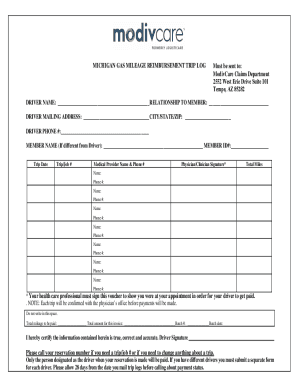

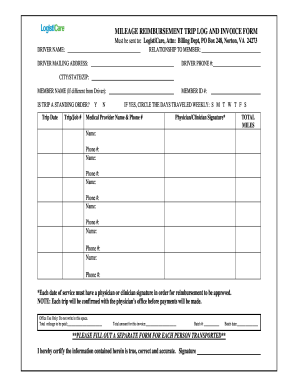

MI Logisticare Mileage Reimbursement Trip Log 2019 free printable template

Show details

Michigan

www.logisticare.comDear Michigan Member,

We have enclosed a blank reimbursement form with this letter. Feel free to make copies of the blank

form for any future trips. You can also contact

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI Logisticare Mileage Reimbursement Trip Log

Edit your MI Logisticare Mileage Reimbursement Trip Log form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI Logisticare Mileage Reimbursement Trip Log form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MI Logisticare Mileage Reimbursement Trip Log online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MI Logisticare Mileage Reimbursement Trip Log. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI Logisticare Mileage Reimbursement Trip Log Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI Logisticare Mileage Reimbursement Trip Log

How to fill out MI Logisticare Mileage Reimbursement Trip Log

01

Begin by downloading the MI Logisticare Mileage Reimbursement Trip Log form from the official website or obtain a physical copy.

02

Fill in your personal information at the top of the form, including your name, address, and contact information.

03

Record the date for each trip you are claiming reimbursement for.

04

Indicate the start and end addresses for each trip, ensuring they are clear and accurate.

05

Measure the total miles driven for each trip and enter that number in the appropriate column.

06

If applicable, note any specific reasons for the trip or include additional pertinent details in the comments section.

07

Once all trips are logged, total the mileage for all trips to ensure it matches your records.

08

Sign and date the form where indicated.

09

Submit the completed form according to the provided submission instructions (via mail, online, etc.).

Who needs MI Logisticare Mileage Reimbursement Trip Log?

01

Individuals who utilize MI Logisticare services for medical transportation and need reimbursement for the miles driven to appointments.

02

Caregivers or family members who drive patients to receive medical treatments and want to be reimbursed for their travel expenses.

Fill

form

: Try Risk Free

People Also Ask about

Does my employer have to reimburse me for mileage in Texas?

There is no law that says employers have to offer mileage reimbursement. Many do because it's a smart way to attract and retain employees. Reimbursements made at the standard Internal Revenue Service rate are not considered income, so they are not subject to tax.

What is the state of Michigan mileage reimbursement?

The new mileage rate effective July 1, 2022 is . 625 cents per mile. Therefore for civil process it is 93.75 cents per mile.Edit This Favorite. Edit This FavoriteCategory:Share:Yes No, Keep Private2 more rows

Do I have to pay mileage to my employees in Michigan?

[1] Because Michigan does not have any laws requiring employers to cover employees' travel expenses, it is between the employer and employee to contract for these terms. It is customary for employers to cover these expenses, as not doing so can lead to higher turnover.

How much does ModivCare pay per mile in Virginia?

Reimbursed at a rate of $0.50 per traveled mile, personal satisfaction of helping others, FREE Emergency Kit, Modivcare driver training, etc.Member FAQs. RegionAreaPhone NumberRegion 4Norfolk866-886-4018Region 5/6Charlottesville866-907-5191Region 7Herndon866-216-78583 more rows

What does the state of Michigan pay for mileage?

The new mileage rate effective July 1, 2022 is . 625 cents per mile. Therefore for civil process it is 93.75 cents per mile.Edit This Favorite. Edit This FavoriteCategory:Share:Yes No, Keep Private2 more rows

What happens if a company doesn't pay mileage?

No reimbursement policy When your employer doesn't provide any mileage reimbursements, you can report the entire amount of your expenses (using either the actual expense or standard mileage method) on Schedule A with your other “job expenses and certain miscellaneous deductions.”

Where is ModivCare based?

Where is ModivCare's headquarters? ModivCare's headquarters is located at 1275 Peachtree Street NE, Atlanta.

How much does modivcare pay per mile in sc 2022?

You will not receive payment for your trip unless your form is complete. The rate is $0.54 per mile. The distance will be the number of miles from your home to your medical appointment. The miles will be given to you during your reservation phone call.

How much does workers comp pay for mileage in Michigan?

The Division of Workers' Compensation (DWC) is announcing the increase of the mileage rate for medical and medical-legal travel expenses by 4 cents to 62.5 cents per mile effective July 1, 2022. This rate must be paid for travel on or after July 1, 2022 regardless of the date of injury.

What is a good mileage reimbursement rate UK?

The mileage rate for 2022 is 45p per mile for the first 10,000 miles and 25p per mile after that for business-related driving. For motorcycles, the rate is 24p per mile, and for cycles - 20p per mile.

Does ModivCare have an app?

The Modivcare app is an easy, convenient and accessible way to schedule and manage all of your Modivcare non-emergency transportation needs. No need to call a care center. For eligible members who drive themselves to appointments, they can submit their claims for Mileage Reimbursement.

Do I need to report mileage reimbursement on my taxes?

FAQ. Is reimbursed mileage considered income? As long as the mileage reimbursement does not exceed the standard IRS mileage rate per mile, it is not taxable. The difference between the mileage rate you receive and the IRS-set rate is considered taxable income.

What type of company is ModivCare?

Modivcare is a healthcare services leader. Our company was created to address the social determinants of health (SDoH) by providing non-emergency medical transportation (NEMT), personal care, nutritious meals, and remote patient monitoring.

Does Michigan have mileage reimbursement laws?

Mileage reimbursement is never allowed for travel between employees' homes, remote work locations, and official work stations. b. Reimbursement for using a privately-owned vehicle for official state business is based on actual miles traveled.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify MI Logisticare Mileage Reimbursement Trip Log without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your MI Logisticare Mileage Reimbursement Trip Log into a dynamic fillable form that you can manage and eSign from anywhere.

How do I fill out the MI Logisticare Mileage Reimbursement Trip Log form on my smartphone?

Use the pdfFiller mobile app to complete and sign MI Logisticare Mileage Reimbursement Trip Log on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Can I edit MI Logisticare Mileage Reimbursement Trip Log on an iOS device?

Use the pdfFiller mobile app to create, edit, and share MI Logisticare Mileage Reimbursement Trip Log from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is MI Logisticare Mileage Reimbursement Trip Log?

MI Logisticare Mileage Reimbursement Trip Log is a document used by individuals to record their travel mileage for reimbursement purposes from Medicaid transportation services.

Who is required to file MI Logisticare Mileage Reimbursement Trip Log?

Individuals who utilize Medicaid transportation services and wish to receive reimbursement for their travel expenses are required to file the MI Logisticare Mileage Reimbursement Trip Log.

How to fill out MI Logisticare Mileage Reimbursement Trip Log?

To fill out the MI Logisticare Mileage Reimbursement Trip Log, you need to provide details such as the date of travel, points of origin and destination, total mileage traveled, and any additional required information specific to your trip.

What is the purpose of MI Logisticare Mileage Reimbursement Trip Log?

The purpose of the MI Logisticare Mileage Reimbursement Trip Log is to document the miles traveled for Medicaid-related trips, ensuring accurate reimbursement for eligible participants.

What information must be reported on MI Logisticare Mileage Reimbursement Trip Log?

The information that must be reported includes the date of the trip, starting and ending locations, purpose of the trip, total miles driven, and any other details as required by the reimbursement policy.

Fill out your MI Logisticare Mileage Reimbursement Trip Log online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI Logisticare Mileage Reimbursement Trip Log is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.