Get the free Chapter 3: Parallel and Perpendicular Lines

Show details

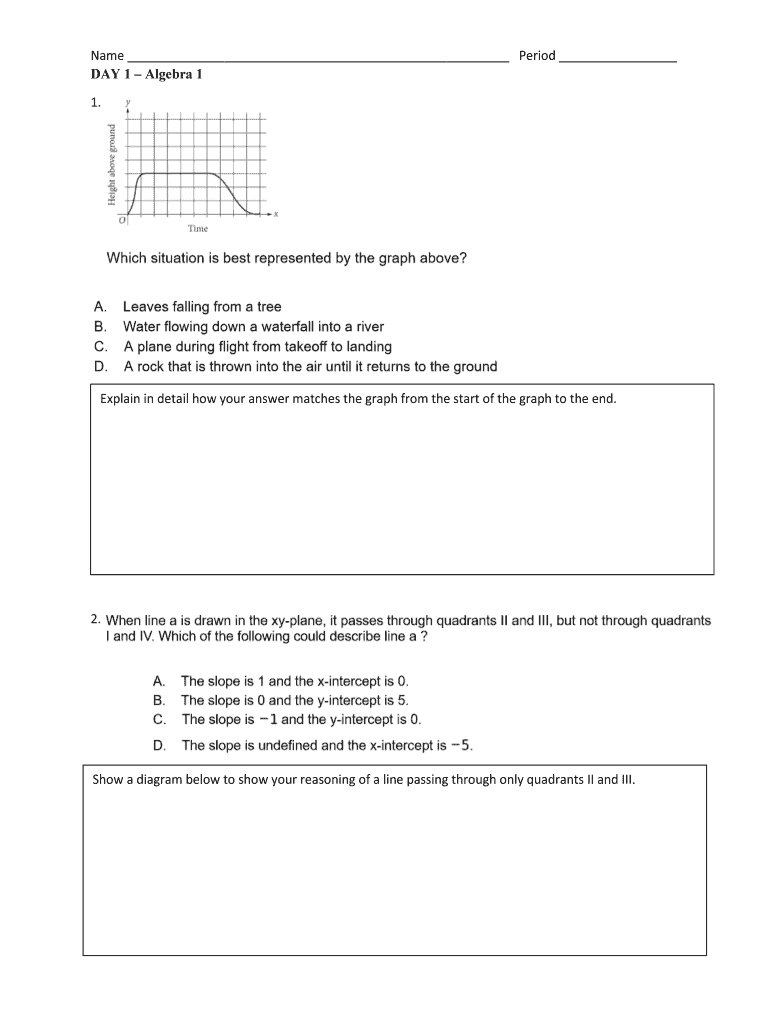

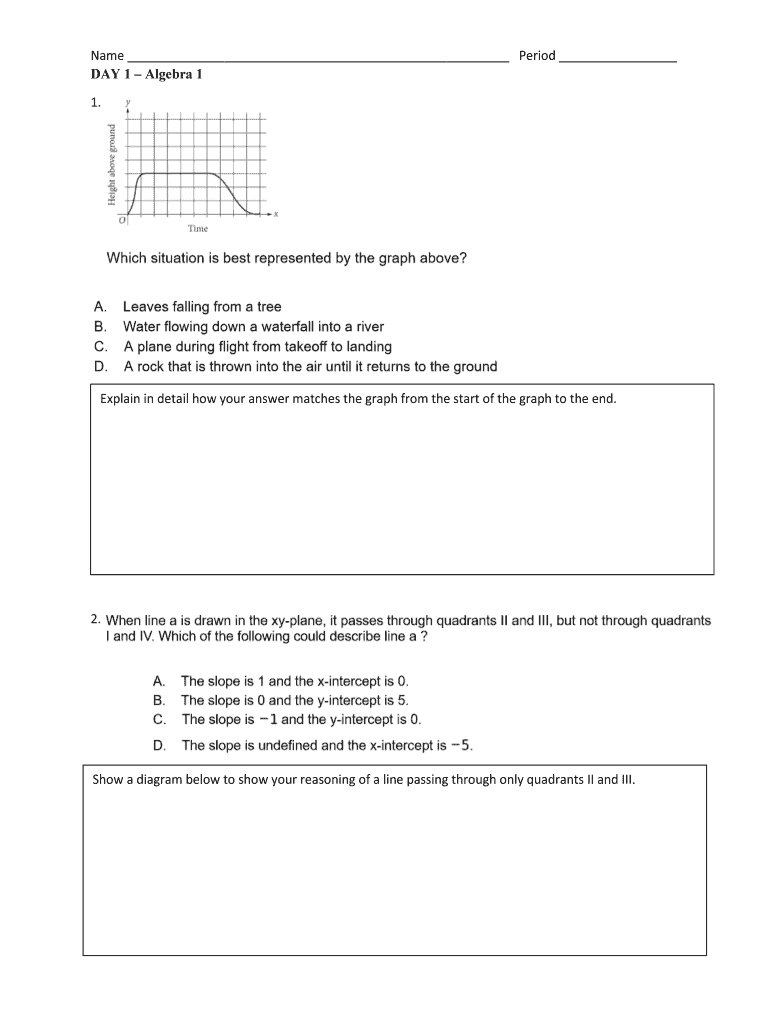

Name Period DAY 1 Algebra 1 1. Explain in detail how your answer matches the graph from the start of the graph to the end.2. Show a diagram below to show your reasoning of a line passing through only

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chapter 3 parallel and

Edit your chapter 3 parallel and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chapter 3 parallel and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit chapter 3 parallel and online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit chapter 3 parallel and. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chapter 3 parallel and

How to fill out chapter 3 parallel and

01

To fill out chapter 3 parallel, follow these steps:

02

Start by reading and understanding the guidelines for chapter 3 parallel.

03

Collect all the necessary information and data for the chapter, ensuring that it is accurate and relevant.

04

Begin with an introduction section that provides a brief overview of the concept of chapter 3 parallel.

05

Next, divide the chapter into appropriate subsections or points, addressing each one separately.

06

Provide detailed explanations and examples to support each point or subsection.

07

Include any relevant diagrams, charts, or graphs to enhance the understanding of the content.

08

Make sure to cite any references or sources used in the chapter.

09

Conclude the chapter with a summary or conclusion section that summarizes the main points discussed.

10

Proofread and edit the chapter for clarity, grammar, and spelling errors.

11

Finally, review the completed chapter to ensure it meets the requirements and guidelines set forth by the project or organization.

Who needs chapter 3 parallel and?

01

Chapter 3 parallel is typically needed by researchers, academics, or individuals involved in the study of parallel computing.

02

It is an important chapter for those exploring the concepts, applications, and challenges of parallel computing.

03

Chapter 3 parallel provides a comprehensive understanding of parallel computing techniques, architectures, and algorithms.

04

It is also beneficial for professionals or students working in fields such as computer science, computer engineering, or data analysis.

05

By studying chapter 3 parallel, individuals can gain insights into the practical implementation and optimization of parallel algorithms and systems.

06

Overall, anyone seeking in-depth knowledge and practical guidance on parallel computing may find chapter 3 parallel valuable.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify chapter 3 parallel and without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like chapter 3 parallel and, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I create an electronic signature for signing my chapter 3 parallel and in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your chapter 3 parallel and and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I complete chapter 3 parallel and on an Android device?

Use the pdfFiller mobile app and complete your chapter 3 parallel and and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is chapter 3 parallel and?

Chapter 3 Parallel refers to the provisions under the U.S. Internal Revenue Code that outline the reporting requirements for certain payments made to foreign persons.

Who is required to file chapter 3 parallel and?

Any U.S. withholding agent who makes payments to foreign persons that are subject to withholding tax must file Chapter 3 Parallel.

How to fill out chapter 3 parallel and?

To fill out Chapter 3 Parallel, you need to complete the appropriate IRS forms, such as Form 1042 and Form 1042-S, providing details about the payments and the beneficiaries.

What is the purpose of chapter 3 parallel and?

The purpose of Chapter 3 Parallel is to ensure that the IRS collects information on payments to foreign entities and individuals, ensuring compliance with U.S. tax laws.

What information must be reported on chapter 3 parallel and?

Information that must be reported includes the amount of the payment, the type of income, the recipient's name and address, and any withholding amounts.

Fill out your chapter 3 parallel and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chapter 3 Parallel And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.