Get the free FATCA AND CRS TAX RESIDENCY SELF-CERTIFICATION FORM

Show details

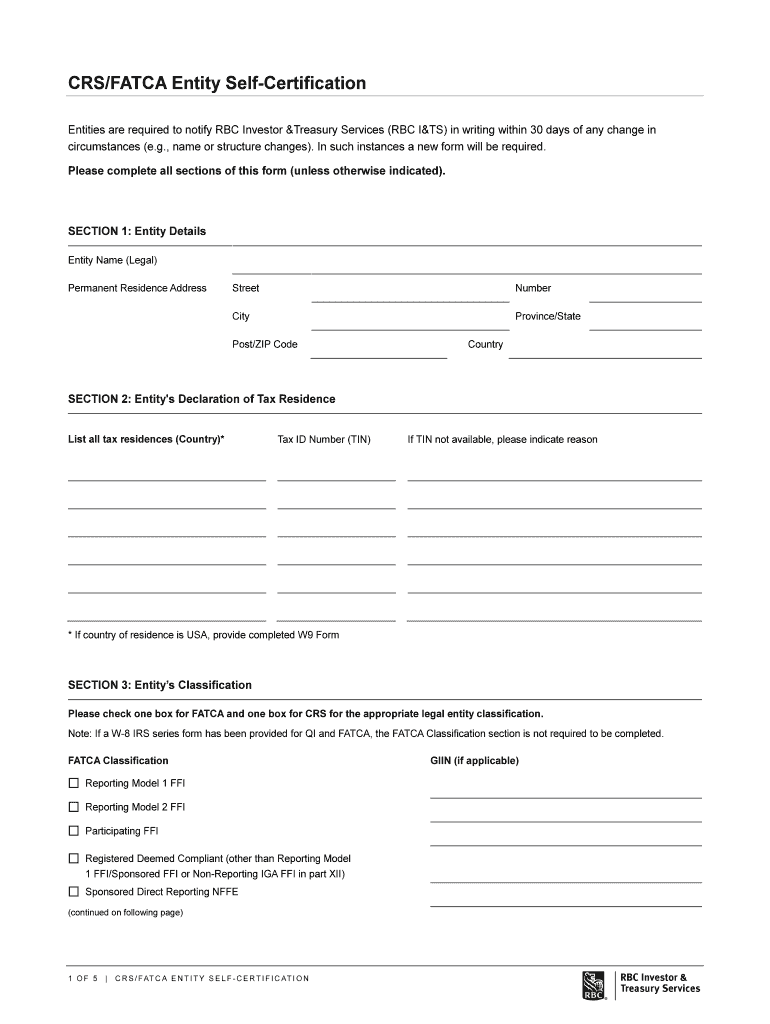

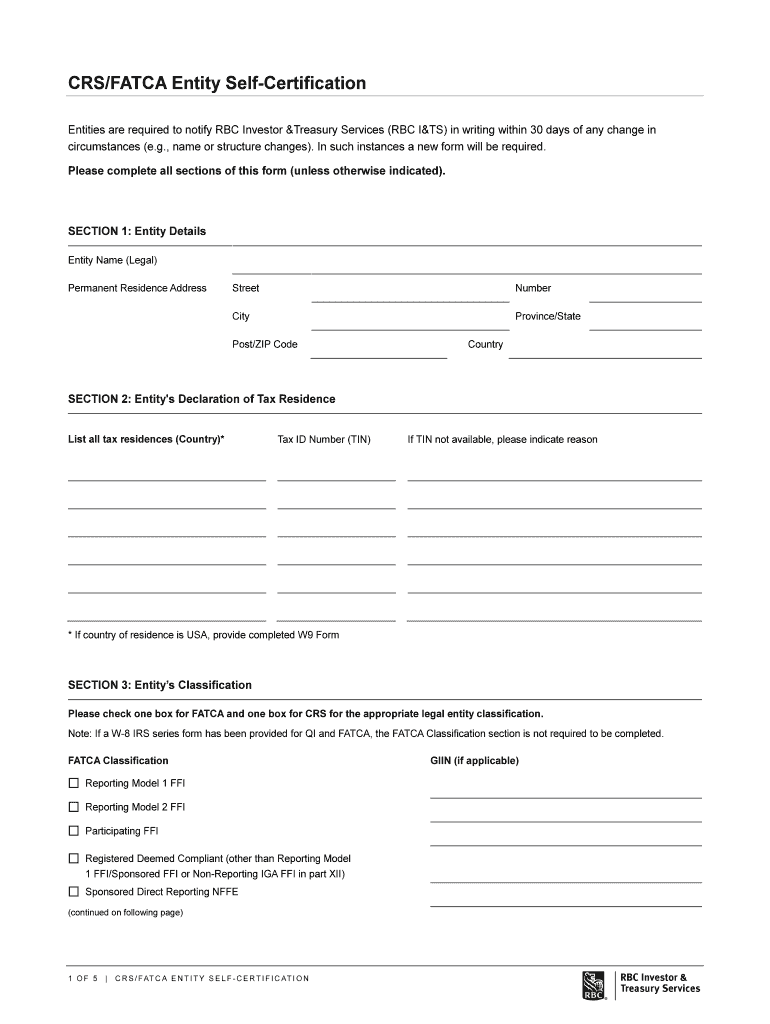

CRS/FATWA Entity Recertification Entities are required to notify RBC Investor Treasury Services (RBC ITS) in writing within 30 days of any change in circumstances (e.g., name or structure changes).

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fatca and crs tax

Edit your fatca and crs tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fatca and crs tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fatca and crs tax online

To use the services of a skilled PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit fatca and crs tax. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fatca and crs tax

How to fill out fatca and crs tax

01

To fill out FATCA and CRS tax forms, follow these steps:

02

Understand the requirements: Familiarize yourself with the regulations and guidelines related to FATCA and CRS tax reporting.

03

Gather necessary information: Collect all the required information such as personal details, financial transactions, and account balances.

04

Determine your status: Determine whether you are an individual, entity, or financial institution required to report under FATCA and CRS tax.

05

Complete the forms: Fill out the necessary forms accurately and provide all the requested information.

06

Review and verify: Double-check your filled-out forms for any errors or omissions. Make sure all the information is accurate.

07

Submit your forms: Submit the completed forms to the appropriate tax authority or financial institution.

08

Keep records: Maintain copies of the filled-out forms and any supporting documentation for future reference or potential audits.

09

It is always recommended to consult a tax professional or seek assistance from the relevant authorities for specific guidance on completing FATCA and CRS tax forms.

Who needs fatca and crs tax?

01

FATCA and CRS tax reporting requirements apply to various individuals, entities, and financial institutions, including:

02

- US citizens or residents with financial accounts or investments outside the United States

03

- Non-US entities with substantial US ownership

04

- Foreign financial institutions that have investments or accounts held by US citizens or residents

05

- Foreign entities that have financial accounts with participating jurisdictions under CRS

06

It is essential to consult a tax advisor or refer to the specific regulations to determine if FATCA and CRS tax reporting is required in your particular case.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit fatca and crs tax in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing fatca and crs tax and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I fill out fatca and crs tax using my mobile device?

Use the pdfFiller mobile app to complete and sign fatca and crs tax on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Can I edit fatca and crs tax on an iOS device?

Use the pdfFiller mobile app to create, edit, and share fatca and crs tax from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is fatca and crs tax?

FATCA (Foreign Account Tax Compliance Act) is a U.S. federal law that requires U.S. citizens and residents to report certain foreign financial accounts and assets. CRS (Common Reporting Standard) is a global standard for the automatic exchange of financial account information between countries, aiming to combat tax evasion.

Who is required to file fatca and crs tax?

U.S. taxpayers with foreign financial assets exceeding certain thresholds must file FATCA. CRS requires financial institutions in participating countries to report account information of foreign tax residents.

How to fill out fatca and crs tax?

FATCA forms are typically filed using Form 8938 for individuals or revised forms for institutions. CRS reporting is generally handled by financial institutions based on their internal processes, as it does not involve individual filing.

What is the purpose of fatca and crs tax?

The purpose of FATCA is to ensure that U.S. taxpayers report all of their foreign financial accounts. The CRS aims to prevent tax evasion by allowing tax authorities worldwide to share information about their residents' foreign financial accounts.

What information must be reported on fatca and crs tax?

FATCA requires reporting of foreign bank accounts, investment accounts, and certain foreign assets. CRS requires financial institutions to report the account holders' personal information, account balances, and income earned in those accounts.

Fill out your fatca and crs tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fatca And Crs Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.