Business tax application 2019-2025 free printable template

Show details

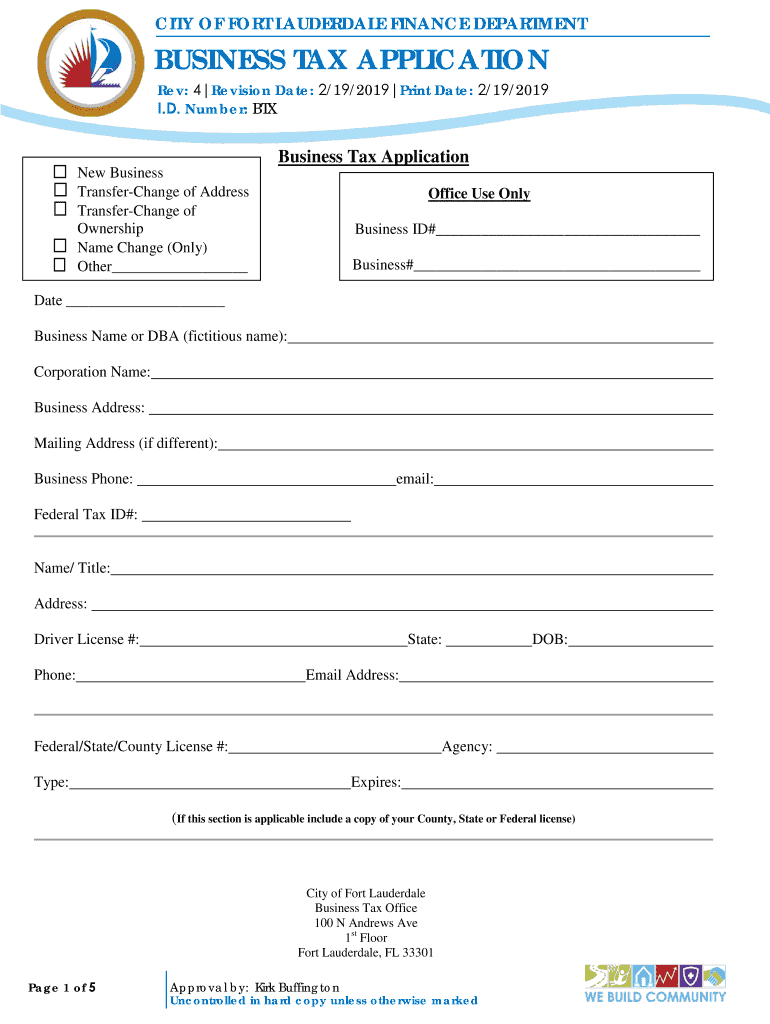

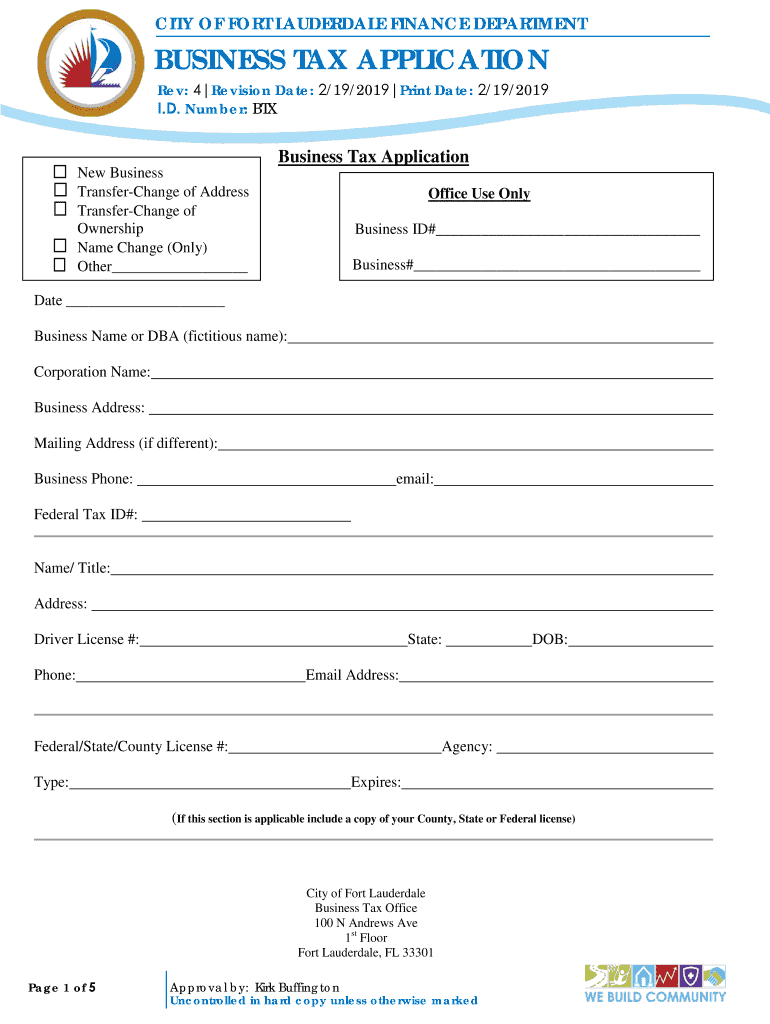

CITY OF FORT LAUDERDALE FINANCE DEPARTMENTBUSINESS TAX APPLICATION Rev: 4 Revision Date: 2/19/2019 Print Date: 2/19/2019 I.D. Number: Business Tax Application New Business TransferChange of Address

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign city of fort lauderdale

Edit your city of fort lauderdale form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your city of fort lauderdale form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing city of fort lauderdale online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit city of fort lauderdale. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out city of fort lauderdale

How to fill out Business tax application

01

Gather all necessary business information, including your legal business name, address, and tax identification number.

02

Determine the type of business structure (e.g., sole proprietorship, partnership, corporation) to select the correct application form.

03

Obtain the correct business tax application form from the IRS website or your local tax authority.

04

Fill out the application form accurately, providing all required information, including income estimates and deductions.

05

Review the completed application for accuracy and completeness.

06

Sign and date the application.

07

Submit the application according to the instructions, either electronically or via mail.

Who needs Business tax application?

01

New businesses applying for a tax identification number.

02

Existing businesses that need to update their tax status or change their business structure.

03

Business owners who are required to file for state or local business taxes.

Fill

form

: Try Risk Free

People Also Ask about

What is the phone number for Broward County business tax receipt?

All unpaid Business Tax Receipts become delinquent October 1 and are assessed a penalty. If you do not receive your renewal notice, you should contact the Broward County Call Center at 954-831-4000. Fax number: 954-357-5479.

Do I need a business tax receipt in Florida?

You must pay a tax to operate any business within city limits. A business tax receipt is proof of payment and it is required before a business opens.

How do I renew my business tax receipt in Florida?

Renew online or call the Miami-Dade Tax Collector's Office at 305-270-4949. The Tax Collector's Office is located at 200 NW 2nd Avenue, Miami, Florida 33128. Upon renewing your Local Business Tax Receipt, your vendor status will be activated.

How do I get a business tax receipt in Florida?

First-time applicants must use the online application system or fill out and print the Local Business Tax receipt application and submit it by mail or in person.

Is a business tax receipt the same as a business license in Florida?

The most common type of business license you will need is a business operating license, often called a “business tax receipt” in Florida. These licenses will be required to operate essentially all types of businesses and will be nearly identical in all cities and counties across Florida.

How do I get a Florida business tax receipt?

First-time applicants must use the online application system or fill out and print the Local Business Tax receipt application and submit it by mail or in person.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my city of fort lauderdale directly from Gmail?

city of fort lauderdale and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit city of fort lauderdale straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing city of fort lauderdale right away.

How do I fill out the city of fort lauderdale form on my smartphone?

Use the pdfFiller mobile app to fill out and sign city of fort lauderdale. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is Business tax application?

A Business tax application is a form or process that businesses must complete and submit to report their taxable income and calculate the taxes owed to relevant authorities.

Who is required to file Business tax application?

Generally, all businesses that generate income are required to file a Business tax application, including corporations, partnerships, sole proprietorships, and limited liability companies (LLCs).

How to fill out Business tax application?

To fill out a Business tax application, gather your financial records, follow the instructions provided by the tax authority, enter your income and expenses accurately, and ensure you provide all required information and signatures.

What is the purpose of Business tax application?

The purpose of the Business tax application is to formally report a business's income, deductions, and tax liability, ensuring compliance with tax laws and facilitating the collection of taxes by the government.

What information must be reported on Business tax application?

The Business tax application typically requires reporting of total income, allowable deductions, business expenses, net profit or loss, and basic business information such as the business name, address, and taxpayer identification number.

Fill out your city of fort lauderdale online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

City Of Fort Lauderdale is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.