Get the free OFFSETS TO OPERATING EXPENDITURES (Schedule A-6)

Show details

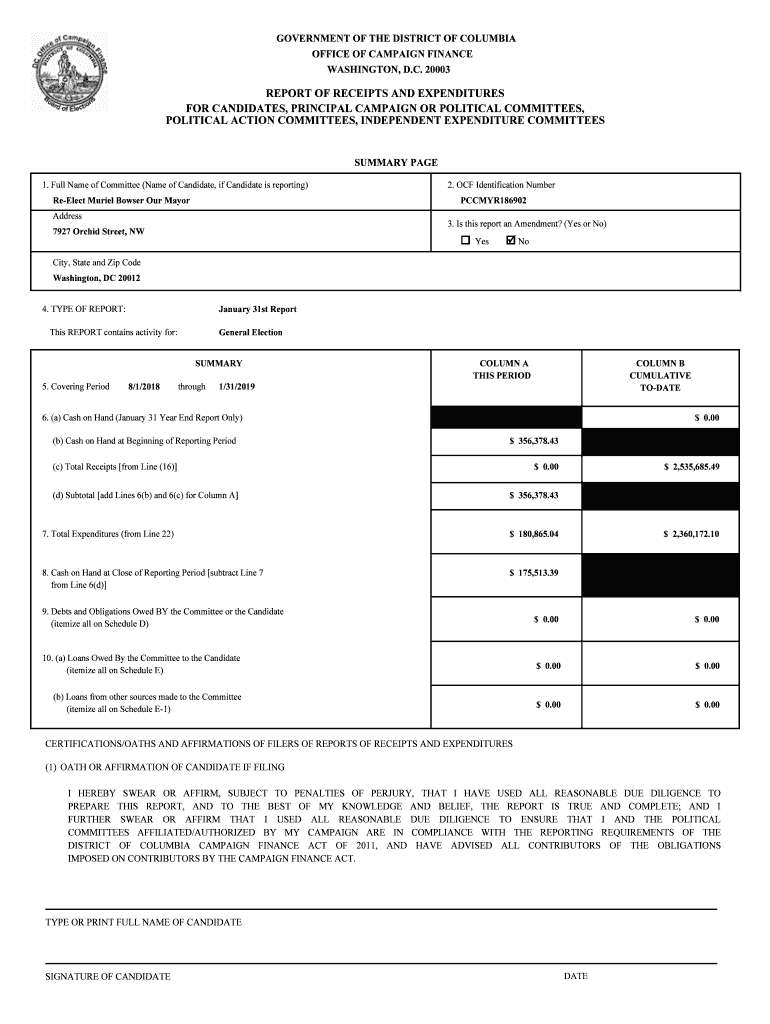

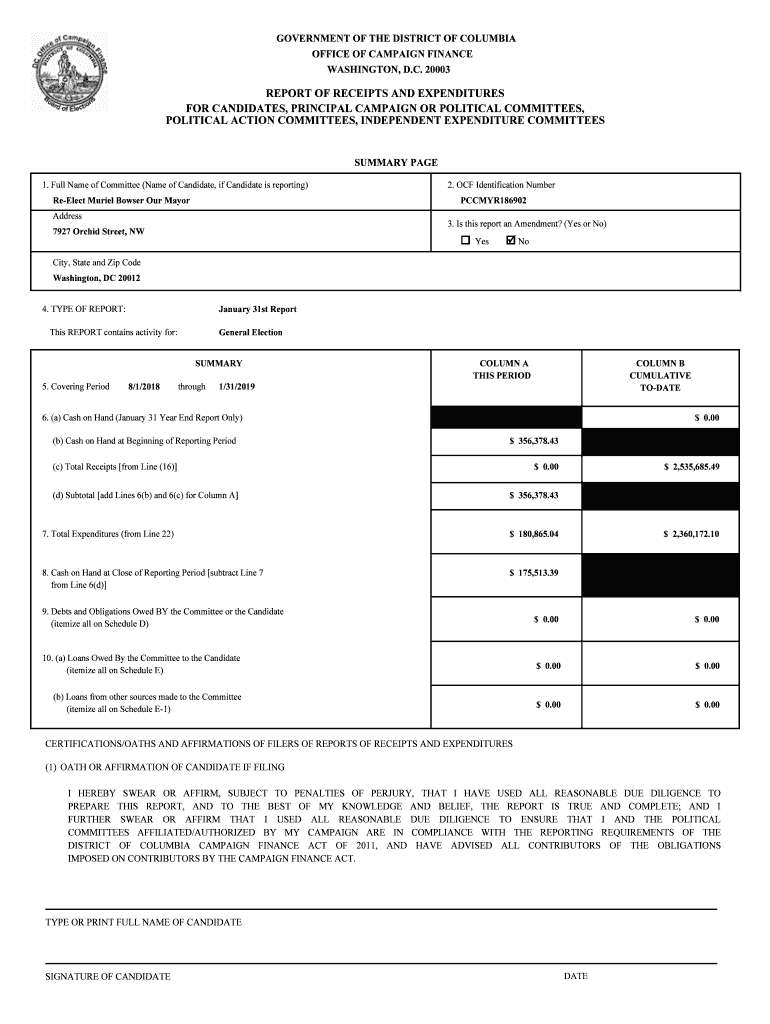

GOVERNMENT OF THE DISTRICT OF COLUMBIA

OFFICE OF CAMPAIGN FINANCE

WASHINGTON, D.C. 20003REPORT OF RECEIPTS AND EXPENDITURES

FOR CANDIDATES, PRINCIPAL CAMPAIGN OR POLITICAL COMMITTEES,

POLITICAL ACTION

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign offsets to operating expenditures

Edit your offsets to operating expenditures form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your offsets to operating expenditures form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit offsets to operating expenditures online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit offsets to operating expenditures. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out offsets to operating expenditures

How to fill out offsets to operating expenditures

01

To fill out offsets to operating expenditures, follow these steps:

02

Identify the operating expenditures you want to offset.

03

Evaluate any potential sources of offsets, such as grants, rebates, or cost savings.

04

Calculate the amount of offset available for each operating expenditure.

05

Determine the eligibility requirements and application process for each offset source.

06

Prepare the necessary documentation and submit applications for the identified offsets.

07

Monitor and track the progress of your offset applications.

08

Once approved, record the offset amounts in the appropriate financial statements or reports.

09

Regularly review and reassess your offset strategy to identify new opportunities or changes in offset availability.

10

Maintain accurate records and documentation to support your offset claims.

11

Periodically evaluate the effectiveness and impact of your offset strategy.

Who needs offsets to operating expenditures?

01

Offsets to operating expenditures can be beneficial for various entities, including:

02

- Businesses aiming to reduce their operating costs and improve financial performance.

03

- Non-profit organizations looking to optimize their funding and allocate resources efficiently.

04

- Government agencies seeking to manage and control their expenditure budgets effectively.

05

- Individuals or households interested in minimizing their expenses while maintaining a certain standard of living.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the offsets to operating expenditures electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your offsets to operating expenditures.

Can I create an electronic signature for signing my offsets to operating expenditures in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your offsets to operating expenditures directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I complete offsets to operating expenditures on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your offsets to operating expenditures by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is offsets to operating expenditures?

Offsets to operating expenditures refer to deductions or reductions applied to a company's operating expenses, often related to tax credits or incentives aimed at lowering overall costs.

Who is required to file offsets to operating expenditures?

Typically, businesses or organizations that qualify for specific tax incentives or credits and want to report reductions in their operating expenditures must file offsets.

How to fill out offsets to operating expenditures?

To fill out offsets to operating expenditures, businesses need to complete the designated forms provided by the tax authority, providing accurate data on expenses, offsets claimed, and relevant supporting documentation.

What is the purpose of offsets to operating expenditures?

The purpose of offsets to operating expenditures is to promote economic growth by reducing the tax burden on qualifying businesses, thereby encouraging investment and expansion.

What information must be reported on offsets to operating expenditures?

Information that must be reported includes total operating expenditures, amounts claimed as offsets, relevant tax identification numbers, and any supporting documentation required by the tax authority.

Fill out your offsets to operating expenditures online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Offsets To Operating Expenditures is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.