MI A-226 2018 free printable template

Show details

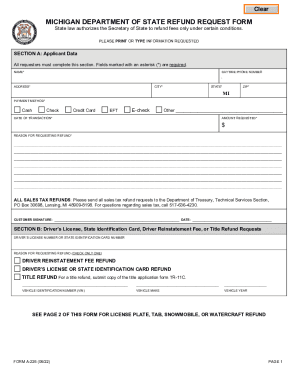

Clear FormMICHIGAN DEPARTMENT OF STATE REFUND REQUEST FORM State law authorizes the Secretary of State to refund fees only under certain conditions. SECTION A: Applicant Data (For All Requestors)

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI A-226

Edit your MI A-226 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI A-226 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MI A-226 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit MI A-226. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI A-226 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI A-226

How to fill out MI A-226

01

Gather all required personal information, including your name, address, and Social Security number.

02

Obtain information regarding the specific program or service that MI A-226 is related to.

03

Fill in the relevant sections of the form as per the instructions provided.

04

Double-check your information to ensure accuracy.

05

Sign and date the form where indicated.

06

Submit the completed form to the appropriate agency or office.

Who needs MI A-226?

01

Individuals seeking financial assistance or services in Michigan may need MI A-226.

02

Providers of assistance programs may also require this form for processing applications.

Fill

form

: Try Risk Free

People Also Ask about

What is the Michigan Form 5633?

Purchasers that failed to claim an available sales or use tax exemption at the time of purchase can request a refund directly from the Michigan Department of Treasury by filing this form. This form does not apply to all potential refund claims by purchasers.

How do I claim my Michigan sales tax refund?

The customer must provide the following information on Form 5633: identifying information of the purchaser and seller; the purchase for which a refund of tax is claimed; and. a statement signed by the seller indicating that the seller paid tax on the original transaction and will not seek a refund of that tax.

How long does it take to get a Michigan tax refund?

When will I receive my Michigan income tax refund? "For refunds, eFile returns take about 14 days and paper returns take about eight weeks," said Ron Leix, a Treasury spokesperson. If there is an error on the return, you could expect your refund to be delayed.

Do I need to return license plate in Michigan?

Registration plates, or tabs issued for 1978 and thereafter shall be returned by the owner within 30 days following the date of transfer or assignment.

Can I get a refund on my registration if I sell my car in Michigan?

(4) The owner of a registered vehicle who transfers or assigns title or interest in that registered vehicle before placing upon the registered vehicle the registration plates or tabs issued for that registered vehicle may obtain a refund in full from the secretary of state for the registration plates or tabs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get MI A-226?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the MI A-226. Open it immediately and start altering it with sophisticated capabilities.

Can I edit MI A-226 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign MI A-226 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I complete MI A-226 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your MI A-226. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is MI A-226?

MI A-226 is a tax form used in the state of Michigan for corporate income tax reporting.

Who is required to file MI A-226?

Corporations doing business in Michigan that meet certain income thresholds are required to file MI A-226.

How to fill out MI A-226?

To fill out MI A-226, gather all necessary financial information, complete each section of the form as per the instructions, and ensure all required signatures are provided before submission.

What is the purpose of MI A-226?

The purpose of MI A-226 is to report corporate income and calculate the tax owed to the state of Michigan.

What information must be reported on MI A-226?

The information that must be reported on MI A-226 includes gross receipts, deductions, adjusted gross income, and any applicable tax credits.

Fill out your MI A-226 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI A-226 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.