Last updated on Feb 20, 2026

Get the free 497328218

Show details

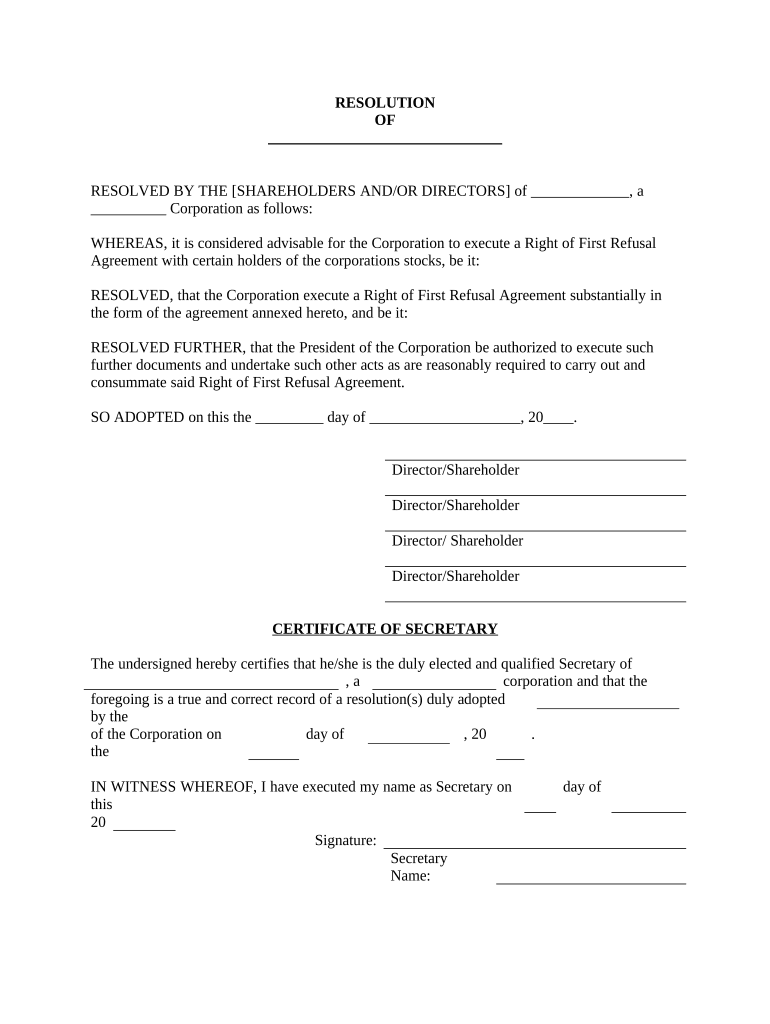

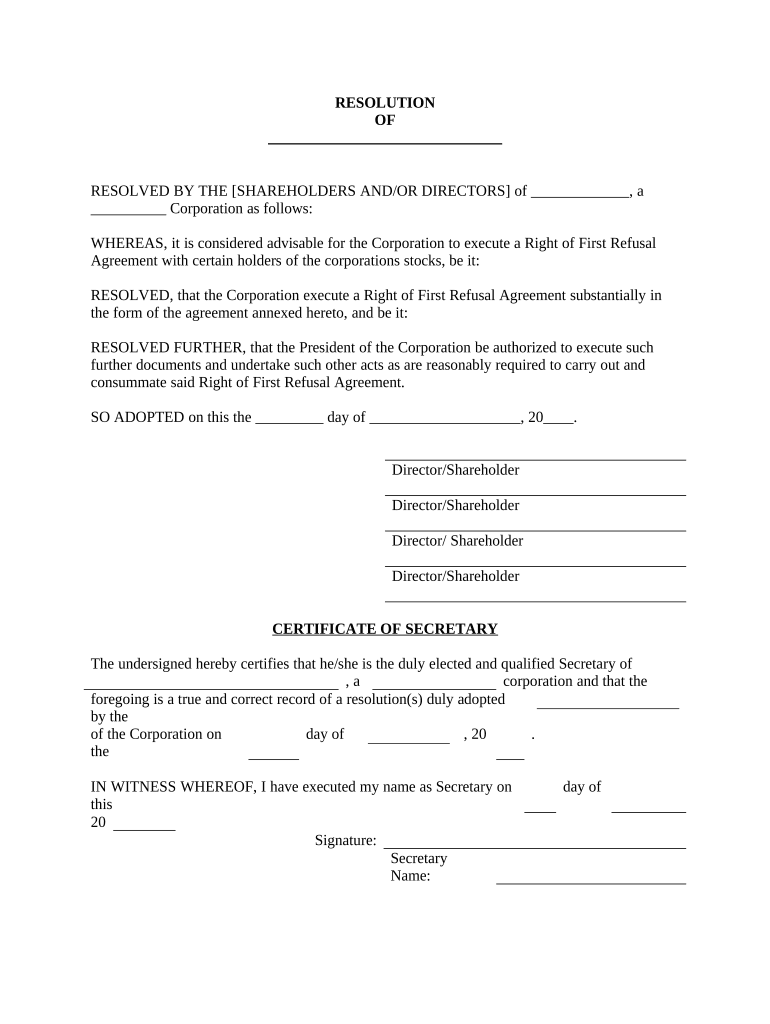

Form with which a corporation advises that it has resolved that some shareholders shall be required to give the corporation the opportunity to purchase shares before selling them to another.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is corporate right of first

A corporate right of first refers to a contractual agreement that gives a corporation the first opportunity to purchase shares or assets before they are offered to other potential buyers.

pdfFiller scores top ratings on review platforms

I was very impressed with this web-based PDF editor

Overall my experience has pretty very positive with PDFfiller.

My colleague recommended PDFfiler as I needed a quick way to sign documents while on the road. PDFfiller has all the features I need, even with the free version of the software.

I think to take this software to the next level, the developer should create browser plugins to sign documents without having to upload them to the PDFfiller website.

First-class customer service! I wanted to try out the free trial version but ended signing up for an annual subscription. I contacted the customer service about this error, and they gave me the refund immediately.

The application worked perfectly for what I needed. Is was a one time need for me but I would highly recommend.

i am starting

Still learning... but so far so good.

Convenient user interface, able to quickly make the necessary edits to my documents and I'm enjoying using the product.

Awesome, quick to learn.

Who needs 497328218 template?

Explore how professionals across industries use pdfFiller.

Corporate right of first refusal form: A comprehensive guide

The corporate right of first refusal form is a critical legal document that allows corporations to maintain a degree of control over the transfer of ownership interests. This guide will provide you with all the necessary information and steps to fill out this form effectively.

Understanding how to fill out a corporate right of first refusal form involves known elements like compliance with legal standards, specific clauses and sections, and instructions for implementation.

What is the corporate right of first refusal?

The corporate right of first refusal (ROFR) is a provision that gives existing shareholders or the corporation the first chance to buy an asset before it is sold to outside parties. This provision serves as a protective measure in corporate governance, ensuring that current stakeholders have the opportunity to maintain their proportionate ownership.

-

It provides existing parties the first opportunity to purchase shares or assets before they can be offered to outsiders.

-

This clause prevents hostile takeovers and protects the interests of shareholders.

-

Understanding terms like 'transfer', 'shareholders', and 'interests' are crucial for grasping ROFR rights.

What are the components of the right of first refusal agreement?

A comprehensive right of first refusal agreement typically contains several essential elements. Each component serves to clarify rights and duties of all parties involved.

-

These may encompass the selling party's obligations and the notice requirements for offers.

-

Clauses might include terms for exercising ROFR and available remedies in case of a breach.

-

While ROFR gives existing owners the right to purchase before others, right of first offer allows them to set the price at which they want to sell first.

How do fill out the corporate right of first refusal form?

Filling out the corporate right of first refusal form involves several key steps to ensure accuracy and compliance.

-

Clearly provide your business information, identify the parties involved, and state the terms of the ROFR.

-

Avoid vague language and ensure signatures are obtained from all required parties.

-

Utilize pdfFiller's features to edit, sign, and store your completed ROFR form securely in the cloud.

Who should sign the right of first refusal agreement?

The signing of a right of first refusal agreement should involve key stakeholders in the corporation to ensure legality and enforceability.

-

Typically includes the corporation, its shareholders, and other involved parties.

-

Ensure that all key parties have signed the agreement to legitimize it and avoid disputes.

-

Make sure that those signing have the legal authority to bind the corporation.

What are the benefits and disadvantages of implementing a right of first refusal?

Implementing a right of first refusal can offer several strategic advantages, but organizations need to recognize any limitations or risks.

-

Includes the protection of shareholder interests and potentially higher asset values.

-

Can lead to restrictions on selling shares, leading to decreased liquidity for shareholders.

-

Investors may view ROFR as a double-edged sword; advantageous when used correctly but can limit opportunities.

What are some real-world examples of right of first refusal agreements?

Examining case studies can provide insightful perspectives on the effectiveness of right of first refusal agreements in practice.

-

Organizations like Google and Apple have implemented ROFR clauses to safeguard investments.

-

These agreements are prevalent in mergers and acquisitions, ensuring current owners have priority.

-

Companies have found that transparent communication helps mitigate potential conflicts surrounding ROFR clauses.

What compliance and legal considerations should keep in mind?

Compliance is essential when drafting the right of first refusal agreement to navigate legal standards effectively.

-

Understand the local laws governing ROFR clauses, which may vary significantly by jurisdiction.

-

Conduct thorough research or consult with a legal advisor to ensure your document meets all legal criteria.

-

It’s advisable to have an attorney review your agreement to confirm its enforceability.

How can use interactive form tools on pdfFiller?

pdfFiller provides interactive tools designed to help you craft, edit, and manage your right of first refusal form seamlessly.

-

Utilize pdfFiller’s editing features to tailor the form to meet your specific business needs.

-

Take advantage of eSigning capabilities for quick, secure submissions of your completed form.

-

Enhance collaboration by enabling team members to interact with the document within pdfFiller.

How can craft a resolution for the right of first refusal?

Creating a resolution specific to the right of first refusal can solidify the terms and conditions under which it operates.

-

A well-structured resolution should clearly state the intent and terms agreed upon by all parties.

-

Include definitions, obligations of parties, and the process for invoking the ROFR.

-

Being mindful of standard formats and requirements can ensure clarity and compliance.

What are the final steps and best practices?

Finalizing your corporate right of first refusal agreement requires meticulous attention to detail.

-

Ensure all terms are correct and complete before signing to avoid future conflicts.

-

Use pdfFiller to store your documents securely, making them easily accessible for future reference.

-

Keep track of any changes or updates to ensure compliance with existing regulations.

What are the conclusion and next steps?

In conclusion, understanding the corporate right of first refusal form and its components is essential for effective governance.

Take advantage of pdfFiller's features to streamline the process, from drafting to finalizing your documents.

How to fill out the 497328218 template

-

1.Open the PDF file containing the 'corporate right of first' form on pdfFiller.

-

2.Begin by entering the name of the corporation in the designated field at the top of the document.

-

3.Provide the date of the agreement in the specified format (DD/MM/YYYY).

-

4.Outline the specific shares or assets included in the right of first by detailing quantity and descriptions in the given sections.

-

5.Identify any third parties who may be involved by filling out their names and contact information as required.

-

6.Include any conditions or deadlines for exercising the right of first, making sure to specify terms clearly.

-

7.Re-read the entire document for accuracy before submitting it to ensure all information is correct.

-

8.Save your changes and download the completed document for your records or for distribution.

-

9.If necessary, share the document with legal counsel for review prior to execution.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.