Last updated on Feb 20, 2026

Get the free Vermont UCC1 Financing Statement template

Show details

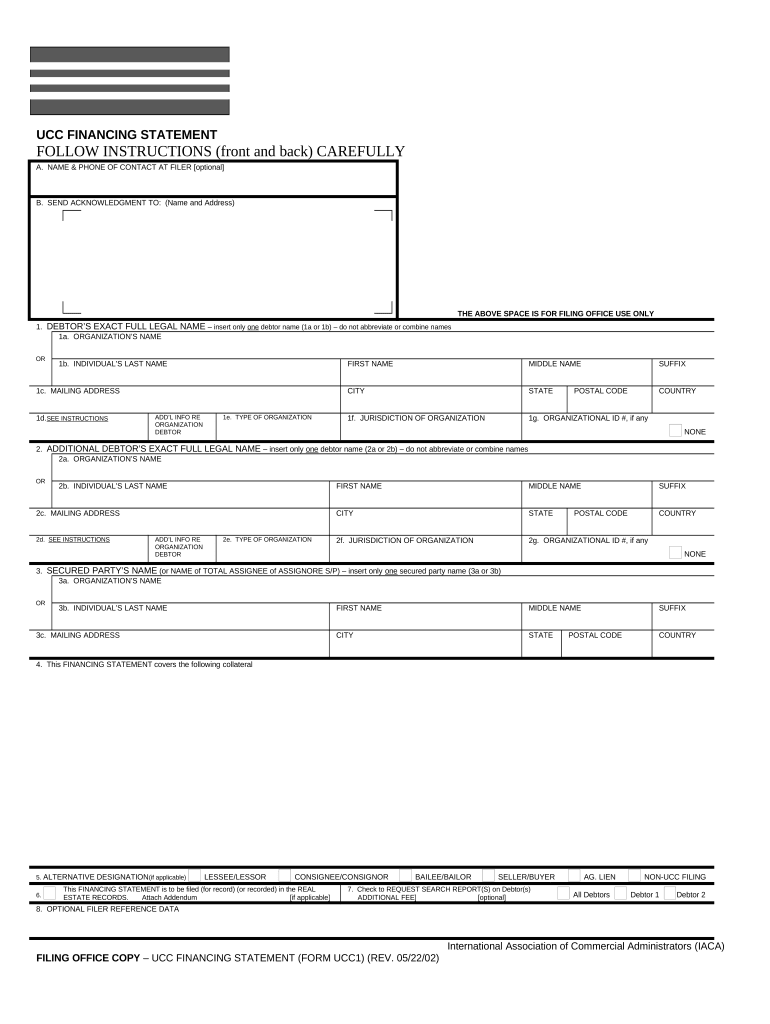

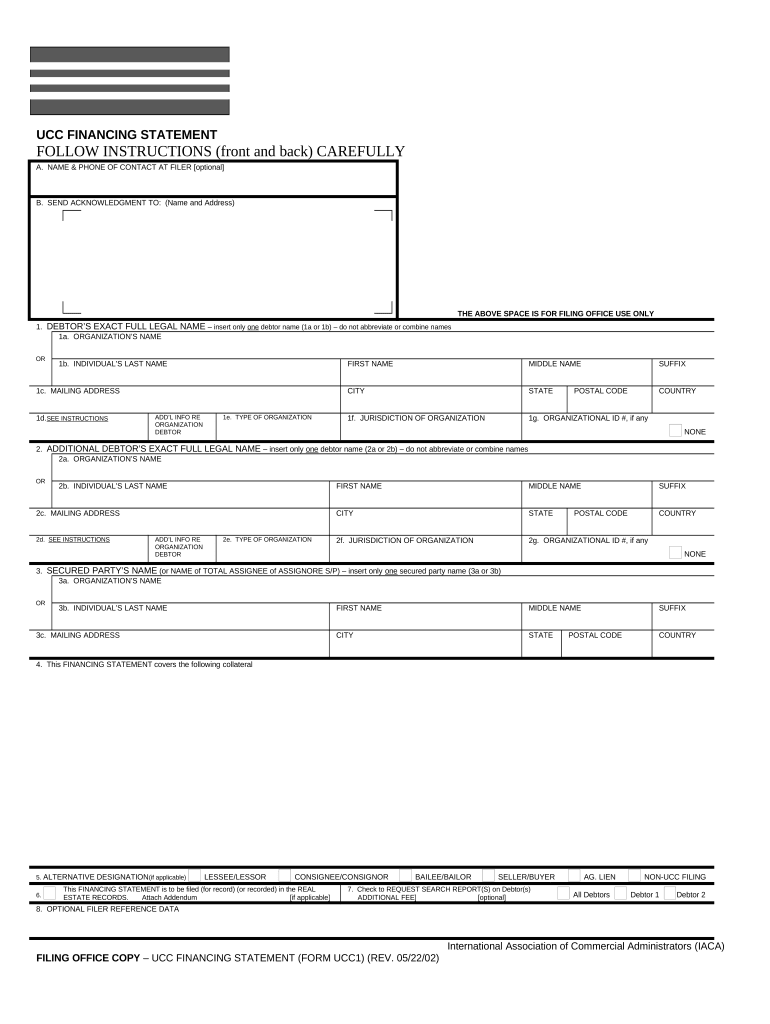

UCC1 - Financing Statement - Vermont -For use after July 1, 2001. This form is a financing statement used to cover certain collateral as specified in the form. This Financing Statement complies will

pdfFiller is not affiliated with any government organization

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is vermont ucc1 financing statement

A Vermont UCC1 Financing Statement is a legal form that a lender files to give notice of its security interest in a debtor's personal property to establish priority in case of bankruptcy or default.

pdfFiller scores top ratings on review platforms

easy to use

very easy

What do you like best about the product?

The affordability of pdf filler to begin with . It's an excellent price for all of the features u need to run a business . And the pff filler is incredibly easy and quick to use . With ismts many features u can do everything from creating your own documents to keep ur business running smoothly to editing documents to fit your needs down to signing document and sending them out to partners or clientele.all in all PDf filler is a awesome addition to your business to keep thingsvk running

What do you dislike about the product?

I haven't yet found anything that I dislike . Or found not useful.

What problems is the product solving and how is that benefiting you?

PDF Fill gives me the ability to either edit a particular document to suit your business needs at the moment or create a document . You can do everything needed from pdf filler from create odit to sign or send to be signed to file , email etc it's very easy to understand and use as well as affordable

This program has saved my processing life! Any and all documents i need from a Verification of Rent to a Processor's Cert are at my fingertips. I love it!

A user friendly, very powerful, I'm impressed.

Great

Who needs vermont ucc1 financing statement?

Explore how professionals across industries use pdfFiller.

How to fill out a Vermont UCC1 financing statement form

What is a UCC1 financing statement?

A UCC1 financing statement is a legal document used to secure a creditor's interest in the personal property of a debtor in Vermont. It acts as a public notice that the creditor has a security interest in the specified collateral, which can include various types of assets. This form is an essential tool in the business financing process, as it protects a lender’s rights to certain assets in case of non-payment.

Why is the UCC1 important in financing?

The UCC1 financing statement serves a crucial purpose in securing loans by providing lenders with a way to legally establish their claims against the borrower's assets. This document not only helps in maintaining a clear record of secured interests but also ensures that creditors are prioritized in bankruptcy situations. In the context of Vermont's legal framework, it aligns with specific state regulations to provide clarity and protect both parties involved.

What are the key fields in the UCC1 form?

Filling out the UCC1 form accurately is paramount, as any errors can lead to complications in securing financing. Below are the key fields included in the form:

-

This section is reserved for the filing office and should be left blank by the filer.

-

Full legal name and address of the debtor must be provided to ensure correct identification.

-

Include the secured party’s name and address to establish the creditor's claim.

-

Precise details of the collateral securing the loan must be described.

-

Any necessary attachments or additional forms must be included during submission.

How to fill out the UCC1 financing statement form?

Completing the UCC1 form involves several methodical steps to ensure accuracy and compliance. Here’s a step-by-step guide:

-

Ensure you have the debtor's full legal name, contact information, and details of the collateral.

-

Follow the prompts in the UCC1 form, paying close attention to required fields.

-

Check for any inaccuracies or omissions, as errors can lead to delays or rejections.

-

File the completed form with the appropriate Vermont state filing office alongside any required fees.

What interactive tools can help with completing the UCC1 form?

Utilizing online tools like pdfFiller can greatly simplify the process of completing and managing the UCC1 form. Features such as eSignature, cloud storage, and collaboration capabilities provide users with a convenient, centralized platform for document management.

-

Easily edit text, add signatures, and make revisions in real time.

-

Invite other parties to review, sign, or comment on the document efficiently.

-

Store UCC1 forms securely in the cloud, allowing for easy access from anywhere.

What compliance and legal considerations should be made?

It's essential to understand Vermont’s specific regulations concerning UCC filings. Additionally, various fees apply depending on the nature of the filing, whether it involves real estate records or other secured interests. Knowing these nuances can help avoid potential legal issues and ensure smooth processing.

-

Familiarize yourself with Vermont’s UCC regulations to ensure compliance.

-

Know the critical timelines for filing and any associated penalties for late submissions.

-

Budget for fees related to filing, searching reports, and amendments.

Understanding case studies on effective use of UCC1 statements

Examining practical examples can provide insight into successful filing strategies. Many Vermont businesses have used UCC1 filings effectively to secure financing and enhance their operational capabilities.

-

Review case studies where businesses successfully used UCC1 to secure loans.

-

Understand what filing methods worked best and why they were effective.

-

Explore the impact on businesses' abilities to grow and manage their assets.

How to fill out the vermont ucc1 financing statement

-

1.Obtain the Vermont UCC1 Financing Statement form from pdfFiller or the appropriate state office.

-

2.Fill in the debtor's legal name and address in the designated fields to ensure accurate identification.

-

3.Provide the secured party's name and address, including the name of the lender or creditor.

-

4.Detail the collateral description clearly, indicating the personal property being secured by the loan.

-

5.Check the box for the type of UCC statement being filed—blanket or specific collateral.

-

6.Review the completed form for any errors or omissions to ensure compliance with legal requirements.

-

7.Sign and date the form where indicated, which may require a witness or notarization depending on local laws.

-

8.Submit the form electronically through pdfFiller or print it for physical submission to the Vermont Secretary of State's office.

-

9.Pay any required filing fees as specified by the state, confirming submission of the document.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.