Last updated on Feb 17, 2026

Get the free Order for Relief in an Involuntary Case - B 253 template

Show details

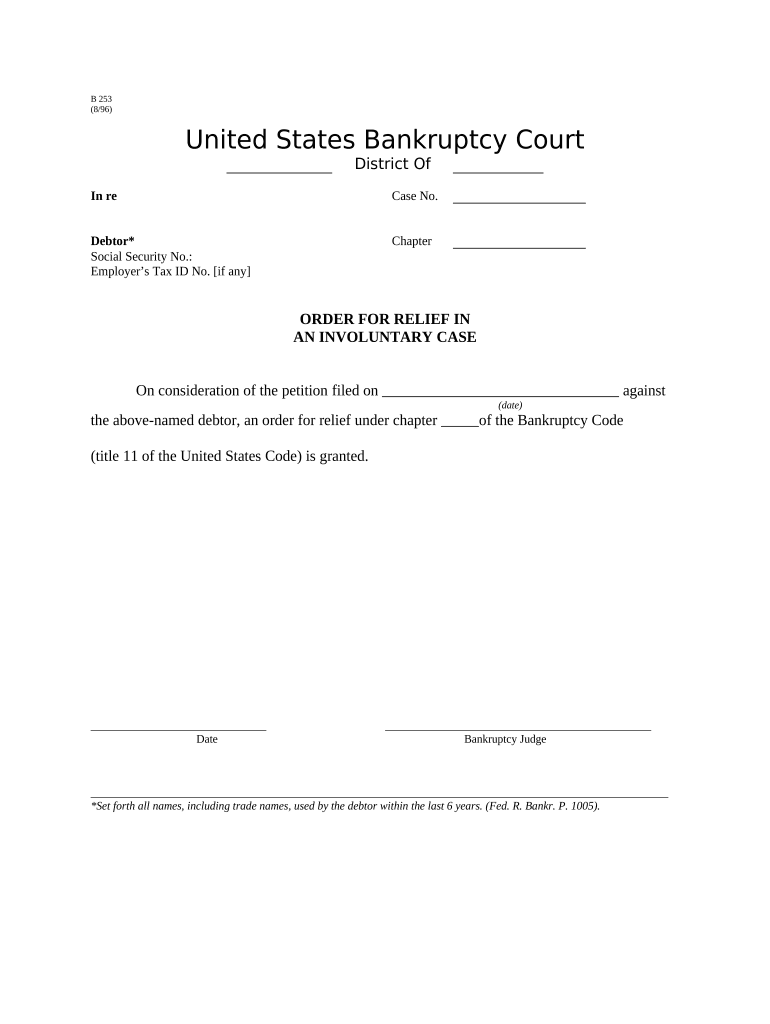

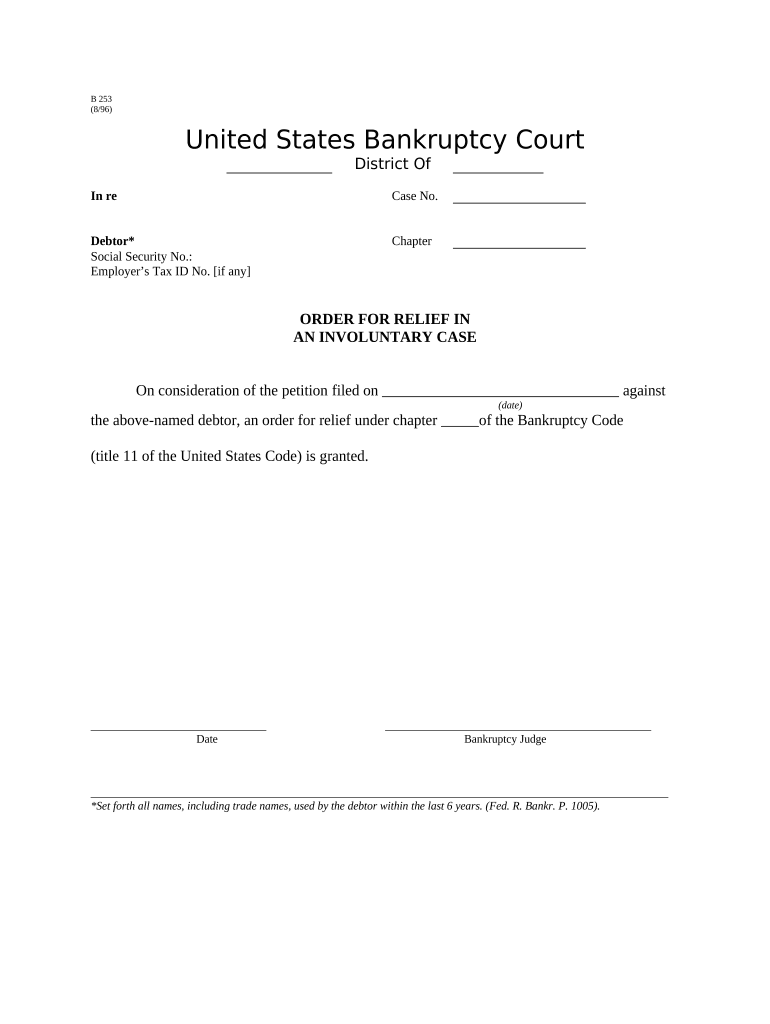

This form is an order for relief in an involuntary bankruptcy case. The form must be signed by the presiding bankruptcy judge.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is order for relief in

An 'order for relief in' is a legal document requesting a court to grant relief from certain obligations or penalties imposed on an individual or entity.

pdfFiller scores top ratings on review platforms

Quick and easy to use

Quick and easy to use. I would recommend everyone to have this especially in COVID-times

Easy and comfy treatment with the…

Easy and comfy treatment with the modified PDF files:)

It is an excellent experience with…

It is an excellent experience with pdFiller. I was attended to by an experienced customer advisor. The service I received is beyond my expectation. Please I will recommend pdFiller for your needs

This was a great service

This was a great service! Customer support was amazing and sorted out any questions I had!

I like the PDFFiller

This is a great program

This is a great program to write up legal documents.

Who needs order for relief in?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Order for Relief in Involuntary Bankruptcy Cases

What is the order for relief in bankruptcy?

The order for relief is a crucial legal decision in the context of involuntary bankruptcy cases. It signifies that the court has recognized a business or individual as unable to meet their financial obligations, allowing the creditors to proceed with the bankruptcy proceedings. Understanding the intricacies of the order for relief is essential for those seeking to navigate the complexities of bankruptcy law.

-

Bankruptcy is a legal process through which individuals or businesses can eliminate or repay some or all of their debts under the protection of the federal bankruptcy court.

-

The Order for Relief initiates the process in an involuntary bankruptcy case and can significantly affect the debtor's financial future.

How can initiate an involuntary bankruptcy case?

Each state has specific eligibility requirements for filing an involuntary petition, generally centered around the debtor's financial situation. Key steps need to be followed precisely to avoid delays or dismissals, such as gathering relevant financial documents, identifying the correct form to file, and ensuring all required information is included.

-

To file an involuntary bankruptcy petition, creditors must show that the debtor is not paying their debts as they come due.

-

Creditors must file a motion along with the petition, full disclosure of the debtor's financial situation, and the necessary fees.

-

Failing to establish qualifying debt or not properly notifying the debtor can result in case dismissal.

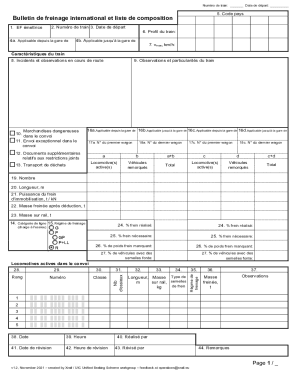

What does Form B 253 entail?

Form B 253, or the Order for Relief form, is integral for those filing an involuntary bankruptcy case. This form contains detailed information about the debtor and the petitioning creditors, making it crucial for the court’s understanding of the case.

-

Composed of various sections, Form B 253 requires information such as debtor names, case numbers, and tax identification numbers.

-

Debtor name and case number are fundamental fields, while Social Security and Employer’s Tax ID details help streamline the identification process.

-

Selecting the appropriate chapter is essential for aligning the bankruptcy process with the debtor’s financial needs.

How do fill out the order for relief form?

Completing Form B 253 accurately is vital to ensure a smooth bankruptcy process. A step-by-step approach facilitates accurate submissions, and having a checklist ensures that no required information is overlooked.

-

Follow a clear, numbered guide to fill out every section of the form, prioritizing accuracy in the debtor's details.

-

Prepare a checklist before submission to ensure all fields are completed and relevant documents are attached.

-

Avoiding incomplete forms and incorrect names can significantly improve your filing experience.

What are the responsibilities of the bankruptcy judge?

The bankruptcy judge plays a pivotal role upon receiving the involuntary petition. Their responsibilities include evaluating the petition and determining whether to grant the order for relief, which can lead to significant consequences for the debtor.

-

The judge must review petition details and hear arguments from the involved parties before making a decision.

-

Judges assess the eligibility requirements and overall evidence presented before the court.

-

Upon granting the order, the judge outlines the next steps the debtor must follow to comply with court mandates.

What are my legal obligations after the order for relief?

Once the order for relief is granted, the debtor experiences various legal obligations. Understanding these is crucial for complying with the bankruptcy’s regulations and avoiding potential legal pitfalls.

-

Post-order, the debtor must adhere to a structured repayment plan, attend meetings with creditors, and provide necessary financial disclosures.

-

Debtors are expected to cooperate with the court and actively participate in the bankruptcy process.

-

Failure to comply with the bankruptcy court's orders can result in dismissal of the case or further legal repercussions.

How can utilize interactive tools and resources?

Modern tools like pdfFiller empower users to efficiently manage bankruptcy-related documentation, including editing and e-signing forms. Leveraging these resources enhances accuracy and facilitates collaboration during the application process.

-

pdfFiller simplifies the editing and signing of bankruptcy forms, making the process user-friendly.

-

Utilizing cloud-based platforms allows multiple parties to work on the order for relief simultaneously.

-

Storing documents on the cloud provides access and security, crucial for sensitive bankruptcy paperwork.

How can ensure compliance with bankruptcy rules?

Ensuring compliance with bankruptcy rules is crucial for a successful petition. By familiarizing yourself with the regulations surrounding Form B 253 and adopting best practices, you can minimize errors and enhance the chances of a favorable outcome.

-

Each state adheres to unique bankruptcy rules; understanding these is important for compliance.

-

Follow all procedural guidelines, meet timelines, and retain documentation throughout the process.

-

Conduct thorough reviews of all submissions to ensure accuracy and completeness, potentially consulting legal assistance.

What are the final steps and next stages after filing?

Once the order for relief has been granted, several additional steps follow, including creditor meetings and potential hearings. Each stakeholder in the case has specific responsibilities that must be addressed to move forward with the bankruptcy process successfully.

-

Debtors will receive notifications regarding necessary meetings or hearings, ensuring compliance with the bankruptcy process.

-

Creditors, debtors, and the bankruptcy judge all have roles during subsequent procedures.

-

Debtors should be thoroughly prepared for discussions with creditors and the bankruptcy court.

How to fill out the order for relief in

-

1.Download the 'order for relief in' template from pdfFiller.

-

2.Open the PDF template using pdfFiller's tools.

-

3.Fill in the required information, including the debtor's name, case number, and relevant financial details.

-

4.Attach any necessary supporting documents that demonstrate the need for relief.

-

5.Review the filled form for accuracy and completeness.

-

6.Choose the appropriate electronic signature option in pdfFiller to sign the document, if required.

-

7.Save the completed document and download it to your device, or proceed to file it with the court as instructed.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.