Last updated on Feb 20, 2026

Get the free Notice of Default on Promissory Note Installment template

Show details

This form is a notice of a default in note payments and a demand to bring the note payments current.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is notice of default on

A notice of default on is a formal declaration from a lender indicating that a borrower has failed to meet the terms of their loan agreement.

pdfFiller scores top ratings on review platforms

Good

GREAT

Such a userfriendly app! Easy set up; just a quick registration, you just open your document on the app and you're good to go!' Excellent app.

good

good and fast

its really easy to use software.

very easy to use and recomendable

Who needs notice of default on?

Explore how professionals across industries use pdfFiller.

Guide to notice of default on promissory note installment

How to fill out a notice of default form

Filling out a notice of default form is essential for effectively communicating the default on a loan. This guide provides a comprehensive overview of the steps involved and key considerations to ensure accuracy in the completion of this important document.

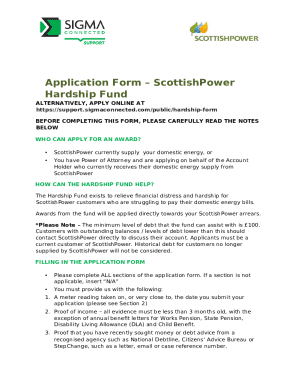

Understanding the notice of default

A Notice of Default (NOD) is a formal notification that a borrower has failed to make required payments on a loan. It serves to inform the borrower of their default and initiates a process that can lead to foreclosure if the situation is not resolved.

-

A clear statement issued by a lender indicating that the borrower has not met their repayment obligations.

-

This document protects lenders' interests and provides borrowers with time to resolve their payment issues.

-

Defaults often occur due to financial hardship, miscommunication, or lack of awareness regarding payment deadlines.

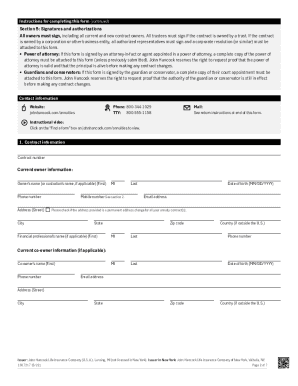

What are the key components of a notice of default?

Key components are crucial in ensuring that all necessary information is conveyed clearly and effectively.

-

Includes borrower identification, account numbers, and outstanding obligations.

-

Specifies when payments were due and the date the notice is issued.

-

Provides transparency regarding the total loan amount and the agreed-upon payment schedule.

-

Outlines specific conditions that constitute a default, providing clarity to the borrower.

How can you fill out a notice of default correctly?

Completing a notice of default requires attention to detail to avoid future complications.

-

Follow each step methodically, ensuring all necessary fields are filled.

-

Pay particular attention to Account #, Date, Customer name, and loan specifics.

-

Neglecting to verify information can lead to processing delays or disputes.

-

Utilize pdfFiller’s features to edit and ensure accuracy before finalizing your document.

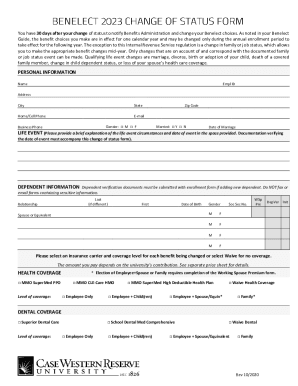

Caution: What are the legal and financial implications?

Ignoring a Notice of Default can lead to severe consequences, including foreclosure.

-

Lenders may initiate legal proceedings to recover the owed amount.

-

Borrowers have the right to contest the notice but must adhere to stipulated obligations.

-

Delaying a response can worsen the situation, increasing financial liabilities.

Details of the default: What to include in your notice

An effective notice details the reasons behind the default to promote understanding and facilitate resolution.

-

Clearly state why the default occurred, allowing the borrower to understand and address it.

-

Include means for the borrower to clarify misunderstandings or errors in documentation.

-

Accuracy in content helps maintain professional communication and supports resolution efforts.

How to manage your document effectively

Utilizing interactive tools can streamline the process of managing your notice.

-

pdfFiller allows users to easily make changes, ensuring the document is current.

-

Electronic signatures enhance security and validate the document's authenticity.

-

Cloud storage offers easy access and management, reducing paperwork and enhancing organization.

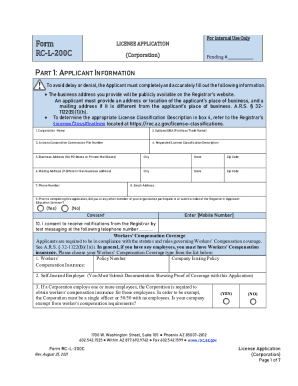

How to fill out the notice of default on

-

1.Open the PDF file for the notice of default on using pdfFiller.

-

2.Begin by entering the date at the top of the document in the designated field.

-

3.Fill in the borrower's full name and address in the appropriate sections.

-

4.Next, provide the lender's information, including the name and address of the lending institution.

-

5.Input the details of the loan agreement, such as the loan amount and the original date of signing.

-

6.Include a clear statement indicating the specific default incidents, such as missed payments.

-

7.Add any relevant legal terms or conditions that apply to the notice of default.

-

8.Finally, review the document for accuracy and completeness, ensuring that all required information is included.

-

9.Save the completed document and download it or share it as needed.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.