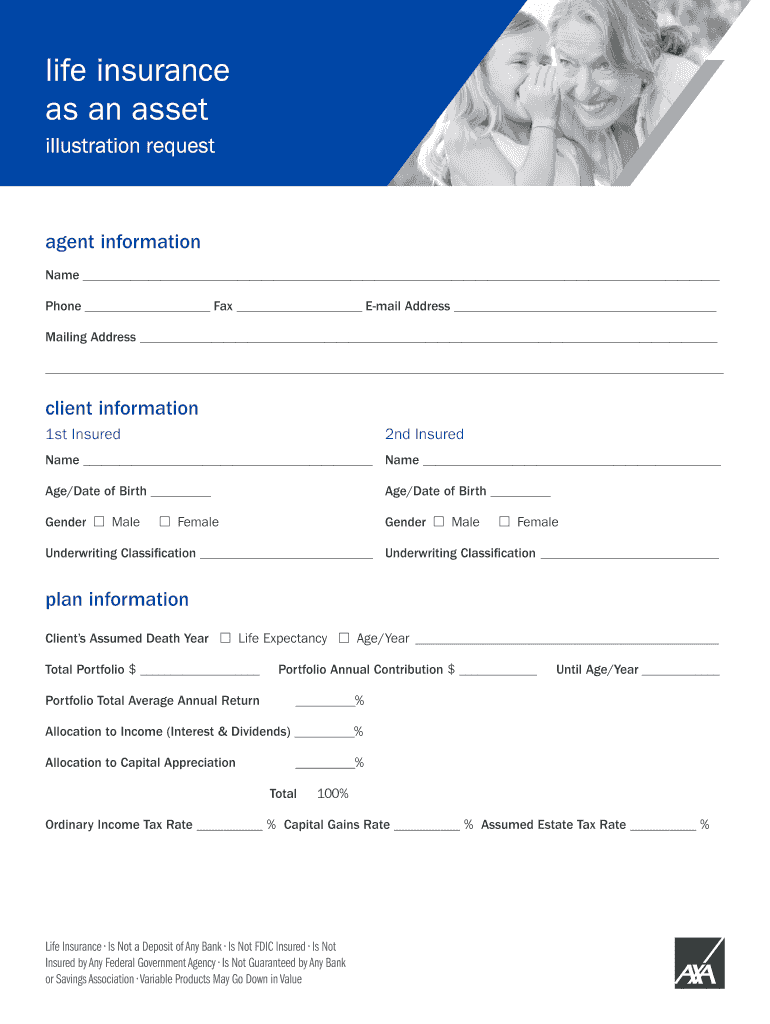

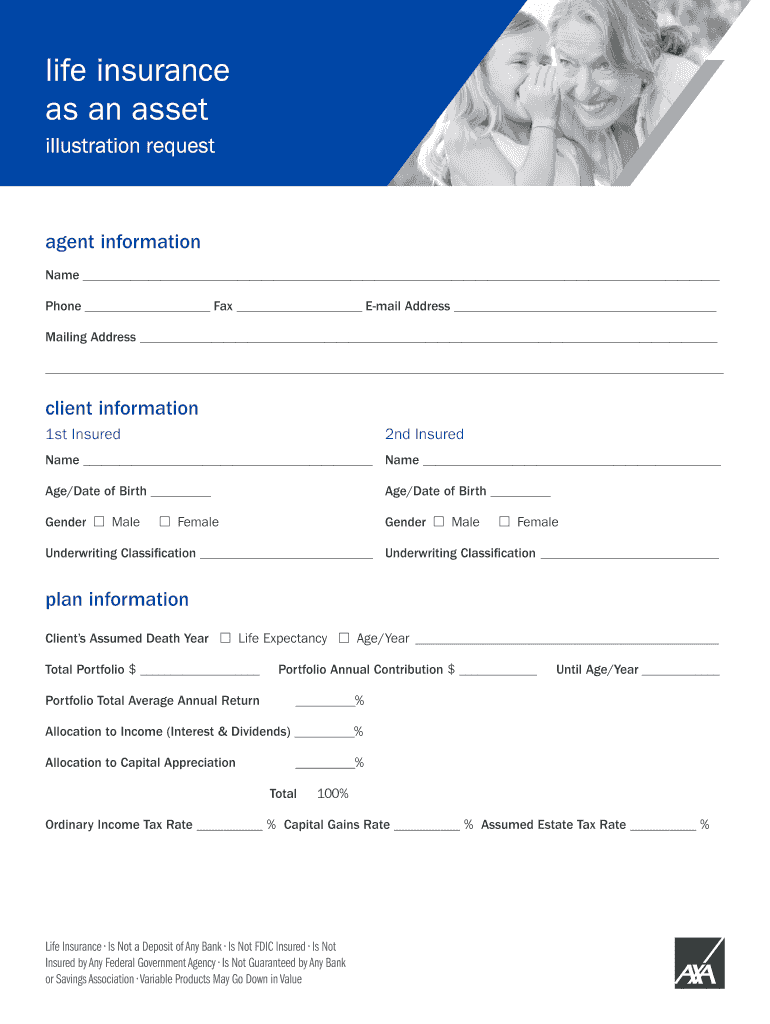

Get the free Life Insurance as an Asset Class SALES KIT

Show details

Life Insurances asset Classmates Kiting this kit: Conversation guide Sales ideas Consumer brochures PINNEYINSURANCE.COM 2 2 6 6 L AVA R I D G E CO U RT 8008234852 ROSEVILLE, CA 95661Advanced Markets

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life insurance as an

Edit your life insurance as an form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life insurance as an form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit life insurance as an online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit life insurance as an. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out life insurance as an

How to fill out life insurance as an

01

To fill out a life insurance application, follow these steps:

02

Gather personal information such as your full name, address, date of birth, and social security number.

03

Provide details about your health history, including any pre-existing conditions or previous medical treatments.

04

Specify the coverage amount and type of life insurance you are applying for (e.g., term life, whole life).

05

Answer questions about your lifestyle, such as tobacco or alcohol use, hobbies, and occupation.

06

Disclose any other existing life insurance policies you may have.

07

Provide beneficiary information, including their full name, relationship to you, and contact details.

08

Review the application thoroughly for accuracy and completeness before submitting it.

09

Sign and date the application where indicated.

10

Submit the completed application along with any required supporting documents to the insurance company.

11

Wait for approval and further instructions from the insurer regarding premiums and policy activation.

Who needs life insurance as an?

01

Anyone who wants to financially protect their loved ones or dependents in the event of their death should consider getting life insurance.

02

Life insurance can be beneficial for:

03

- Parents with young children who want to ensure their children's financial stability and future education expenses.

04

- Breadwinners or sole earners in a family who want to replace their income and support their dependents if they pass away.

05

- Individuals with co-signed debts or mortgages to prevent their family members from inheriting those financial obligations.

06

- People who have significant financial responsibilities or debts, such as business owners or those with substantial loans.

07

- Individuals who want to leave behind a financial legacy or provide an inheritance to their loved ones.

08

Ultimately, the decision to get life insurance depends on individual circumstances and financial goals. It is advisable to consult with an insurance professional to determine the most suitable coverage for your needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in life insurance as an without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your life insurance as an, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I edit life insurance as an on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign life insurance as an on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How can I fill out life insurance as an on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your life insurance as an from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is life insurance as an?

Life insurance is a contract between an insurer and the insured, where the insurer provides a monetary benefit to the beneficiaries upon the death of the insured in exchange for premium payments.

Who is required to file life insurance as an?

Typically, individuals or entities that hold a life insurance policy must file it. This includes policyholders, agents, or estate executors when claiming benefits.

How to fill out life insurance as an?

To fill out a life insurance form, the policyholder needs to provide personal information, including name, address, date of birth, and beneficiaries, along with policy details such as coverage amount and type.

What is the purpose of life insurance as an?

The purpose of life insurance is to provide financial security and peace of mind by ensuring that beneficiaries receive a specified sum of money upon the policyholder's death.

What information must be reported on life insurance as an?

On life insurance filings, important information includes the policyholder's personal details, beneficiary information, terms of the policy, and coverage limits.

Fill out your life insurance as an online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Insurance As An is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.