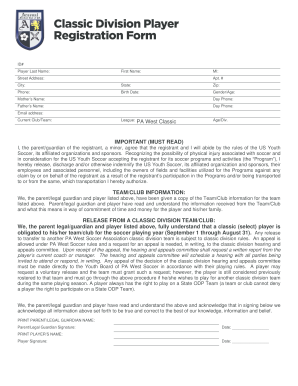

Get the free Balloon Secured Note template

Show details

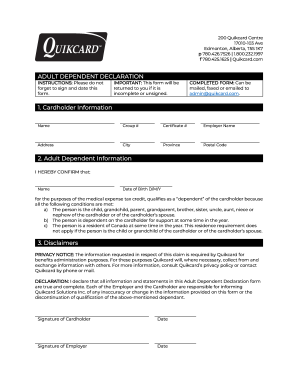

This form is a balloon promissory note, with security. A balloon note is structured such that a large payment is due at the end of the repayment period. Adapt to fit your specific circumstances.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is balloon secured note

A balloon secured note is a type of loan that requires a large final payment at the end of the term, typically backed by collateral.

pdfFiller scores top ratings on review platforms

Excellent software. Convenient and time saving. I'm able to use it after business hours and complete time sensitive documents in the same day.

Cant believe how easy it is to use...very very happy with PDFfille

I have had a great experience with this app for the purpose of getting the proper paper work done

esta genial me sirvio mucho para la escuela

The savings in time, money and processing are enormous. I would highly recommend the app to anyone interested in time management.

Great forms to find, helped with several projects

Who needs balloon secured note template?

Explore how professionals across industries use pdfFiller.

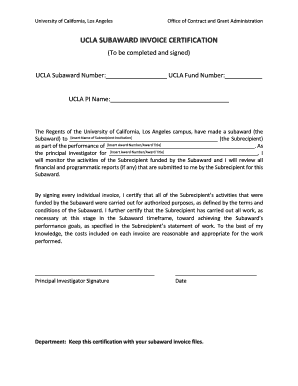

How to fill out the balloon secured note template

-

1.Open the PDF file containing the balloon secured note template.

-

2.Begin by filling in your name and contact information at the top of the document.

-

3.Enter the date of the agreement in the specified field.

-

4.Fill in the principal amount of the loan in the designated box.

-

5.Specify the interest rate agreed upon for the loan.

-

6.Indicate the loan term, including the start and end dates.

-

7.If applicable, provide details about the collateral securing the loan.

-

8.Fill out the payment schedule, ensuring to highlight the balloon payment due at the end of the term.

-

9.Review all entered information for accuracy and completeness.

-

10.Sign and date the document to validate the agreement.

-

11.If required, have a witness or notary public sign the document as well.

-

12.Save the completed document and send a copy to the lender and retain a copy for your records.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.