Get the free Health Savings Account Payroll Deduction Form - Healthy Blue HSA

Show details

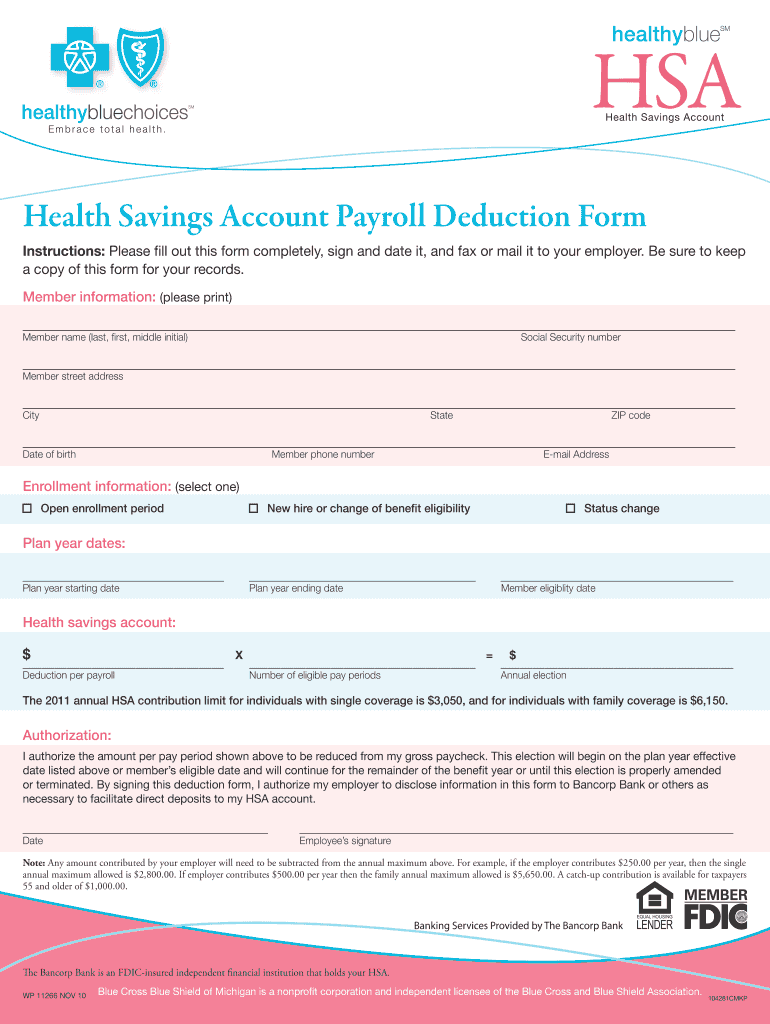

HSA Health Savings Account Payroll Deduction Form Instructions: Please fill out this form completely, sign and date it, and fax or mail it to your employer. Be sure to keep a copy of this form for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign health savings account payroll

Edit your health savings account payroll form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your health savings account payroll form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit health savings account payroll online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit health savings account payroll. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out health savings account payroll

How to fill out health savings account payroll:

01

Obtain the necessary forms: First, you need to obtain the appropriate forms from your employer or the financial institution managing your health savings account (HSA). These can often be found on the company's website or requested from the HR department.

02

Provide your personal information: Fill out your personal information accurately on the payroll form. This typically includes your name, address, social security number, and other relevant details. Double-check that all the information is correct to avoid any issues.

03

Specify contribution amount: Indicate the amount you want to contribute to your health savings account through payroll deductions. This is the portion of your earnings that will be set aside for healthcare expenses and will be deducted automatically from your paycheck.

04

Review and sign: Before submitting the form, carefully review all the information you have provided. Make sure everything is accurate and complete. Once you are satisfied, sign the payroll form to authorize the designated deductions.

Who needs health savings account payroll:

01

Employees with a high deductible health plan (HDHP): Health savings account payroll is primarily beneficial for individuals covered under a high deductible health plan. These are health insurance plans with higher deductibles and lower premiums, allowing individuals to save on their monthly healthcare costs. To maximize the benefits, employees often utilize HSA payroll deductions.

02

Those looking to save for future healthcare expenses: Health savings account payroll allows individuals to set aside a portion of their earnings directly into their HSA. This provides a convenient way to save and accumulate funds specifically for future healthcare expenses, such as medical treatments, prescriptions, or even retirement healthcare costs.

03

Individuals seeking tax advantages: HSAs offer various tax advantages. The contributions made through payroll deductions are typically made on a pre-tax basis, reducing your taxable income. Additionally, the funds in your HSA grow tax-free and can be withdrawn tax-free when used for eligible medical expenses. People looking to minimize their tax burden while saving for healthcare can benefit from health savings account payroll.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify health savings account payroll without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your health savings account payroll into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I execute health savings account payroll online?

pdfFiller has made it simple to fill out and eSign health savings account payroll. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for the health savings account payroll in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your health savings account payroll in minutes.

What is health savings account payroll?

Health savings account payroll is a type of payroll deduction that allows employees to contribute pre-tax dollars to a health savings account.

Who is required to file health savings account payroll?

Employers offering health savings accounts as part of their benefit package are required to file health savings account payroll.

How to fill out health savings account payroll?

Health savings account payroll can be filled out by employers using payroll software or manually with the help of a payroll provider.

What is the purpose of health savings account payroll?

The purpose of health savings account payroll is to help employees save for medical expenses and reduce their taxable income.

What information must be reported on health savings account payroll?

Health savings account payroll must include employee contributions, employer contributions, and any other relevant information regarding the health savings account.

Fill out your health savings account payroll online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Health Savings Account Payroll is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.