Get the free audited statement of account under see 314 form - webtel

Show details

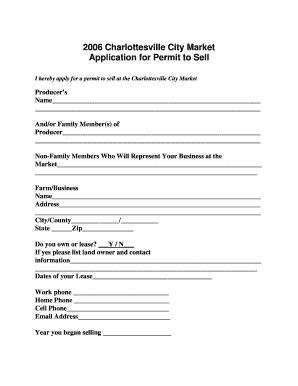

FORM VAT 240 See rule 34(3) AUDITED STATEMENT OF ACCOUNTS UNDER SECTION 31(4) OF THE VAT ACT, 2003 CERTIFICATE Certified that I / we being a Chartered Accountant / Cost Accountant / Tax Practitioner

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign audited statement of account

Edit your audited statement of account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your audited statement of account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing audited statement of account online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit audited statement of account. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out audited statement of account

How to fill out an audited statement of account:

01

Begin by gathering all the necessary financial information and documents. This includes bank statements, invoices, receipts, and any other relevant financial records.

02

Start by filling out the basic information section of the audited statement of account. This typically includes your name or the name of your organization, contact information, and the period covered by the statement.

03

Next, list the assets and liabilities. Assets refer to any resources or properties that you or your organization own, such as cash, investments, or real estate. Liabilities, on the other hand, include any debts or financial obligations.

04

Provide a breakdown of the income earned during the specified period. This can include revenue from sales, services rendered, or any other sources of income. Be sure to provide detailed information about the sources and amounts of income.

05

Include a detailed summary of the expenses incurred. This can range from rent and utilities to employee salaries and general operating costs. It's important to provide accurate and detailed information to ensure transparency.

06

Once you have filled out all the necessary sections, review and double-check your entries for accuracy and completeness. Ensure all calculations are correct and that all the necessary information is provided.

07

If you are unsure about any specific sections or have complex financial matters, consider seeking assistance from an accountant or financial professional. They can provide guidance and ensure your audited statement of account is prepared accurately and in compliance with relevant regulations.

Who needs an audited statement of account:

01

Business owners: Audited statements of account are often required by business owners to provide an accurate and transparent overview of their company's financial health. These statements can be used for internal purposes, such as decision-making and budget planning, or external purposes, such as loan applications or investor relations.

02

Non-profit organizations: Many non-profit organizations are required to provide audited statements of account to maintain transparency and accountability. These statements help donors, grantors, and other stakeholders understand how the organization is utilizing its resources and funds.

03

Government entities: Governments and government agencies often require audited statements of account to ensure compliance with financial regulations and provide transparency to the public. These statements help demonstrate the responsible use of taxpayer funds and maintain public trust.

In essence, anyone who wants to provide an accurate and transparent overview of their financial position may require an audited statement of account. It serves as a comprehensive record of income, expenses, assets, and liabilities, allowing organizations and individuals to make informed financial decisions and demonstrate financial accountability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my audited statement of account in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your audited statement of account and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I send audited statement of account to be eSigned by others?

Once your audited statement of account is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I fill out audited statement of account using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign audited statement of account. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is audited statement of account?

An audited statement of account is a financial document that has been reviewed and verified by an external auditor to ensure its accuracy.

Who is required to file audited statement of account?

Certain businesses and organizations are required to file audited statements of account, such as publicly traded companies, non-profit organizations, and government agencies.

How to fill out audited statement of account?

To fill out an audited statement of account, you will need to gather all relevant financial information, work with an external auditor to review and verify the information, and then submit the completed statement to the relevant authorities.

What is the purpose of audited statement of account?

The purpose of an audited statement of account is to provide stakeholders with an accurate and reliable representation of an entity's financial position and performance.

What information must be reported on audited statement of account?

An audited statement of account typically includes financial statements such as balance sheets, income statements, and cash flow statements, as well as notes to the financial statements.

Fill out your audited statement of account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Audited Statement Of Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.