Get the free Pledge of Stock for Loan template

Show details

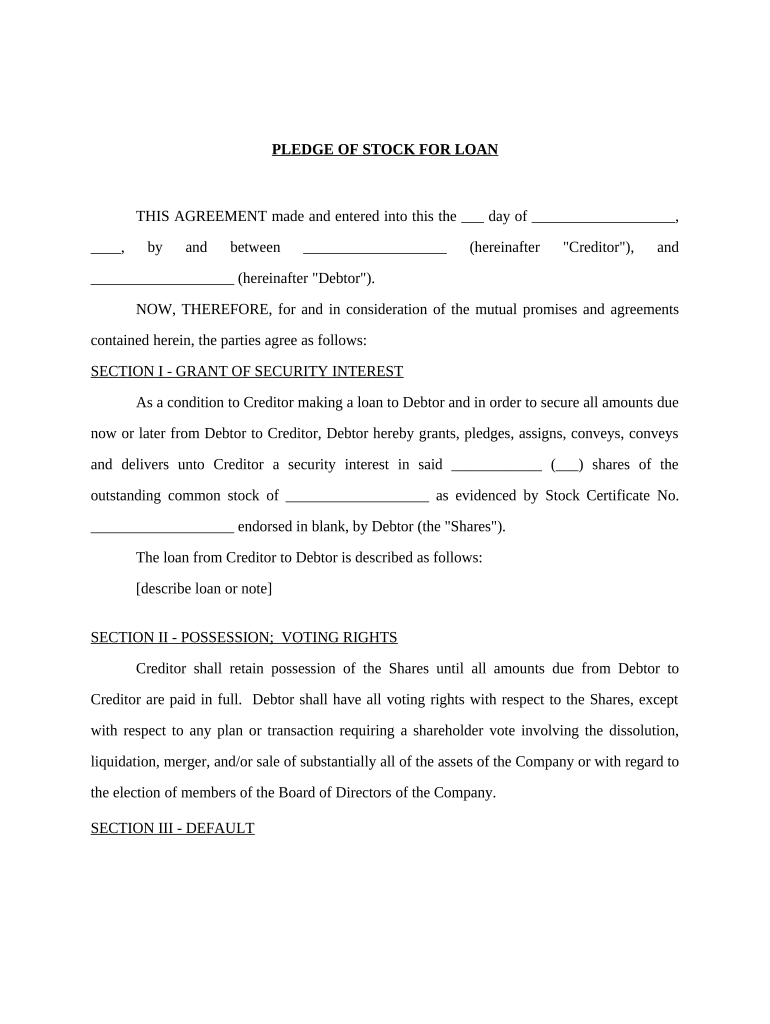

This Pledge of Stock for Loan is used as a condition to Creditor making a loan to Debtor and in order to secure all amounts that are presently due or later from Debtor to Creditor.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is pledge of stock for

A pledge of stock for is a legal document that secures a loan against the pledge of shares in a corporation as collateral.

pdfFiller scores top ratings on review platforms

What a relief, this application is shamazing.

PDFfiller was a great source for forms. It has many different features which were easy to use once you learned them. The tutorial videos make it really easy.

very GOOD BUT COULD DO WITH MORE symbols and shape options

PDF FILLER IS SO EASY TO USE AND IT'S GREAT SERVICE.

Everything been find except I can cannot pull this up from another computer, or even what I have already did

Extremely easy to find the forms I needed, thank you.

Who needs pledge of stock for?

Explore how professionals across industries use pdfFiller.

Pledge of Stock for Loan: A Comprehensive How-to Guide

What is a pledge of stock for a loan?

Pledging stock as collateral involves using stocks as security to secure a loan. This practice is essential for both debtors and creditors in the lending process. Understanding the implications and mechanics behind a pledge of stock can be beneficial for anyone considering this financial arrangement.

-

This refers to setting aside stocks as a promise to repay the loan, where the lender can claim these stocks if the borrower defaults.

-

Stock pledges provide assurance for lenders and can often result in favorable loan terms for borrowers.

-

The creditor is the lender who provides funds, while the debtor is the borrower who offers stock as collateral.

What does a stock pledge agreement involve?

A stock pledge agreement outlines the terms of the stock pledged in a loan. This document specifies the rights of both parties and the conditions under which the creditor may take possession of the stocks.

-

Typically includes legal definitions, obligations, and detailed provisions about the pledged stocks.

-

Security interest grants the creditor rights over the stock, while voting rights detail the governance of those shares.

-

Common stocks such as shares from established companies are often used due to their liquidity and market value.

How do you fill out the pledge of stock form?

Filling out the pledge of stock form is a straightforward process when you know how to proceed step-by-step. Accurate completion ensures legal soundness and clarity for all involved parties.

-

Clearly state the date of agreement and the names and addresses of both creditor and debtor.

-

Define the amount of the loan, interest rates, and repayment schedule.

-

Specify the number of shares and their respective ticker symbols.

-

Outline whether the debtor retains voting rights and under what conditions.

What are ownership and voting rights?

Understanding ownership and voting rights is crucial in a stock pledge scenario. The rights of the debtor and creditor must be clearly defined in the pledged agreement.

-

The debtor typically retains ownership rights until a default occurs, while the creditor gains rights over the pledged shares.

-

In case of default, the creditor can sell or retain the shares to recover owed amounts.

-

Share voting rights impact company control, and specific terms should be negotiated at the time of the pledge.

What situations lead to default in stock pledges?

Identifying conditions that lead to a debtor's default is essential for both parties. Knowing potential default scenarios helps in mitigating risks.

-

Default may occur due to missed payments, bankruptcy, or severe financial distress.

-

The creditor is entitled to take possession of the shares pledged and may sell them to fulfill the loan amount.

-

Upon default, the creditor may choose to hold onto the stocks until market conditions improve or sell immediately.

How do legalities impact stock pledges?

Legal considerations surrounding stock pledges vary by region. It's essential to familiarize oneself with both federal and local laws affecting pledging practices.

-

Different jurisdictions may have unique requirements and protections for debtors and creditors.

-

Certain industries face stricter regulations that can complicate stock pledges.

-

Involving legal professionals when drafting agreements can ensure compliance and protect parties' rights.

How can pdfFiller assist in managing your stock pledge documents?

pdfFiller provides a seamless platform to manage your stock pledge documents efficiently. Users can easily edit, eSign, and collaborate on documents from any location.

-

Simply log in to pdfFiller, find the stock pledge form template, and start editing your documents.

-

You can securely send documents for signing and receive them back instantly, streamlining the process.

-

Ensure all your documents are kept safely and are easily accessible whenever needed.

How to fill out the pledge of stock for

-

1.Obtain a blank pledge of stock for template from pdfFiller.

-

2.Begin by filling in the date at the top of the document.

-

3.Enter the name of the borrower and their contact information in the designated fields.

-

4.Provide the lender’s name and contact information next to the borrower’s details.

-

5.Specify the type and amount of stock being pledged, including the stock certificate number.

-

6.Include the total value of the pledged stock at the time of signing.

-

7.Outline the terms of the pledge, including any conditions for default.

-

8.Both parties must sign and date the document at the bottom; ensure signatures are clear.

-

9.Lastly, save the completed document as a PDF or print it out for physical signatures.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.