Get the free Conditional Guaranty of Payment of Obligation template

Show details

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty agreement is

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

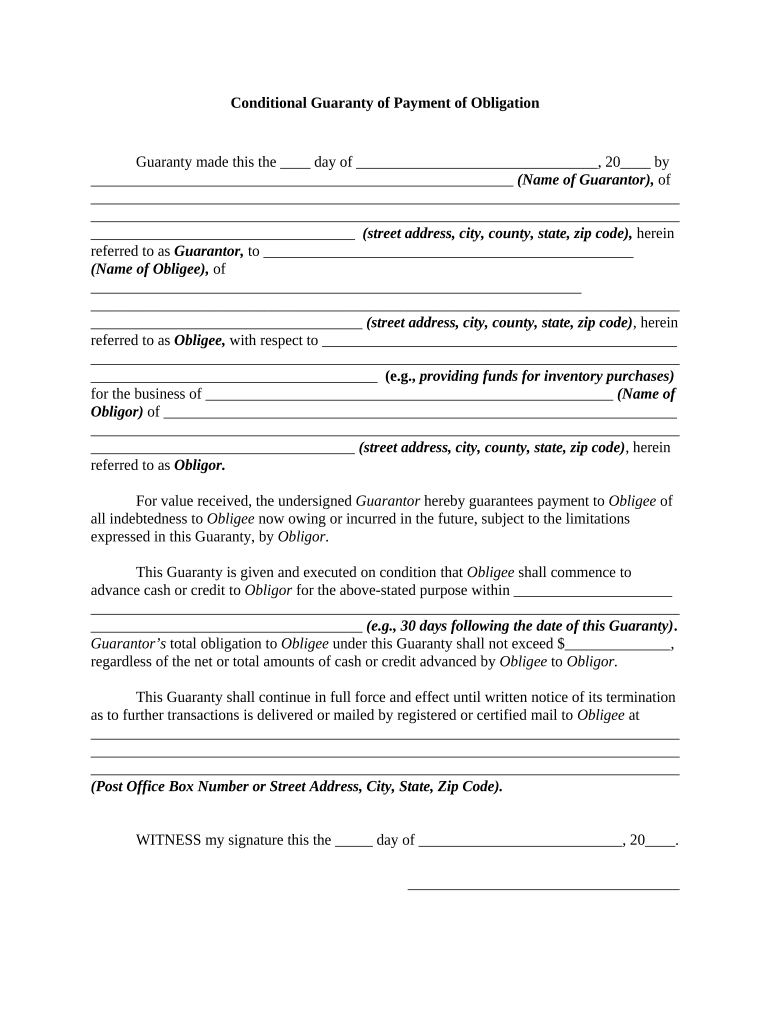

What is conditional guaranty of payment

A conditional guaranty of payment is a legal document where a guarantor agrees to pay the debts or obligations of a debtor only under specified conditions.

pdfFiller scores top ratings on review platforms

By far the best PDF editor.

By far the best PDF editor.It not only worked flawlessly but the experience was awesome.I ask to unsubscribe while in the 30 days free trial and 7 minutes later I was unsubscribed without further questions.

exellent.

Exellent, the most avanced technology in PDF creations.

Easy

Easy to fill out and send via USPS

The support team at PDFFiller is top notch

The support team at PDFFiller is top notch. They always respond promptly and professionally and even accept suggestions for improvement of the software. I personally am amazed at the evolution of this product over the last 7 or 8 years.

Outstanding customer support

Outstanding customer support! Very appreciated! Paul, in particular.

Good forms but did not find what I was…

Good forms but did not find what I was looking for which is fine

Who needs conditional guaranty of payment?

Explore how professionals across industries use pdfFiller.

Conditional Guaranty of Payment Form: A Comprehensive Guide

If you're looking to understand the conditional guaranty of payment form, you've come to the right place. This guide offers detailed insights on how to fill out, edit, and manage this crucial document.

Understanding the Conditional Guaranty of Payment Form

A conditional guaranty of payment is a legal agreement where a third party agrees to take responsibility for a debt or obligation of another, but only under specific conditions. This contrasts with an unconditional guaranty, which does not have such limitations.

-

It binds the guarantor to cover obligations only when predefined circumstances occur.

-

Conditional guaranties require specific triggers for enforcement, while unconditional ones can be enforced immediately.

-

Such guaranties offer security to creditors, ensuring that payments will be made if conditions are met.

Key Components of the Form

-

Details about the person or entity providing the guaranty.

-

Information regarding the party to whom the guarantee is provided.

-

Identification of the party whose obligation is being guaranteed.

-

Specifies the reason for the guaranty, such as a loan or lease obligation.

-

Outlines any restrictions and specific conditions under which the guaranty is valid.

Filling Out Your Form: Step-by-Step Instructions

-

Start by filling in the date and the full name of the guarantor.

-

Include the complete address of the guarantor to establish legal footing.

-

Provide all necessary details regarding the obligee.

-

Clearly state the purpose, as this helps define the agreement's scope.

-

Fill out the details of the obligor to identify those whose obligations are being covered.

-

State the financial amount guaranteed and any conditions tied to it.

-

Ensure the guarantor signs and, if necessary, have the form notarized to validate it.

Best Practices for Completing the Form

-

Double-check all information for accuracy to prevent legal issues.

-

Ambiguities can lead to disputes; be explicit about the purpose.

-

A lawyer can provide insights into complex legal terms and implications.

Common Mistakes to Avoid

-

Incomplete forms are often rejected; ensure every section is filled out.

-

Read and understand all terms to avoid unintended obligations.

-

Certain jurisdictions require notarization for validity.

Legal Considerations and Compliance

-

Laws can vary greatly; know your local regulations.

-

A guarantor is financially liable if the obligor defaults.

-

Failure to keep the form updated can nullify the guaranty.

Utilizing pdfFiller to Manage Your Guaranty Form

-

With pdfFiller's tools, you can manage all aspects of your document in one place.

-

Access your documents from anywhere, ensuring flexibility and convenience.

-

Follow the intuitive interface to easily edit and sign your forms.

How to fill out the conditional guaranty of payment

-

1.Open the conditional guaranty of payment form in pdfFiller.

-

2.Begin by entering the date at the top of the document.

-

3.Fill in the name and address of the guarantor in the designated fields.

-

4.Provide the name and address of the debtor who requires the guarantee.

-

5.Specify the conditions under which the guarantee will be effective. This could include payment deadlines or specific events triggering the obligation.

-

6.State the amount or limit of liability for which the guarantor is responsible.

-

7.Ensure all parties involved, including the debtor and guarantor, sign the document in the appropriate areas.

-

8.Review the filled document for accuracy, ensuring all required fields are complete.

-

9.Save a copy of the completed form and share it with the involved parties for their records.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.