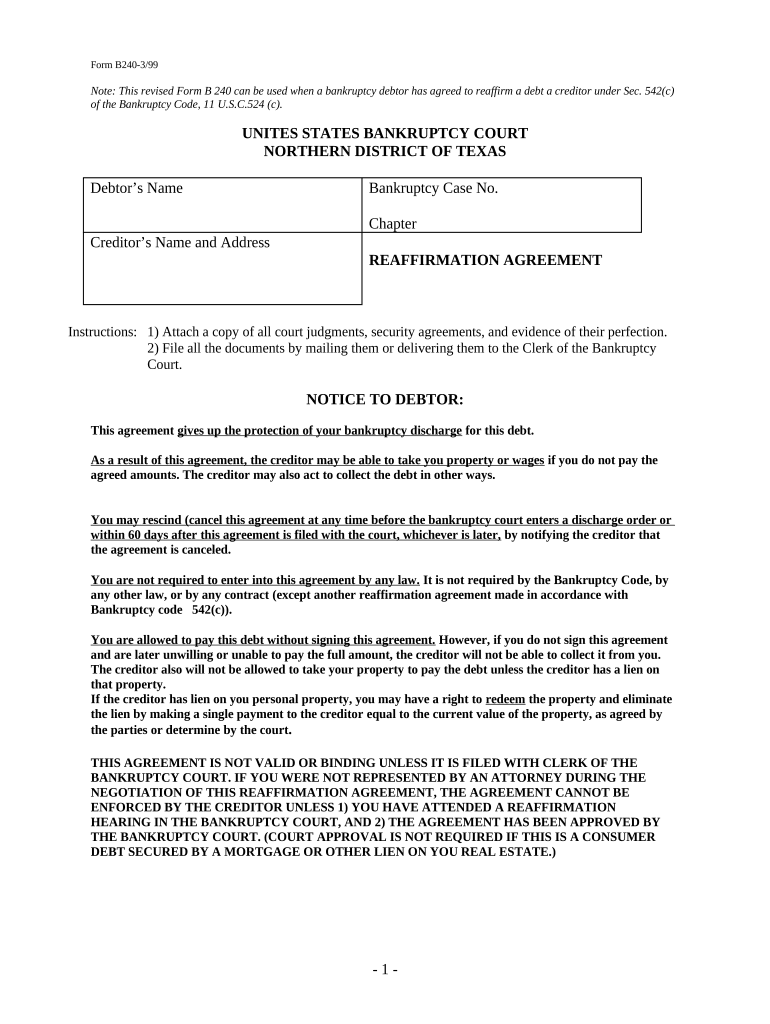

What do need to complete a reaffirmation agreement form?

When filling out a reaffirmation agreement form, it's essential to include specific information such as the debtor's name, bankruptcy case number, the chapter under which the bankruptcy was filed, and the creditor's name and address. Careful completion of these fields helps avoid errors that could delay the process.

-

The full name of the debtor filing for bankruptcy.

-

The unique identifier assigned to the debtor's bankruptcy case.

-

The chapter of bankruptcy under which the case is being filed, e.g., Chapter 7 or Chapter 13.

-

The full legal name and address of the creditor to whom the debt is owed.

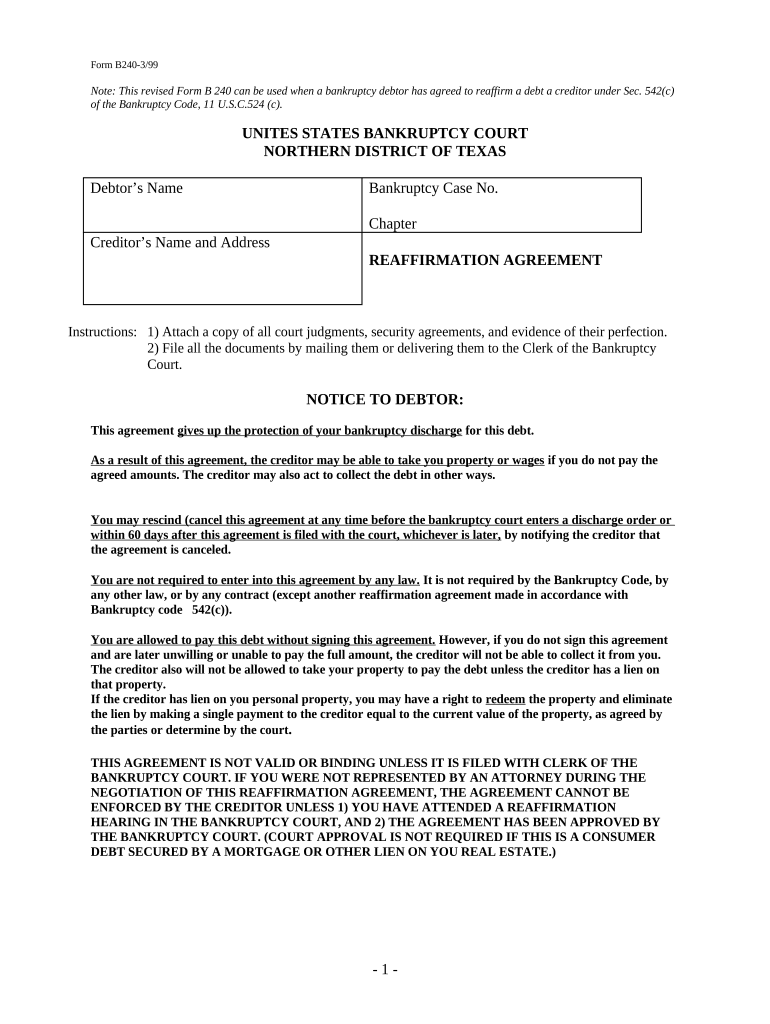

What are the risks of entering a reaffirmation agreement?

While reaffirmation agreements can be beneficial, they come with substantial risks. Entering one can mean losing important bankruptcy protections, which normally discharge the obligation to pay debts. Therefore, if a debtor fails to meet the terms of the agreement, they could face serious consequences.

-

Signing the agreement takes away the protections granted by bankruptcy, making the debtor liable for the reaffirmed debt.

-

Failing to fulfill the terms of the reaffirmation can lead to legal action or foreclosure.

-

Reaffirmations can impact a debtor's future financial obligations and influence new debt applications.

How to file a reaffirmation agreement?

Filing a reaffirmation agreement with the bankruptcy court involves a few critical steps. Ensure that all forms are completed accurately and include any necessary documentation such as court judgments or security agreements.

-

You can choose to either mail your documents or deliver them in person to the Clerk of the Bankruptcy Court.

-

Be aware of any deadlines associated with filing the reaffirmation agreement to prevent complications.

When can rescind a reaffirmation agreement?

Debtors can rescind a reaffirmation agreement under certain conditions, such as if they believe they are unable to maintain the obligations. It's important to formally notify the creditor about the cancellation to avoid any future complications.

-

Informing the creditor is crucial for the rescission of the agreement to be acknowledged.

-

There is a specified timeframe in which the rescission can occur, often before the discharge is finalized.

How can manage my reaffirmation agreements?

pdfFiller offers a robust cloud-based platform that makes managing reaffirmation agreements simple and efficient. The platform provides features like editing, eSigning, and tracking to ensure you're organized and compliant with requirements.

-

Easily edit and manage reaffirmation agreements with an intuitive interface.

-

Share and collaborate on documents with team members or advisors.

Conclusion

In conclusion, a reaffirmation agreement form can be essential in maintaining relationships with creditors while navigating bankruptcy. Understanding its implications, filing process, and potential risks is vital. Using tools like pdfFiller can empower you to manage your reaffirmation agreement form easily.

How to fill out the reaffirmation agreement template

-

1.Obtain the reaffirmation agreement form from your lender or download it from the bankruptcy court's website.

-

2.Fill in your personal information, including your name, address, and case number, at the top of the form.

-

3.Enter the details of the debt, including the type of loan, the creditor's name, and the loan account number.

-

4.Specify the property being secured by the loan, providing a description and its current value.

-

5.Review the terms outlined in the agreement, ensuring you understand your obligations and the consequences of defaulting.

-

6.Sign the form in the designated area and include the date of your signature.

-

7.Ensure you have the lender’s representative sign and date the agreement as well, confirming their assent.

-

8.Make copies of the completed form for your records and for your bankruptcy attorney.

-

9.File the original reaffirmation agreement with the bankruptcy court by submitting it to your bankruptcy case administrator.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.