Get the free Investment selection or switch form - Commonwealth Bank ...

Show details

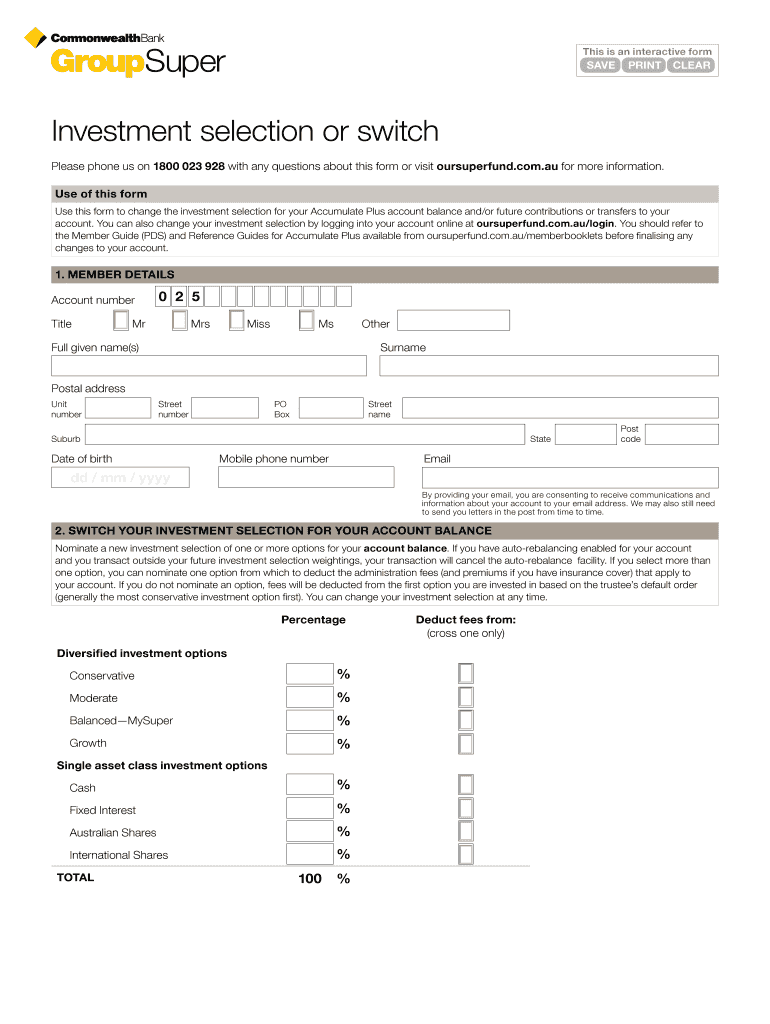

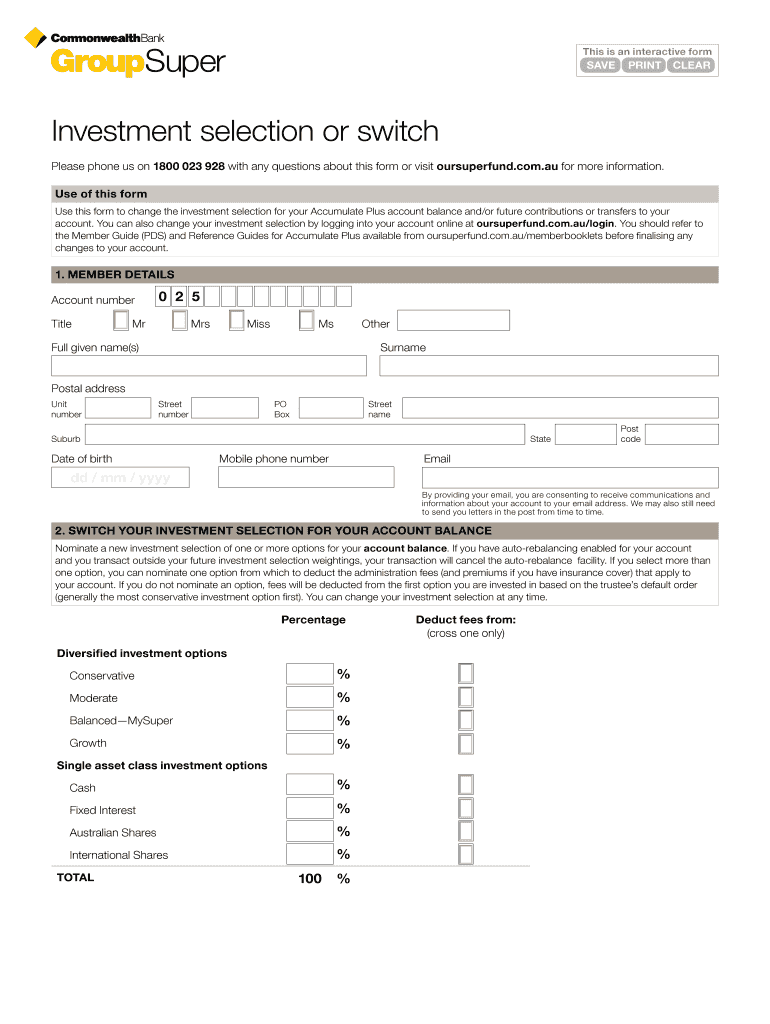

This is an interactive formSAVEPRINTCLEARInvestment selection or switch

Please phone us on 1800 023 928 with any questions about this form or visit oursuperfund.com.AU for more information.

Use of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign investment selection or switch

Edit your investment selection or switch form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your investment selection or switch form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit investment selection or switch online

Follow the steps down below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit investment selection or switch. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out investment selection or switch

How to fill out investment selection or switch

01

To fill out investment selection or switch, follow these steps:

02

Start by evaluating your investment goals and risk tolerance.

03

Determine the type of investment products you are interested in, such as stocks, bonds, mutual funds, or ETFs.

04

Research and analyze different investment options to find the ones that align with your goals and risk profile.

05

Consider factors like past performance, fees, management expertise, and the investment's underlying assets.

06

Once you have selected your desired investments, review the required forms or online platform provided by your investment service provider.

07

Fill out the necessary information accurately, including personal details, investment amounts, and allocation preferences.

08

Double-check all the information to ensure it is correct and in line with your investment objectives.

09

Submit the completed form or make the changes through the online platform as instructed by your investment service provider.

10

Keep a copy of the filled-out form or record the confirmation details for future reference.

11

Monitor your investment selection or switch periodically and make adjustments if needed based on market conditions or changes in your financial situation.

Who needs investment selection or switch?

01

Anyone who wants to invest or make changes to their investment portfolio may need investment selection or switch.

02

Specifically, individuals who:

03

- Want to start investing and build a diversified portfolio

04

- Need to adjust their investment strategy due to changing financial goals

05

- Seek to optimize their investment returns by reallocating funds

06

- Are dissatisfied with the performance or fees of their current investments and want to switch to better options

07

- Experience significant life events or changes that require reevaluating their investment portfolio

08

- Wish to respond to market trends or economic conditions by shifting their investment allocations

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the investment selection or switch in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your investment selection or switch and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out the investment selection or switch form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign investment selection or switch and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I complete investment selection or switch on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your investment selection or switch, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is investment selection or switch?

Investment selection or switch refers to the process of choosing or changing an investment fund within a portfolio, allowing investors to realign their investments based on their financial goals and market conditions.

Who is required to file investment selection or switch?

Individuals and entities managing investment portfolios, including mutual funds, retirement accounts, and other financial assets, are typically required to file investment selection or switch forms when they change their investment choices.

How to fill out investment selection or switch?

To fill out an investment selection or switch form, an investor must provide personal identification information, specify the existing investments they wish to switch from, the new investment options they want to select, and any necessary signatures to authorize the changes.

What is the purpose of investment selection or switch?

The purpose of investment selection or switch is to allow investors to adjust their portfolios in response to changing financial needs, market conditions, or investment strategies, ultimately aiming to optimize returns and risk management.

What information must be reported on investment selection or switch?

The information that must be reported typically includes investor identification details, current investment holdings, selected new investments, the rationale for the switch, and any relevant signatures or authorizations.

Fill out your investment selection or switch online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Investment Selection Or Switch is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.