Get the free Int erna l R evenue Service

Show details

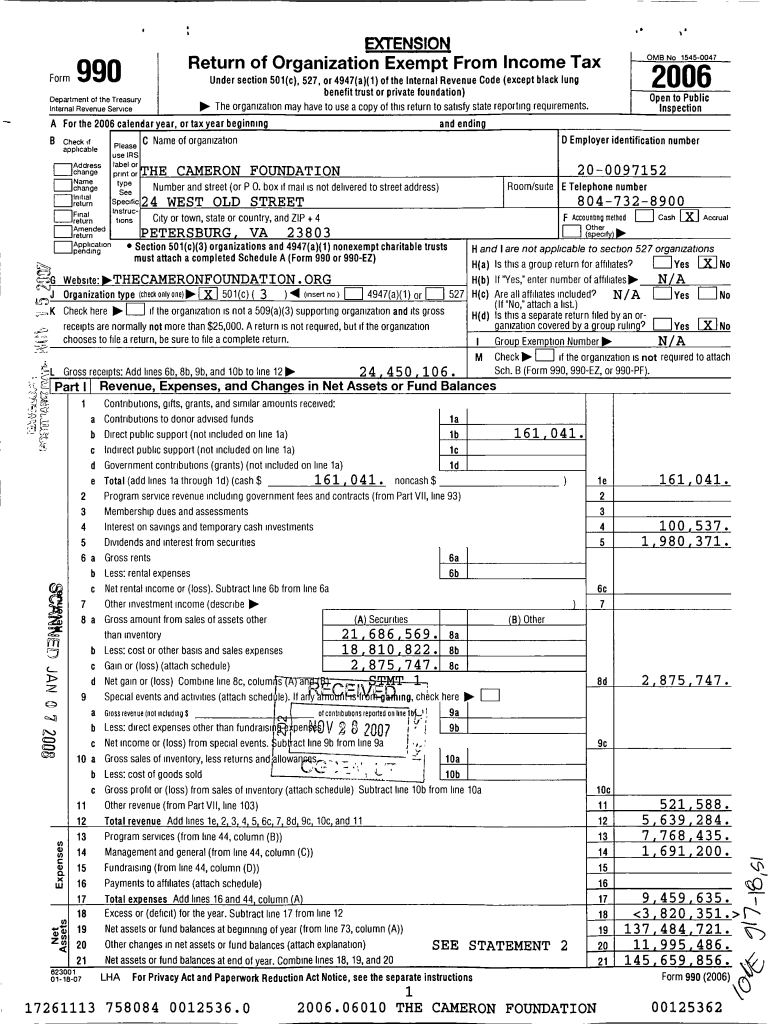

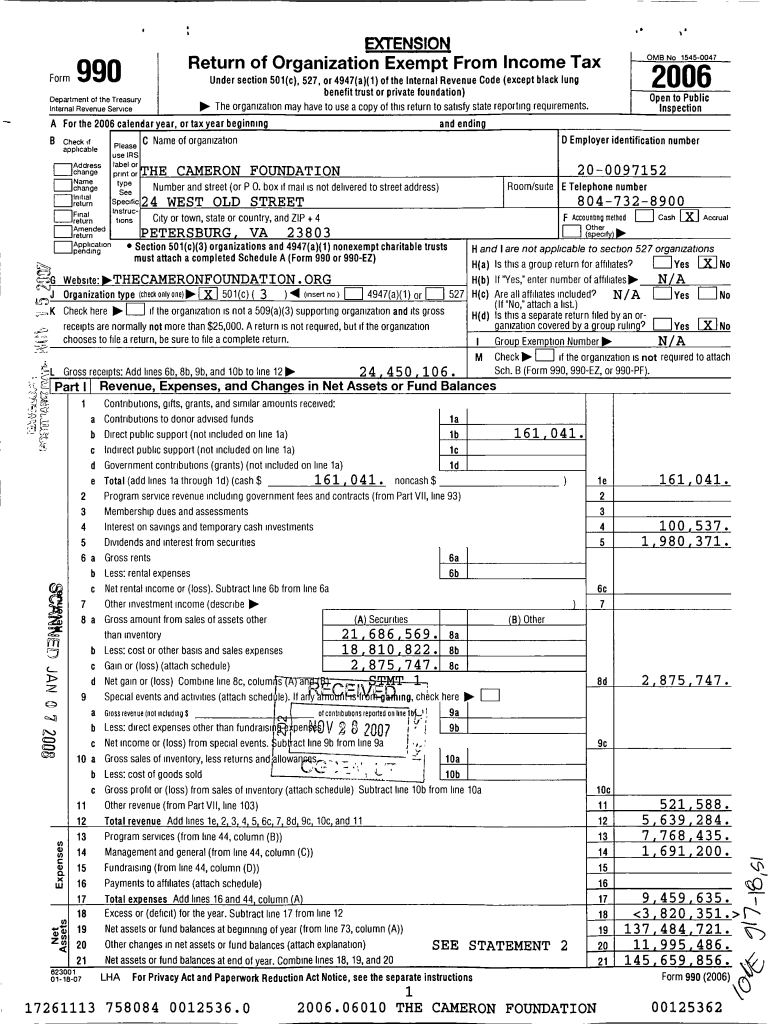

EXTENSION Return of Organization Exempt From Income Tax990FormDepartment of the Treasury Int Erna l Re venue ServiceCheck if please use IRS label or applicable Address changer, nor Specific return

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign int erna l r

Edit your int erna l r form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your int erna l r form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing int erna l r online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit int erna l r. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out int erna l r

How to fill out int erna l r

01

To fill out an internal report, follow these steps:

02

Begin by gathering all relevant information and documentation for the report.

03

Start with a clear and concise title for the report, indicating the purpose or subject matter.

04

Provide an introduction that summarizes the background and objective of the internal report.

05

Break down the report into sections or headings to organize the information effectively.

06

Present the data, findings, or analysis in a logical and structured manner.

07

Include any supporting evidence, charts, graphs, or tables to enhance the understanding of the report's content.

08

Offer interpretations or explanations of the data and discuss any patterns or trends.

09

Provide recommendations or actionable steps based on the report's findings.

10

Conclude the report by summarizing the main points and highlighting key takeaways.

11

Proofread and revise the report for any grammatical errors or typos before finalizing and distributing it to the intended recipients.

Who needs int erna l r?

01

Internal reports are typically required by organizations or businesses for various purposes such as:

02

- Management teams need internal reports to assess the company's performance, identify areas of improvement, and make informed decisions.

03

- Department heads may need internal reports to evaluate the progress and effectiveness of their teams or projects.

04

- Human resources departments may utilize internal reports to analyze employee performance, track training and development initiatives, or address any workplace issues.

05

- Finance departments often rely on internal reports to monitor budgets, analyze financial data, and ensure compliance with regulations.

06

- Compliance and audit departments may require internal reports to assess adherence to internal policies, laws, and regulations.

07

- Any individual or team responsible for monitoring or analyzing organizational processes, performance, or outcomes may need internal reports to support their work.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get int erna l r?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the int erna l r. Open it immediately and start altering it with sophisticated capabilities.

How do I edit int erna l r online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your int erna l r to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out the int erna l r form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign int erna l r and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is int erna l r?

The Internal Revenue Service (IRS) defines 'internal revenue' as taxes imposed on income, payroll, capital gains, and other forms of revenue generated within a country.

Who is required to file int erna l r?

Individuals and entities, including corporations, partnerships, and organizations, that earn income or engage in taxable transactions are generally required to file internal revenue forms.

How to fill out int erna l r?

To fill out an internal revenue form, individuals or entities should gather relevant financial information, including income, deductions, and credits, and carefully follow the instructions provided for the specific form.

What is the purpose of int erna l r?

The purpose of internal revenue forms is to report income, calculate tax liability, and ensure compliance with federal tax laws.

What information must be reported on int erna l r?

Essential information includes total income, various deductions, credits claimed, filing status, and any other necessary financial details specific to the form being filed.

Fill out your int erna l r online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Int Erna L R is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.