Get the free 2012 Montana S Corporation Information and Composite Tax Return - revenue mt

Show details

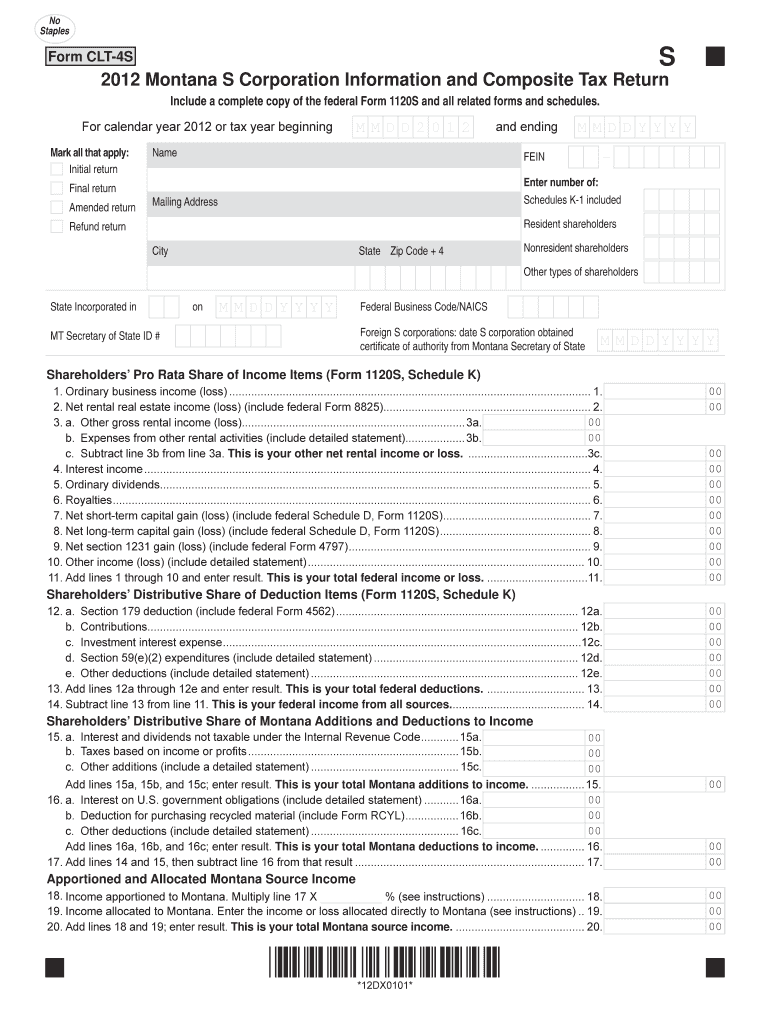

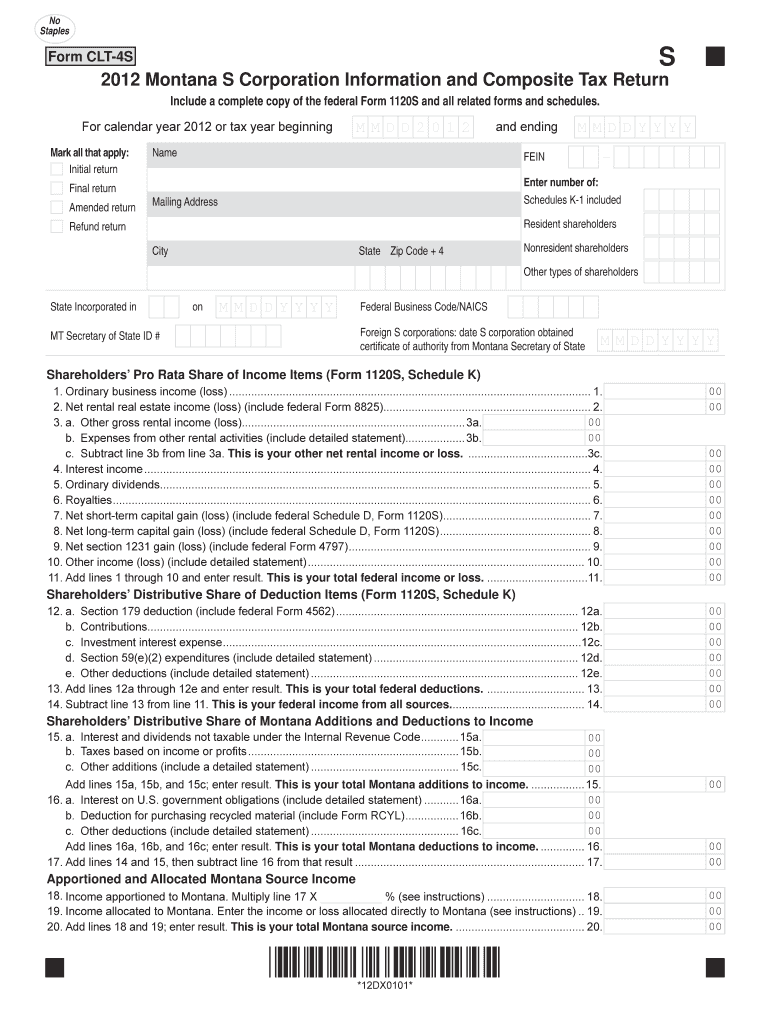

Ordinary business income (loss). ... 9. Net section 1231 gain (loss) (include federal Form 4797). .... Interest on U.S. government obligations (include detailed statement) ... Form CLT-4S, Page 2.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2012 montana s corporation

Edit your 2012 montana s corporation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012 montana s corporation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2012 montana s corporation online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2012 montana s corporation. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2012 montana s corporation

How to fill out 2012 Montana S Corporation:

01

Obtain the necessary forms: To start filling out the 2012 Montana S Corporation, you'll need to acquire the required forms from the Montana Department of Revenue. These forms typically include the Montana S Corporation Form, as well as any additional forms that might be necessary for your specific situation.

02

Provide basic business information: Begin by providing the basic details of your S Corporation, such as its legal name, mailing address, federal employer identification number (EIN), and the date the corporation was formed. This information helps identify your company and ensures accurate record-keeping.

03

Declare S Corporation status: Indicate that your Montana corporation has elected S Corporation status for the tax year 2012, according to your federal tax filing. This is an important step as it allows your corporation to be treated as a pass-through entity for tax purposes.

04

Report income and deductions: Write down all income received by the S Corporation during the 2012 tax year. This includes revenue from sales, services, investments, or any other source. Additionally, deduct any allowable expenses relevant to your business operations, such as wages, rent, supplies, and utilities. Ensure that all figures are accurate and supported by appropriate documentation.

05

Complete Schedule K-1: If your S Corporation had any shareholders during the 2012 tax year, you must complete a Schedule K-1 for each shareholder. This form reports each shareholder's allocation of income, deductions, credits, and other pertinent information. Provide accurate and thorough details for each shareholder.

06

Calculate tax liability: Once all the necessary information has been filled out, calculate the tax liability of the S Corporation by following the instructions provided on the tax forms. This will involve applying the appropriate tax rates and determining any credits or deductions applicable to your corporation. Double-check your calculations to ensure accuracy.

07

Sign and submit the forms: After reviewing all the information and making sure everything is accurate, sign the tax forms as required. Depending on your filing method, either mail the forms to the designated address or submit them electronically through the Montana Department of Revenue's online portal.

Who needs 2012 Montana S Corporation?

01

Small business owners: Individuals who operate a small business and want to benefit from the pass-through taxation and limited liability characteristics of an S Corporation may opt for the 2012 Montana S Corporation. This entity type can provide various tax advantages while still offering personal liability protection.

02

Entrepreneurs seeking tax flexibility: Business owners looking for the ability to pass income, losses, deductions, and credits through the corporation to their personal tax returns may find the 2012 Montana S Corporation advantageous. This structure can allow for potential tax savings and increased flexibility in tax planning.

03

Companies aiming for growth and succession planning: S Corporations are often favored by businesses with plans for growth or eventual transfer of ownership. The 2012 Montana S Corporation provides an attractive option if you foresee expanding your business, bringing on additional shareholders, or planning for the future transfer of ownership interests.

Overall, the 2012 Montana S Corporation can benefit individuals and businesses seeking tax advantages, flexibility, and future growth opportunities while still maintaining personal liability protection. It is important to consult with a tax professional or attorney familiar with Montana's tax laws and regulations when considering the formation or operation of an S Corporation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 2012 montana s corporation online?

pdfFiller has made it simple to fill out and eSign 2012 montana s corporation. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How can I edit 2012 montana s corporation on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing 2012 montana s corporation.

How do I edit 2012 montana s corporation on an iOS device?

You certainly can. You can quickly edit, distribute, and sign 2012 montana s corporation on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is montana s corporation information?

Montana S corporation information includes details about a corporation that has elected to be treated as an S corporation for tax purposes in the state of Montana.

Who is required to file montana s corporation information?

Any corporation that has elected to be treated as an S corporation for tax purposes in Montana is required to file S corporation information.

How to fill out montana s corporation information?

Montana S corporation information can be filled out using the official forms provided by the Montana Department of Revenue. The forms must be completed with accurate and up-to-date information about the corporation.

What is the purpose of montana s corporation information?

The purpose of Montana S corporation information is to report the corporation's financial and tax-related details to the Montana Department of Revenue for tax assessment purposes.

What information must be reported on montana s corporation information?

The information that must be reported on Montana S corporation information includes details about the corporation's income, expenses, assets, and any other relevant financial information.

Fill out your 2012 montana s corporation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2012 Montana S Corporation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.