Get the free Recent business divestitures

Show details

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549FORM 8K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of the earliest

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign recent business divestitures

Edit your recent business divestitures form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your recent business divestitures form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit recent business divestitures online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit recent business divestitures. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

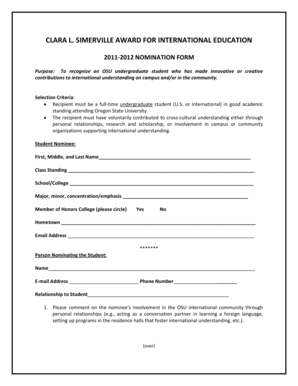

How to fill out recent business divestitures

How to fill out recent business divestitures

01

Start by reviewing any documents or contracts related to the divestiture to understand the scope and requirements.

02

Gather all relevant financial and operational information about the business being divested.

03

Identify any regulatory or legal obligations that need to be addressed during the divestiture process.

04

Develop a detailed plan outlining the steps and timeline for the divestiture.

05

Determine the valuation of the business being divested and establish a fair selling price.

06

Assemble a team of professionals, including lawyers, accountants, and consultants, to assist with the divestiture.

07

Advertise the business for sale and actively seek potential buyers.

08

Evaluate prospective buyers and negotiate a sale agreement that meets your objectives.

09

Prepare the necessary legal documentation, such as purchase agreements and transfer of ownership documents.

10

Execute the divestiture transaction and ensure smooth transfer of assets and liabilities to the buyer.

11

Complete any post-divestiture obligations, such as notifying employees or fulfilling any remaining contractual obligations.

12

Monitor the transition period to ensure a successful handover and address any issues that arise.

13

Keep proper records of the divestiture process for future reference or compliance purposes.

Who needs recent business divestitures?

01

Companies looking to streamline their operations and focus on core business areas may need recent business divestitures.

02

Businesses facing financial challenges or seeking to raise capital may opt for divestitures to generate funds.

03

Companies undergoing mergers or acquisitions may divest certain business units to comply with regulatory requirements or reduce overlap.

04

Businesses planning to exit a particular market or industry may choose to divest their operations in that area.

05

Investors or private equity firms may be interested in recent business divestitures as opportunities for investment or acquisition.

06

Government entities may require divestitures to promote competition and fair market practices.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my recent business divestitures directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your recent business divestitures and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I complete recent business divestitures online?

With pdfFiller, you may easily complete and sign recent business divestitures online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I complete recent business divestitures on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your recent business divestitures by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is recent business divestitures?

Recent business divestitures refer to the process by which a company sells off or removes a portion of its business operations, subsidiaries, or assets to improve efficiency, focus on core activities, or raise capital.

Who is required to file recent business divestitures?

Companies that undergo divestitures, particularly those publicly traded or under regulatory scrutiny, are typically required to file disclosures about their divestitures with relevant authorities such as the SEC or similar regulatory bodies in their jurisdiction.

How to fill out recent business divestitures?

To fill out a divestiture report, companies should provide details about the transaction, including the nature of the assets sold, the parties involved, any financial implications, and the rationale behind the decision. This often involves completing specific forms required by regulatory agencies.

What is the purpose of recent business divestitures?

The purpose of recent business divestitures includes improving financial performance, increasing shareholder value, focusing on core business areas, raising capital, and streamlining operations.

What information must be reported on recent business divestitures?

Companies must report information such as the nature and value of the divested assets, the financial terms of the transaction, reasons for the divestiture, projected impact on the company's financial health, and any potential benefits or risks associated.

Fill out your recent business divestitures online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Recent Business Divestitures is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.