Get the free Class B Common Stock, par value

Show details

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549FORM 10K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED December

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign class b common stock

Edit your class b common stock form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your class b common stock form via URL. You can also download, print, or export forms to your preferred cloud storage service.

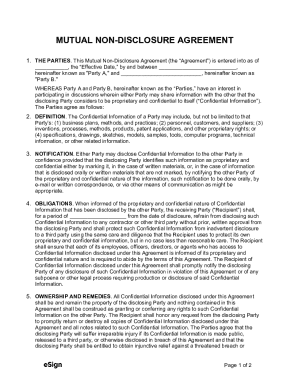

Editing class b common stock online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit class b common stock. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

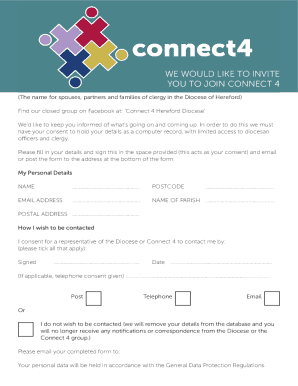

How to fill out class b common stock

How to fill out class b common stock

01

To fill out class B common stock, follow these steps:

02

Obtain the necessary forms: Check with your issuing company or financial institution to obtain the required forms for filling out class B common stock.

03

Provide your personal information: Fill in your personal details, including your full name, address, contact information, and any other requested identification.

04

Specify the number of shares: Indicate the number of class B common stock shares you wish to obtain or transfer.

05

Provide payment details: If purchasing class B common stock, provide the necessary payment information, such as your bank account details or preferred method of payment.

06

Review and sign the form: Carefully review all the information you have provided and ensure its accuracy. Sign the form where required.

07

Submit the form: Send the completed form to the issuing company or financial institution through the designated channels, such as mail or online submission.

08

Await confirmation: Once the form is submitted, wait for confirmation from the issuing company or financial institution regarding the status of your class B common stock.

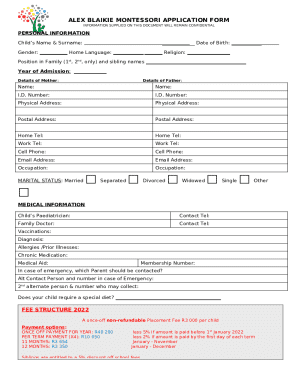

Who needs class b common stock?

01

Various entities and individuals may need or utilize class B common stock, including:

02

- Investors: Investors who want voting rights and preferential treatment in dividend distributions might choose to acquire class B common stock.

03

- Founders or executives: Founders or executives of a company may have class B common stock to maintain control and voting power even after selling or going public.

04

- Strategic partners: Strategic partners who seek a closer relationship with a company may be granted class B common stock as part of a partnership agreement.

05

- Employees: Some companies provide their employees with class B common stock to incentivize them and align their interests with the company's success.

06

- Shareholders: Shareholders of a company may acquire class B common stock as a means of increasing their ownership stake and influence in the company's decisions.

07

- Acquirers or potential acquirers: Acquirers or potential acquirers of a company may purchase class B common stock to gain a greater hold on the target company.

08

The utilization and need for class B common stock can vary depending on the specific circumstances and objectives of the entities or individuals involved.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit class b common stock from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your class b common stock into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I execute class b common stock online?

pdfFiller has made filling out and eSigning class b common stock easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I fill out class b common stock on an Android device?

On Android, use the pdfFiller mobile app to finish your class b common stock. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

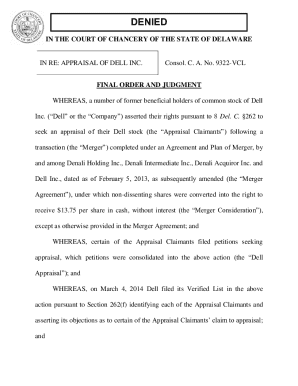

What is class b common stock?

Class B common stock generally refers to a category of equity shares that often have different voting rights and dividend policies compared to Class A shares. Class B shares may carry fewer voting rights and are sometimes issued to company insiders.

Who is required to file class b common stock?

Companies that have issued Class B common stock to investors are required to file reports regarding the ownership and status of those shares. This typically applies to publicly traded companies and those that meet certain regulatory thresholds.

How to fill out class b common stock?

To fill out a form related to Class B common stock, an individual or entity must provide information such as the number of shares owned, the name of the stockholder, and any associated voting rights. The specific requirements may vary by jurisdiction and the type of filing.

What is the purpose of class b common stock?

The purpose of Class B common stock is often to maintain control within a certain group (e.g., founders, management) of a company while allowing outside investors to participate in the ownership and economic benefits of the business without the same voting power.

What information must be reported on class b common stock?

Information that must be reported includes the number of shares, ownership details, any changes in ownership, dividends declared, and any voting rights associated with Class B shares.

Fill out your class b common stock online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Class B Common Stock is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.