Last updated on Feb 20, 2026

Get the free hardship letter to creditors examples

Show details

Most debt counselors say that it is a good idea to talk to the people to whom you owe money. If you ignore the problem it will only get worse. You may find that you are paying extra interest and your

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

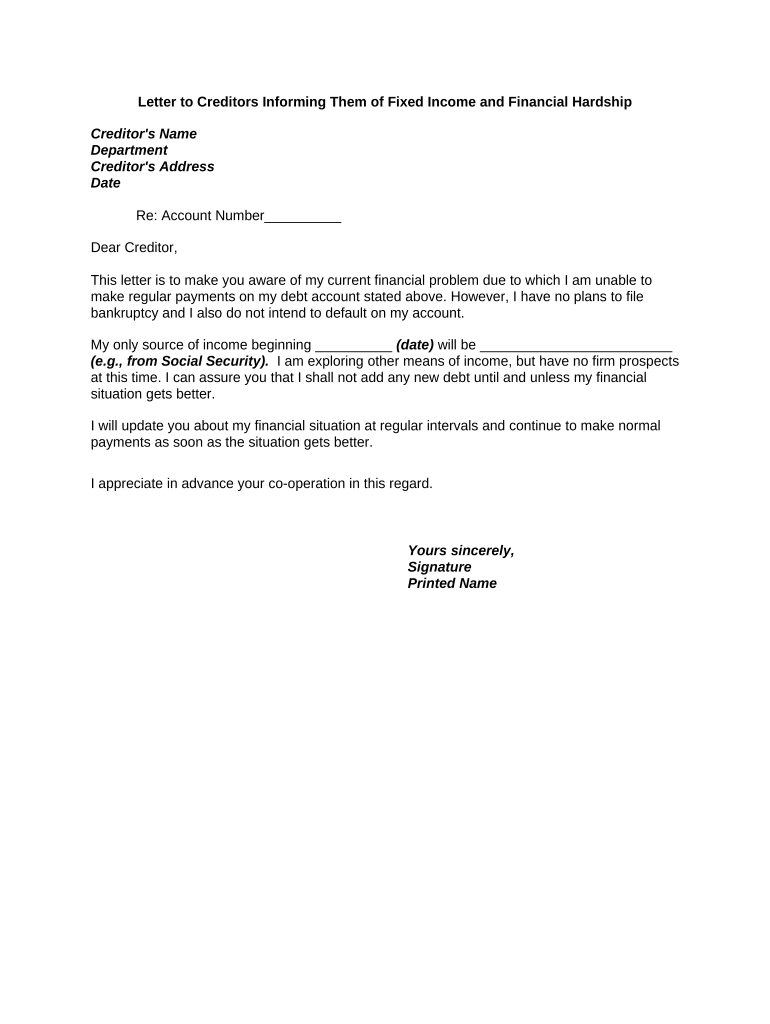

What is letter to creditors informing

A letter to creditors informing is a formal communication informing creditors about relevant information pertaining to a debtor's financial situation or status.

pdfFiller scores top ratings on review platforms

JUST A WONDERFUL TOOL TO HAVE ACCESS TO!!

takes a bit of getting used to, but is, in fact, very user-friendly.

Who needs hardship letter to creditors?

Explore how professionals across industries use pdfFiller.

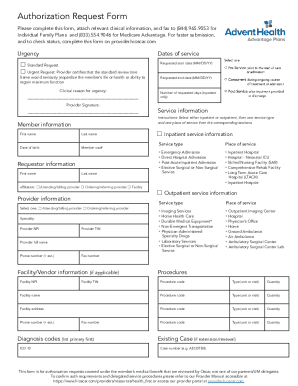

Letter to creditors informing form

Writing a letter to creditors informing them of your financial situation is crucial when facing hardship. This document serves as an official communication, allowing you to articulate your challenges, proposed solutions, and ongoing commitment to managing your debts effectively. A well-crafted letter can not only safeguard your credit rating but can also open the door for potential negotiations.

What is the importance of informing creditors?

Understanding the importance of informing creditors is essential for maintaining financial health. Proactively communicating your circumstances can prevent misunderstandings and prevent escalation into legal actions.

-

Informing creditors of your financial issues allows for transparency and may lead to more flexible repayment terms.

-

Failing to inform creditors can result in harsh penalties, including collections and damage to your credit rating.

-

Proactive communication can positively affect your credit score by demonstrating your willingness to resolve debts.

What should be included in a letter to creditors?

The letter to creditors must contain key components to ensure clarity and effectiveness. Each element plays a role in preserving your intent and making your situation understood.

-

Accurately identifying your lender ensures that your communication is directed to the right person.

-

Referencing the specific account number helps the creditor quickly access and understand your file.

-

Including the date confirms timely communication, indicating that you are addressing the matter proactively.

-

Clearly stating your financial hardship from the beginning helps set the context for your request.

-

Specifying income sources allows the creditor to see your financial landscape clearly.

-

Communicating your intention to pay reinforces your commitment to settle your debts.

-

Encouraging continued communication opens avenues for negotiation and support from the creditor.

How can you fill out the letter?

Filling out the letter to creditors involves a series of simple, systematic steps that should be followed carefully to ensure all necessary information is included.

-

Include your full name, address, and contact details at the top.

-

Accurate creditor details are crucial for directing your message effectively.

-

Clearly articulate your current circumstances to provide a comprehensive picture.

-

Updating creditors about any changes in your financial situation is vital.

-

Regular updates keep your creditors informed and engaged in your process.

-

End on a positive note by thanking the creditor for their understanding and by including your contact information.

How to edit and sign your letter using pdfFiller?

pdfFiller provides a user-friendly platform to edit and eSign your letter seamlessly, which simplifies the process of sending formal communications.

-

Access pdfFiller to edit pre-existing templates, allowing you to customize details easily.

-

Take advantage of digital signatures to authenticate your document without the need for print.

-

For teams handling multiple letters, utilize collaboration tools for efficiency and clarity.

-

Manage your letters efficiently for future reference, ensuring you maintain an organized record.

What are best practices for communicating with creditors?

Employing best practices in your communication with creditors can create a more positive environment for negotiation.

-

Use clear and respectful language to maintain professionalism throughout your correspondence.

-

Keep thorough records of all communications, helping you track your engagements with creditors.

-

Be informed about your rights as a debtor to advocate for yourself effectively.

-

Don’t hesitate to seek expert debt advice for tailored strategies if needed.

Why is compliance with financial regulations necessary?

Ensuring compliance with financial regulations is crucial for avoiding legal pitfalls that can exacerbate your debt situation. Each region may have different requirements that you need to understand.

-

Being aware of local debt communication regulations can help you craft letters that comply with legal standards.

-

Review compliance notes that are relevant to your specific region to avoid potential issues.

-

Consult a legal expert when faced with complex situations that fall outside your understanding.

How to address common concerns with creditors?

Handling concerns with creditors can be daunting, but knowledge and strategy can turn the tide in your favor.

-

Follow up with a reminder email or letter if you don’t receive a response within a reasonable time.

-

Document any harassment incidents; it may be necessary to escalate the matter legally.

-

Explore various negotiation tactics to work out a more manageable payment plan with your creditors.

-

If your financial situation continues to decline, research options like debt consolidation or bankruptcy.

How to fill out the hardship letter to creditors

-

1.Open pdfFiller and select 'Create New Document' to start a new letter template.

-

2.Choose the 'Letter to Creditors Informing' template from the available options.

-

3.Fill in the sender's information, including name, address, and contact details at the top of the document.

-

4.In the body of the letter, clearly state the purpose of the letter and any relevant details regarding the financial situation.

-

5.Include a clear and concise description of the circumstances, such as payment plans, bankruptcy filing, or changes in financial status.

-

6.Add a list of specific creditors being addressed in the letter if applicable.

-

7.Conclude the letter with a professional closing statement, expressing willingness to discuss further and providing contact information for follow-up.

-

8.Review the filled-out letter to ensure all information is accurate and double-check for any grammatical errors.

-

9.Save the document, then choose the option to download it or send it directly to creditors using pdfFiller's sharing features.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.