Last updated on Feb 17, 2026

Get the free For Chapter 11 Cases: The List of Creditors Who Have the 20 Largest Unsecured Claims...

Show details

For Chapter 11 Cases: The List of Creditors Who Have the 20 Largest Unsecured Claims Against You Who Are Not Insiders (non-individuals)

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is for chapter 11 cases

Chapter 11 cases refer to a legal process allowing businesses to reorganize their debts while continuing operations and seeking a viable path to profitability.

pdfFiller scores top ratings on review platforms

Love the concept and the ease of working with documents. Had a little difficulty with submitting payment but one of your online folks (Anne) searched and assisted. All is good!

Love Love Love this! So easy and wonderful!

My only wish is that I could covert it back to a word document.

Paying monthly on something that I don't need all the time is excessive. Wish could pay by the document.

It so rocks to be able to save the content of forms that don't normally allow it.

works pretty darn good, so far. Just have used it one time for one form. We'll see...

Who needs for chapter 11 cases?

Explore how professionals across industries use pdfFiller.

How to fill out a Chapter 11 cases form

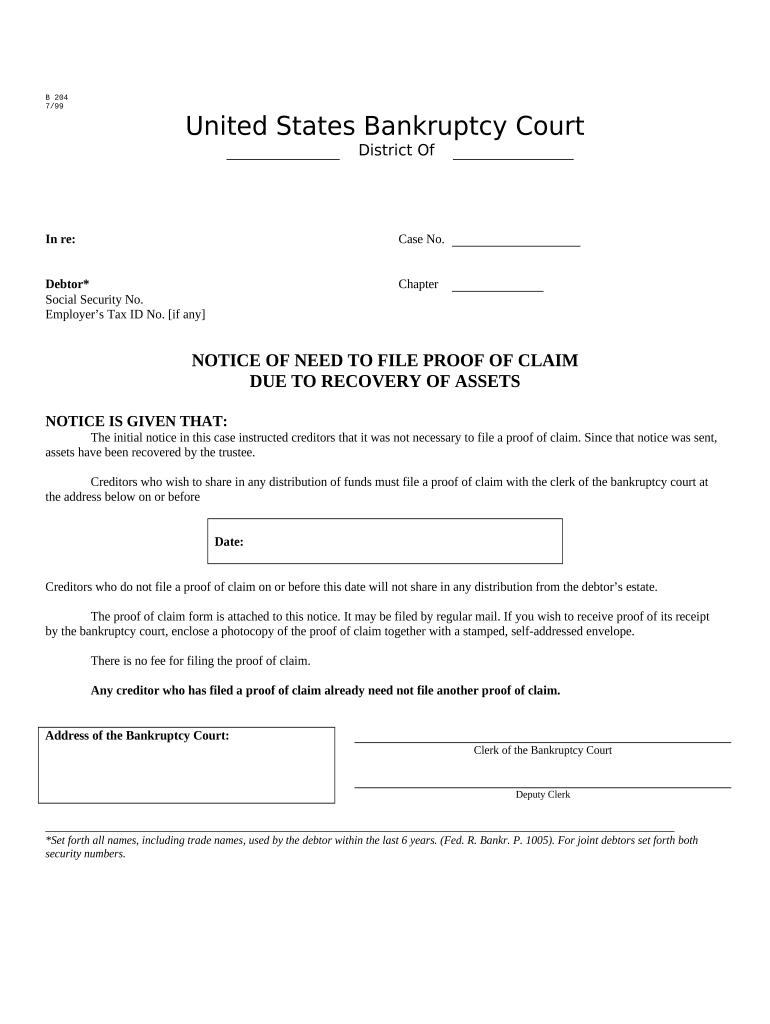

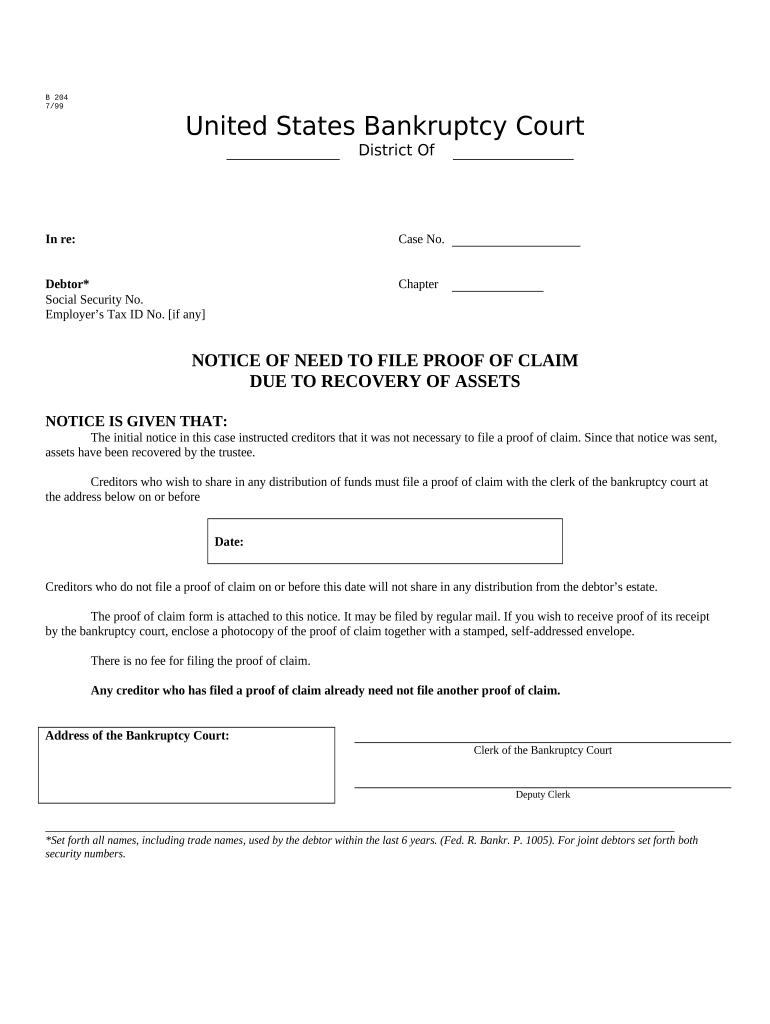

Filing for Chapter 11 bankruptcy can be a complex process that requires accurate completion of specific forms. Among these, the B 204 proof of claim form is vital for creditors asserting their rights during bankruptcy filings. This guide provides comprehensive instructions on filling out this form to ensure you meet the necessary legal requirements.

What is Chapter 11 bankruptcy?

Chapter 11 bankruptcy is a legal proceeding that allows businesses and individuals to reorganize their debts while continuing to operate. Unlike Chapter 7, where assets are liquidated, Chapter 11 enables debtors to propose a plan to repay creditors over time, providing a chance for financial recovery.

-

Chapter 11 aims to allow businesses to restructure their debt without ceasing operations, thereby increasing the likelihood of repaying creditors.

-

While Chapter 7 focuses on liquidation, Chapter 13 is limited to individuals with regular income. Chapter 11 can apply to various entities, providing more flexibility.

-

The primary stakeholders include the debtor, creditors, the bankruptcy court, and potentially a committee of unsecured creditors.

What is the B 204 proof of claim form?

The B 204 form is crucial for creditors wishing to establish their claims against a debtor in Chapter 11 bankruptcy. This form must be completed accurately to ensure that claims are considered valid by the bankruptcy court.

-

It serves to inform the court of the amount owed to the creditor and the nature of the claim, which is essential for creditors to recover debts.

-

All creditors who wish to assert their claims must file this form by the specified deadline to ensure their claims are recognized in the bankruptcy proceedings.

-

Timely filing of the B 204 form is critical as late submissions may result in the loss of legal rights to recover owed amounts.

How to fill out the B 204 form: A step-by-step guide

Filling out the B 204 form requires detailed attention to ensure compliance with bankruptcy regulations. The following sections must be completed carefully.

-

Provide the name of the debtor and case number. Accurate information is vital for the verification of your claim.

-

Clearly state the nature of your claim and the amount owed. Include supporting documents if necessary to substantiate your claim.

-

Ensure all required signatures are included. This section may also require supporting attachments like contracts or invoices.

-

Follow the given instructions regarding submission, whether electronically or by mail, and ensure to submit by the set deadline.

What common mistakes to avoid when filing the B 204 form?

Mistakes in filling out the B 204 form can have serious implications for your claim. Awareness of these common pitfalls can save time and resources.

-

Incomplete forms can lead to automatic denial of claims, so ensure all sections are filled out correctly.

-

Each bankruptcy case has specific deadlines. Submitting late can invalidate your claim, making it critical to track these dates.

-

Always retain a personal copy of your filed claim. This is essential for future reference, especially if discrepancies arise.

How can interactive tools help manage bankruptcy documents?

Utilizing interactive tools like pdfFiller enhances the efficiency of managing bankruptcy documents, including the B 204 form. These tools provide a user-friendly platform for document handling.

-

With pdfFiller, you can quickly edit, fill, and electronically sign the B 204 form, simplifying the filing process.

-

Store your filed documents securely online to prevent data loss and ensure easy access whenever needed.

-

The collaborative features enable easy sharing of documents with legal advisors for guidance and review, enhancing your filing confidence.

How to fill out the for chapter 11 cases

-

1.Access the pdfFiller platform and log in to your account.

-

2.Search for the Chapter 11 case form in the document library.

-

3.Select the appropriate form version for your needs.

-

4.Begin filling out the required fields, starting with basic information about your business such as name, address, and tax identification number.

-

5.Provide detailed information about your financial situation, including assets, liabilities, income, and expenditures.

-

6.Complete the sections related to your proposed reorganization plan, specifying how you intend to repay creditors during the bankruptcy process.

-

7.Attach any necessary supporting documents that are required, such as financial statements and list of creditors.

-

8.Review all entered information for accuracy and completeness before submission.

-

9.Submit the completed form through pdfFiller, ensuring you follow any additional instructions or compliance requirements.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.