Get the free SECOND DEED OF TRUST THIS Second Deed of Trust dated this ...

Show details

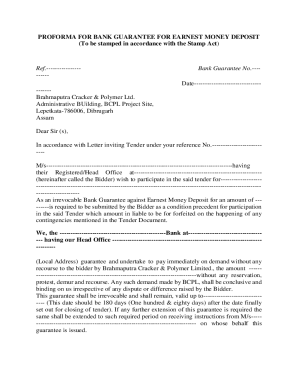

After recording please return to: City of Gaithersburg c/of Department of Legal Services 31 South Summit Avenue Gaithersburg, MD 20877SECOND DEED OF TRUST THIS Second Deed of Trust dated this day

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign second deed of trust

Edit your second deed of trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your second deed of trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit second deed of trust online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit second deed of trust. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out second deed of trust

How to fill out second deed of trust

01

To fill out a second deed of trust, follow these steps:

02

Begin by providing the basic information about the property, such as the address and legal description.

03

Identify the parties involved in the deed of trust, including the borrower (trustor) and the lender (beneficiary).

04

Specify the terms of the loan, including the principal amount, interest rate, repayment terms, and any additional provisions.

05

Outline the rights and responsibilities of both the borrower and the lender regarding the property.

06

Include any necessary clauses or provisions related to default, foreclosure proceedings, or release of the deed of trust.

07

Sign and date the deed of trust, ensuring that all parties involved have signed the document.

08

Record the deed of trust with the appropriate county office to make it a public record and protect the lender's interest in the property.

09

It is recommended to consult with a legal professional when filling out a second deed of trust to ensure compliance with local laws and regulations.

Who needs second deed of trust?

01

A second deed of trust is typically needed by individuals or entities who want to secure a second loan on a property that already has an existing mortgage or deed of trust in place.

02

Common scenarios where a second deed of trust may be required include:

03

- Homeowners seeking to take out a home equity loan or line of credit using their property as collateral.

04

- Real estate investors looking to secure a second mortgage on a property to finance additional purchases.

05

- Business owners who need to secure a loan using their commercial property as collateral.

06

- Individuals looking to co-sign a loan for someone else, where the second deed of trust provides security for the co-signer's interest in the property.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my second deed of trust directly from Gmail?

second deed of trust and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Can I sign the second deed of trust electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your second deed of trust in seconds.

Can I edit second deed of trust on an iOS device?

You certainly can. You can quickly edit, distribute, and sign second deed of trust on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is second deed of trust?

A second deed of trust is a legal document that secures a loan or financing against a property, which already has a primary deed of trust in place. It is subordinate to the first mortgage and is often used to finance additional borrowing.

Who is required to file second deed of trust?

Typically, the borrower seeking additional financing against their property is responsible for filing the second deed of trust. Lenders who provide the second loan may also have a role in the filing process.

How to fill out second deed of trust?

To fill out a second deed of trust, you need to provide information such as the names of the parties involved, a legal description of the property, the amount of the loan, and agreed-upon terms, along with signatures from the borrower and lender.

What is the purpose of second deed of trust?

The purpose of a second deed of trust is to secure additional financing against a property that already has an existing mortgage, allowing the borrower to access more capital while using the same property as collateral.

What information must be reported on second deed of trust?

Key information that must be reported on a second deed of trust includes the borrower and lender's names, the property description, loan amount, interest rate, repayment terms, and any pertinent conditions or clauses.

Fill out your second deed of trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Second Deed Of Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.