Get the free property will sample

Show details

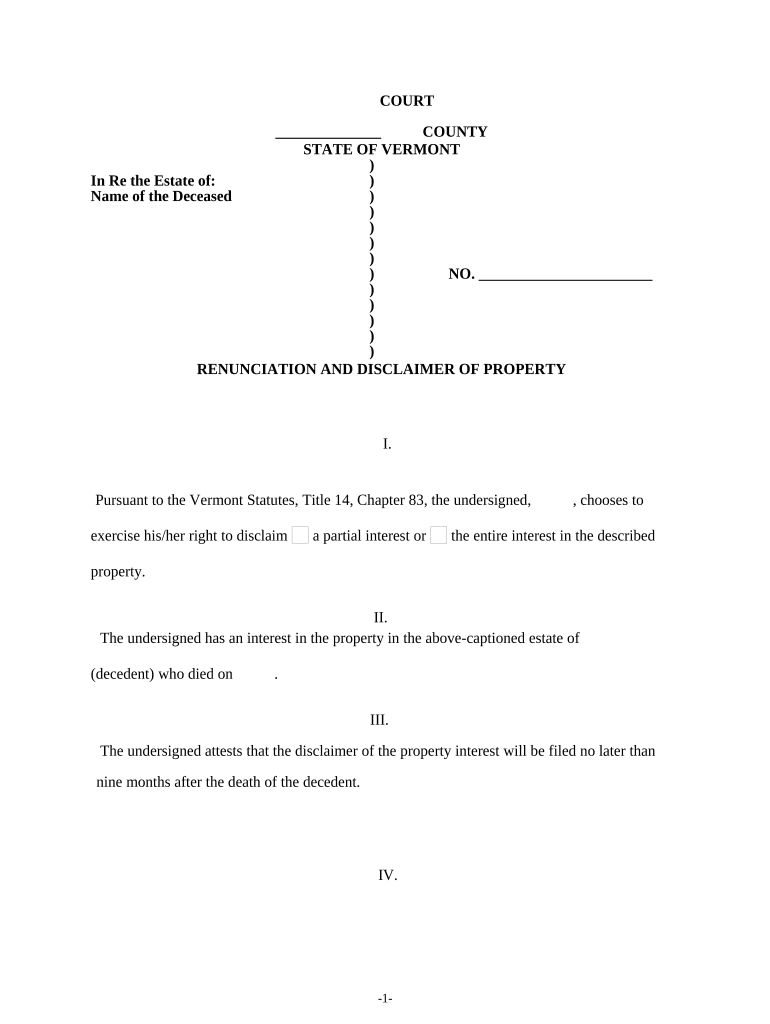

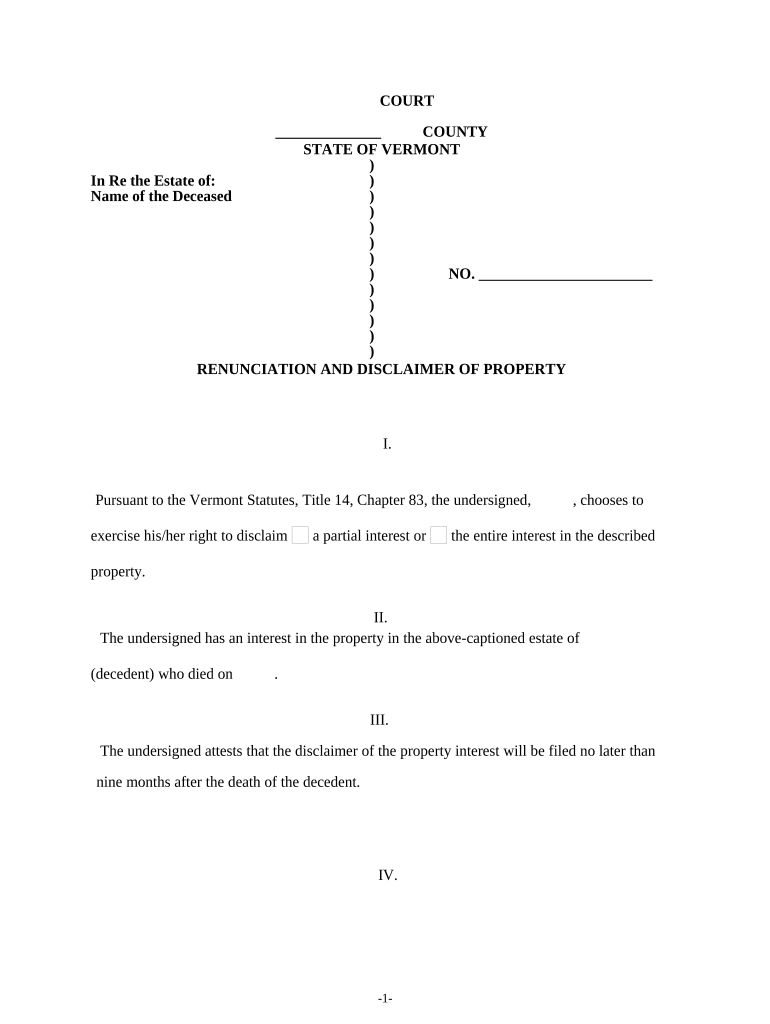

This form is a renunciation and disclaimer of property inherited from a decedent by a will where the heir does not want the property. You can adapt it to fit your circumstances.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is renunciation and disclaimer of

A renunciation and disclaimer of is a legal document in which an individual relinquishes their right to inherit assets or benefits.

pdfFiller scores top ratings on review platforms

I LOVE PDF FILLER, I USE IT ALL THE TIME, IT IS EASY TO USE AND VERY PROFESSIONAL.

PDF is most useful to me for preparing tax forms.

PDFfiller is very useful for filling out government forms. Wish it was more used friendly.

For medical forms, this makes things soooo much easier!

need to remove the pdf verified box fromprinting it appears i nmiddle of doc why

a little hard to use for me need more practice?

Who needs property will sample template?

Explore how professionals across industries use pdfFiller.

How to fill out a renunciation and disclaimer of form form: A comprehensive guide

Understanding renunciation and disclaimer

Renunciation and disclaimer are legal mechanisms that allow individuals to refuse interest in a property or asset. This process can be essential during estate management and can help prevent unintended inheritance. In Vermont, understanding the key distinctions and implications of both terms is essential for beneficiaries.

-

A renunciation is a formal rejection of an inheritance, while a disclaimer refers to a legal document declaring one's intention to relinquish rights or interest.

-

Beneficiaries may renounce property to avoid liabilities, tax burdens, or disputes among heirs.

-

While both involve rejecting an inheritance, renunciation applies to bequests under wills, and disclaimers can apply to various forms of gifts or trust distributions.

What is the legal framework in Vermont?

Vermont has specific statutes that govern the renunciation and disclaimer process. Understanding these laws is crucial for anyone involved in estate proceedings.

-

Vermont law requires that disclaimers follow statutory forms and procedures to be valid.

-

It is vital to adhere to the required timelines, as failure to do so can invalidate a disclaimer.

-

Renouncing property can shift distribution to other beneficiaries, significantly affecting inheritance outcomes.

How do you initiate the renunciation process?

Filling out a renunciation or disclaimer form can be straightforward if approached systematically. This process is essential for ensuring that your intentions are documented clearly.

-

Begin with personal details, including your relationship to the deceased, and clearly state your intent to renounce.

-

Accurate details about the deceased and the facts surrounding the inheritance must be disclosed to avoid legal complications.

-

Be specific about the property interests you wish to renounce, including any identification numbers or legal descriptions.

What are the filing requirements and timelines?

Timeliness and proper filing are crucial to ensure that your renunciation is legally recognized. Missing deadlines can have lasting effects on estate proceedings.

-

The law stipulates a strict deadline that must be adhered to for the disclaimer to be valid.

-

Disclaimers must be filed with the appropriate probate court and provided to the personal representative handling the estate.

-

Failing to file the disclaimer on time can lead to unintentional acceptance of the property, complicating matters further.

What are the implications of renunciation?

The decision to renounce property has significant legal ramifications. Understanding these implications can help you make informed decisions.

-

Renouncing your right to property may prevent future claims against the estate and alleviates possible tax burdens.

-

When one beneficiary renounces, the property typically passes to the next in line, which might impact overall distributions.

-

Renouncing property can have tax implications, thus reviewing with a tax professional before proceeding is advisable.

Why use interactive tools for document management?

Using platforms like pdfFiller can streamline the document management process, making it easier to edit, sign, and collaborate.

-

This platform allows you to create and customize your disclaimer form efficiently.

-

Digital signatures can significantly speed up the process, allowing for immediate submission and reductions in paperwork.

-

Easily share documents with others or consult online, facilitating smoother communication and faster resolutions.

What security and privacy considerations should be taken into account?

Handling sensitive documents requires strict security protocols. Choosing platforms with robust privacy features is critical.

-

It's essential to keep personal information secure to prevent unauthorized access.

-

pdfFiller implements stringent security measures, including encryption and access restrictions.

-

Ensure your document management complies with all relevant laws to avoid legal issues.

Summary

Filling out a renunciation and disclaimer of form form is an important step in managing property rights after a death. Understanding the process, requirements, and implications can make a significant difference in the outcomes for you and your family. Using tools like pdfFiller can streamline this task, allowing for easy document management, editing, and collaboration.

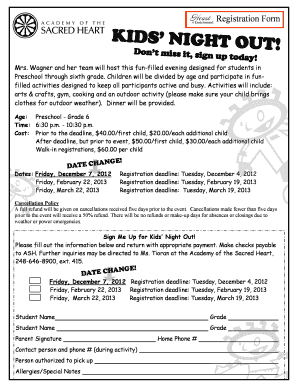

How to fill out the property will sample template

-

1.Visit pdfFiller and create an account or log in if you already have one.

-

2.Upload the ‘renunciation and disclaimer of’ document template you need to fill out.

-

3.Begin by entering your personal information at the top of the form, including your full name and address.

-

4.Clearly state your relationship to the deceased or the source of the inheritance in the designated section.

-

5.Locate the section where you must indicate your intention to renounce the inheritance; check the appropriate boxes or write a clear statement.

-

6.If required, provide details about the specific assets or benefits you are disclaiming.

-

7.Review all information for accuracy, ensuring it comprehensively conveys your intentions.

-

8.Once satisfied, save your filled document and either print it for physical signing or follow the electronic submission process if applicable.

-

9.Ensure to sign and date the document where indicated, and if needed, have it notarized for legal validity.

-

10.Lastly, submit the completed form to the appropriate estate or trust administrator as per legal requirements.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.