Get the free Form DVAT 27A - Views Exchange - webtel

Show details

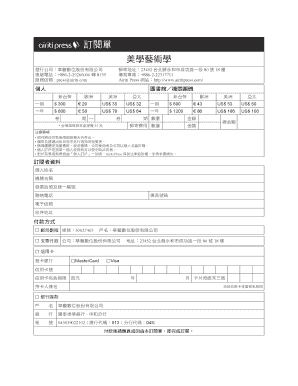

Department of Trade and Taxes Government of NCT of Delhi Form DAT 27A See Rule 33A Intimation of deposit of Government dues 1. TIN 2. Name and address of the dealer 3. Period from To d m m y y d d

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form dvat 27a

Edit your form dvat 27a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form dvat 27a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form dvat 27a online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form dvat 27a. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form dvat 27a

How to fill out form DVAT 27A?

01

Retrieve form DVAT 27A: Download the form from the official website of the Department of Trade and Taxes, or obtain a physical copy from the concerned department office.

02

Understand the purpose: Form DVAT 27A is used for filing monthly returns for dealers registered under the Delhi Value Added Tax (DVAT) Act, 2004. It includes details regarding sales, purchases, and tax liabilities.

03

Provide basic information: Start by entering the dealer's TIN (Taxpayer Identification Number), legal name, business address, and contact details in the appropriate sections of the form.

04

Fill in the transaction details: In the subsequent sections of the form, provide details of sales made during the reporting period. This may include taxable as well as tax-exempt sales. Fill in the transaction values, including the VAT charged, separately for different commodity categories.

05

Report purchase details: Similarly, provide information about purchases made for the reporting period. Specify the different commodity categories, transaction values, VAT paid, and any additional details required.

06

Compute and report tax liability: Based on the sales and purchase figures provided, calculate the tax liability by subtracting the VAT paid on purchases from the VAT charged on sales. Report this amount in the relevant section of the form.

07

Declare additional information: Apart from the transaction details, form DVAT 27A may also require disclosing other relevant information such as opening and closing stock values, credit notes issued, debit notes received, etc. Complete these sections appropriately.

08

Verify and sign: Carefully review all the entered information to ensure accuracy and completeness. Once satisfied, sign the form along with the authorized signatory to certify the accuracy of the information provided.

09

Submit the form: Submit the completed form DVAT 27A along with any supporting documents, if required, to the designated department office or through the online portal, within the specified deadline for filing monthly returns.

Who needs form DVAT 27A?

01

Dealers registered under the Delhi Value Added Tax (DVAT) Act, 2004: Any business entity operating in Delhi that is registered under the DVAT Act needs to fill out form DVAT 27A.

02

Businesses selling taxable goods: Form DVAT 27A is primarily relevant for businesses engaged in the sale of goods that attract VAT. It helps them report their sales, purchases, and tax liabilities accurately to the concerned tax authorities.

03

Monthly return filers: The form is specifically required for filing monthly returns as mandated by the DVAT Act. It enables the tax department to monitor and collect the appropriate tax revenue from registered dealers on a regular basis.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form dvat 27a?

Form DVAT 27A is a return to be filed by dealers registered under the Delhi Value Added Tax Act, 2004.

Who is required to file form dvat 27a?

Dealers registered under the Delhi Value Added Tax Act, 2004 are required to file form DVAT 27A.

How to fill out form dvat 27a?

Form DVAT 27A can be filled out online on the official website of the Delhi government or through an approved offline utility.

What is the purpose of form dvat 27a?

The purpose of form DVAT 27A is to report the details of sales and purchases made by a dealer during a specific period.

What information must be reported on form dvat 27a?

Information such as gross turnover, taxable turnover, tax collected, tax paid, and refunds claimed must be reported on form DVAT 27A.

Can I create an electronic signature for the form dvat 27a in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your form dvat 27a in minutes.

How can I fill out form dvat 27a on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your form dvat 27a, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I edit form dvat 27a on an Android device?

With the pdfFiller Android app, you can edit, sign, and share form dvat 27a on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your form dvat 27a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Dvat 27a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.