Last updated on Feb 20, 2026

Get the free General of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion template

Show details

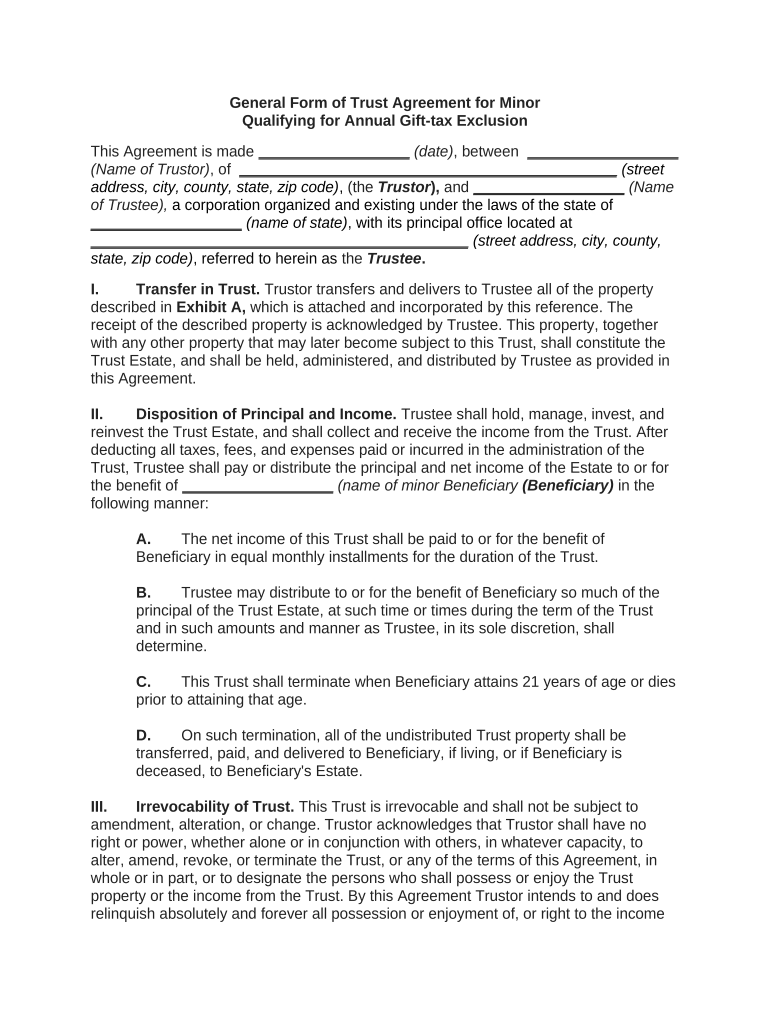

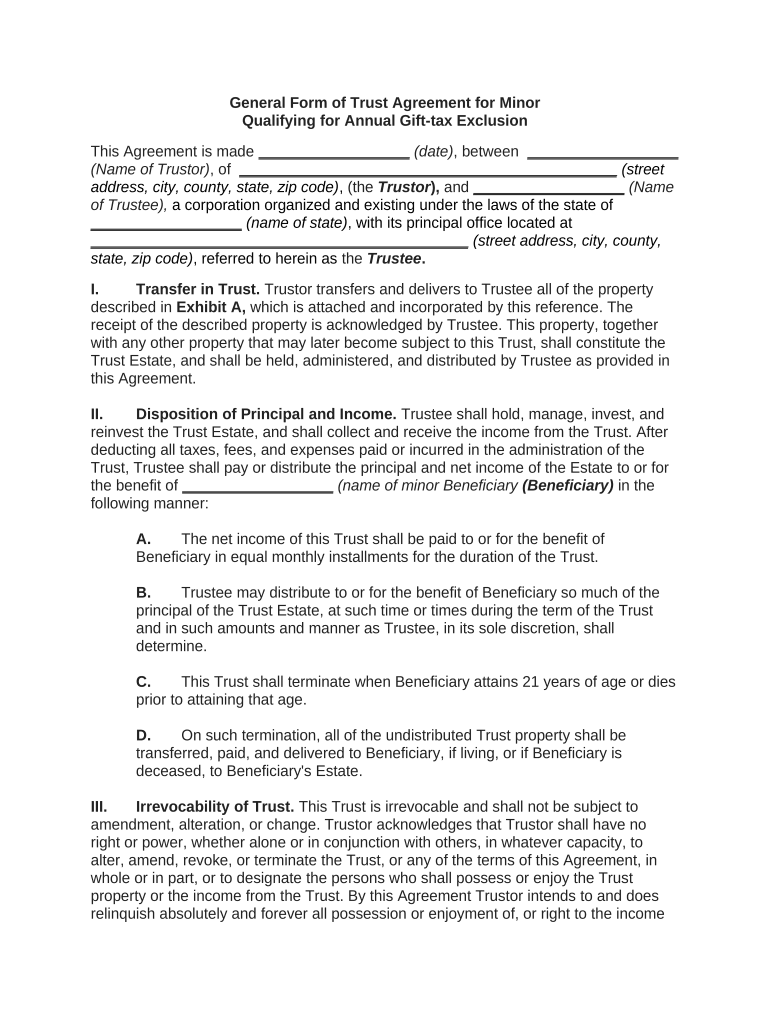

This form is a general form of trust agreement for a minor qualifying for an annual gift tax exclusion.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is general form of trust

A general form of trust is a legal document that outlines the arrangement whereby one party holds property or assets for the benefit of another party.

pdfFiller scores top ratings on review platforms

I haven't dived into all the…

I haven't dived into all the features....and takes a little bit to learn...but worth the effort!

This is really cool

This is really cool

Had a little trouble finding sites I…

Had a little trouble finding sites I needed but chat "Paul" helped me and everything ran smoothly after that.

I will use this app every time I need…

I will use this app every time I need to fill pdf's. I use a macbook and it works perfectly.

great forms and easily fillable

Great product easy to use and fillable

perfect for work

perfect for work

Who needs general of trust agreement?

Explore how professionals across industries use pdfFiller.

A comprehensive guide to the general form of trust form

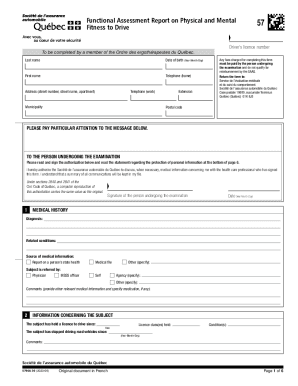

How to fill out a general form of trust form

Filling out a general form of trust form involves gathering necessary documents, clearly outlining the trustor's intentions, and understanding the roles of the trustee and beneficiaries. It's crucial to ensure all sections of the form are completed accurately to avoid delays in the trust's effectiveness.

Understanding the general form of trust agreement

A trust is a legal arrangement where one party (the trustee) holds assets for the benefit of another (the beneficiary). The general form of trust agreement serves as a foundational document that outlines the terms under which a trust operates, ensuring a clear understanding and protection of the involved parties' rights.

-

A trust is defined as a fiduciary relationship where one party holds property for the benefit of another.

-

This agreement is crucial as it legally binds the trustee to manage the trust assets per the trustor's wishes.

-

Key components of trust agreements often include the names of trustors, trustees, beneficiaries, and specific terms concerning asset management.

What are the key components of the general form of trust?

Understanding the roles of the trustor and trustee is crucial in the management of a trust. The trustor creates the trust and sets its terms, while the trustee is responsible for administering the trust in accordance with those terms.

-

The trustor outlines the trust terms, whereas the trustee must manage the trust assets and adhere to the guidelines set forth.

-

This refers to the act of placing assets into the trust, ensuring they are managed according to the trustor's specifications.

-

The trust estate consists of all assets that are held in the trust, which are identified and outlined in the agreement.

What are the detailed provisions of the trust?

Understanding the provisions regarding the disposition of principal and income is paramount. This includes how income will be distributed and under what circumstances the principal can be accessed.

-

This outlines how both the principal and income generated from assets will be distributed to beneficiaries.

-

The trust may specify that income distributions occur on a monthly basis, ensuring ongoing support for beneficiaries.

-

In some cases, the trustee holds discretion over when and how principal distributions are made to beneficiaries, which requires a careful balance of duty.

-

Conditions under which a trust may terminate often relate to the beneficiary reaching a certain age or meeting other predefined conditions.

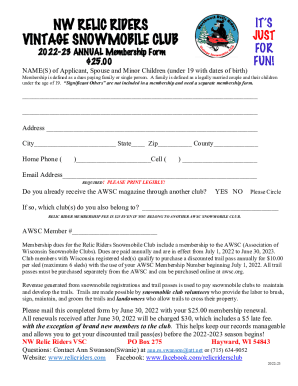

Why should you establish a general trust form?

Establishing a general trust form provides numerous advantages such as safeguarding wealth for future generations and maximizing your estate planning strategy. Additionally, trusts can offer tax advantages that may significantly reduce tax implications on gifted assets.

-

Trusts safeguard assets, ensuring they are passed down as intended, thereby providing financial security for future generations.

-

Employing effective estate planning strategies allows individuals to preserve their intended legacies and minimize disputes among heirs.

-

The annual gift-tax exclusion can be advantageous for individuals looking to transfer wealth without incurring significant tax burdens.

How does a general trust work?

A general trust operates through the governance of the trust documents, which outline the management mechanisms and responsibilities of the trustee. Compliance with legal standards ensures the trust remains a viable structure through which assets can be managed.

-

The trustee oversees the administration of trust assets and ensures compliance with the trust's terms and conditions.

-

Trustees have fiduciary duties to act in the best interests of the beneficiaries, necessitating transparency and diligent management.

-

Ensuring legal compliance includes adhering to local regulations governing trusts, which can vary by region.

Filling out the general form of trust

Creating a trust requires careful attention to detail. A step-by-step guide helps ensure that the trust document meets legal requirements and reflects the trustor’s wishes.

-

Begin by collecting necessary information about assets and parties involved, followed by completing the trust form accurately.

-

After initial completion, it's essential to review and amend the trust conditions as needed to adapt to life changes.

-

Consider using pdfFiller for easy editing, eSigning, and collaboration on the trust document, facilitating a smoother process.

Managing your general trust over time

Managing a trust is an ongoing task that requires diligence. Monitoring the trust estate and making amendments as appropriate ensure that it continues to serve its purpose effectively.

-

Regularly checking on the trust estate helps ensure that assets are performing as expected and can inform necessary adjustments.

-

Life changes often necessitate amendments to the trust agreement, be it due to shifts in family structure or changes in financial status.

-

Trustees are responsible for timely distributions as stated in the trust agreement, which requires ongoing attention to meet the beneficiaries' needs.

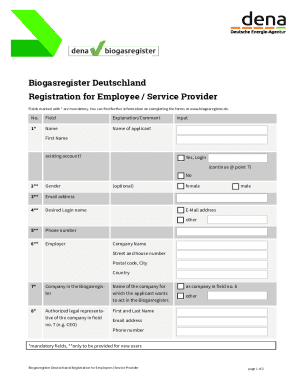

How to fill out the general of trust agreement

-

1.Open the PDF file of the general form of trust.

-

2.Begin by entering the names of the trustor(s) in the designated fields; this is typically the person or people creating the trust.

-

3.Next, input the name of the trustee; this is the individual responsible for managing the trust assets according to the trust document.

-

4.Fill in the details of the beneficiaries; these are the individuals or organizations who will benefit from the trust.

-

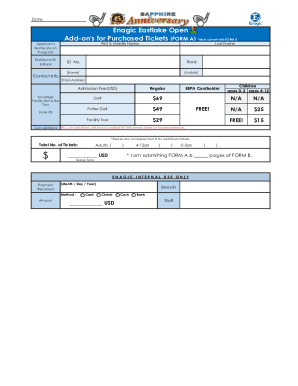

5.Specify the assets that will be included in the trust; this can include cash, property, stocks, or other valuables.

-

6.Review all entered information for accuracy, ensuring there are no errors or omissions before finalizing the document.

-

7.Once completed, save the file and follow instructions to print it out, if necessary, for signatures.

-

8.If required, arrange for the document to be notarized or witnessed to meet legal requirements.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.