Get the free Debts and Obligations Owed BY the Constituent-Service Program and/or Elected

Show details

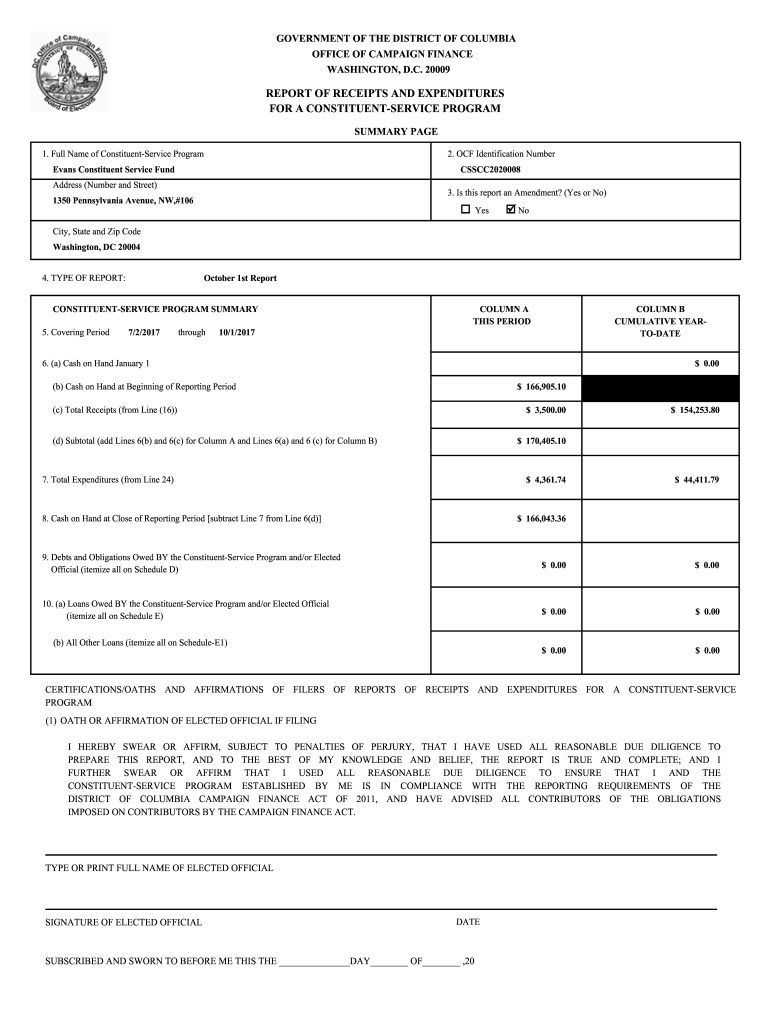

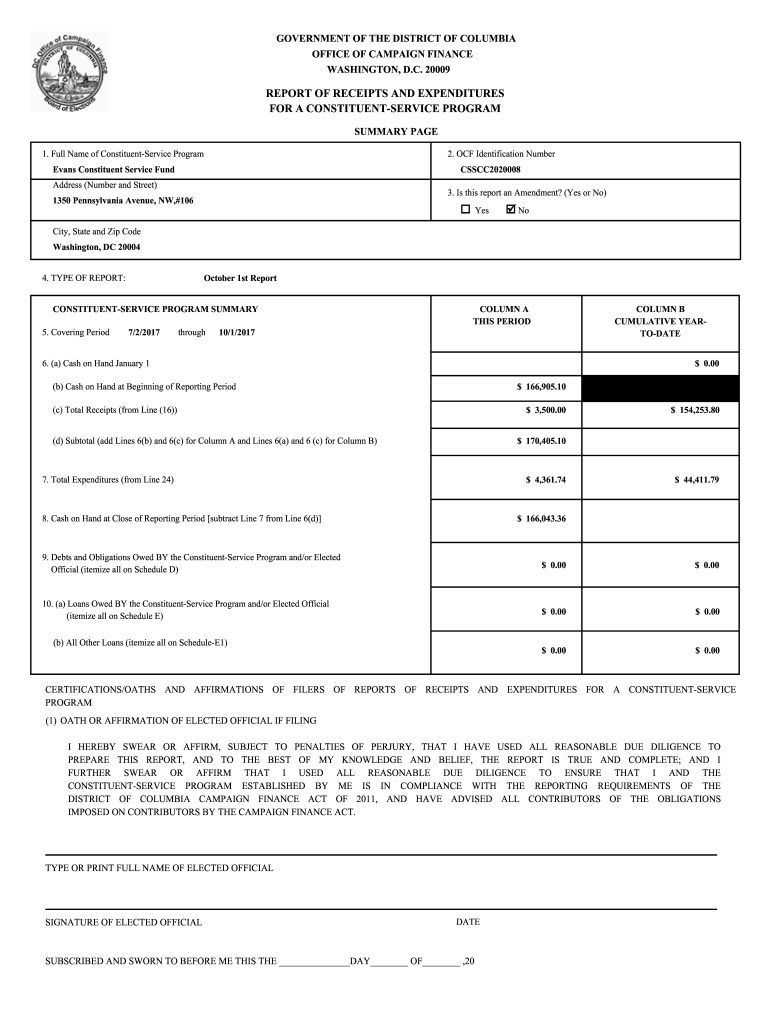

GOVERNMENT OF THE DISTRICT OF COLUMBIA

OFFICE OF CAMPAIGN FINANCE

WASHINGTON, D.C. 20009REPORT OF RECEIPTS AND EXPENDITURES

FOR A CONSTITUENTSERVICE PROGRAM

SUMMARY PAGE

1. Full Name of ConstituentService

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign debts and obligations owed

Edit your debts and obligations owed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your debts and obligations owed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing debts and obligations owed online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit debts and obligations owed. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out debts and obligations owed

How to fill out debts and obligations owed

01

To fill out debts and obligations owed, follow these steps:

02

Gather all relevant information: Start by compiling all documentation related to the debts and obligations owed. This may include loan agreements, credit card statements, billing invoices, or any other relevant financial documents.

03

Review the details: Carefully examine each debt and obligation to understand its terms, interest rates, repayment schedules, and any associated penalties or fees.

04

Prioritize your debts: Determine which debts and obligations need immediate attention and which can be addressed later. Consider factors such as the interest rates, outstanding balances, and potential consequences of non-payment.

05

Create a repayment plan: Develop a comprehensive plan to repay your debts. This includes setting a budget, allocating funds towards debt repayment, and considering debt consolidation or negotiation options if necessary.

06

Communicate with creditors: Reach out to your creditors to discuss your situation, negotiate new repayment terms, or explore possible debt relief options. It is crucial to maintain open and honest communication during this process.

07

Follow the plan consistently: Stick to your repayment plan and make regular payments towards the debts and obligations owed. Adjust the plan as needed but ensure that you meet your financial commitments.

08

Monitor your progress: Continually track your progress and evaluate your financial situation. Celebrate milestones and make adjustments to your plan if required.

09

Seek professional advice if necessary: If you find it challenging to manage your debts and obligations owed, consider consulting a financial advisor, credit counselor, or debt management agency for expert guidance and assistance.

Who needs debts and obligations owed?

01

Debts and obligations owed are relevant to individuals or businesses who have borrowed money, utilized credit facilities, or made financial commitments that require repayment. This includes people with mortgages, car loans, student loans, credit card debts, personal loans, and any other form of borrowed funds. Additionally, businesses that have taken loans, issued bonds, or entered into contractual obligations also need to manage their debts and obligations owed. Properly addressing and fulfilling these financial obligations is crucial to maintaining good financial health and avoiding potential legal or financial consequences.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find debts and obligations owed?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the debts and obligations owed in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an electronic signature for signing my debts and obligations owed in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your debts and obligations owed and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out debts and obligations owed using my mobile device?

Use the pdfFiller mobile app to complete and sign debts and obligations owed on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is debts and obligations owed?

Debts and obligations owed refer to any amounts of money that a person or organization is legally required to pay to another party, including loans, mortgages, credit card balances, and other financial liabilities.

Who is required to file debts and obligations owed?

Individuals and businesses that have incurred debts or obligations, such as loans, outstanding bills, or other financial liabilities, are typically required to report these on financial statements or tax filings.

How to fill out debts and obligations owed?

To fill out debts and obligations owed, individuals or businesses must gather information regarding all outstanding debts, including the creditor's name, account numbers, amounts owed, and due dates. This information should then be entered into the designated forms or templates as required by the relevant authority.

What is the purpose of debts and obligations owed?

The purpose of reporting debts and obligations owed is to provide a complete picture of an individual or organization's financial health, helping stakeholders understand their liabilities and manage risks.

What information must be reported on debts and obligations owed?

The information that must be reported typically includes the names of creditors, types of obligations, total amounts owed, payment terms, due dates, and any collateral associated with the debts.

Fill out your debts and obligations owed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Debts And Obligations Owed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.