Get the free An Overview of Itemized Tax Deductions and Their Limitations

Show details

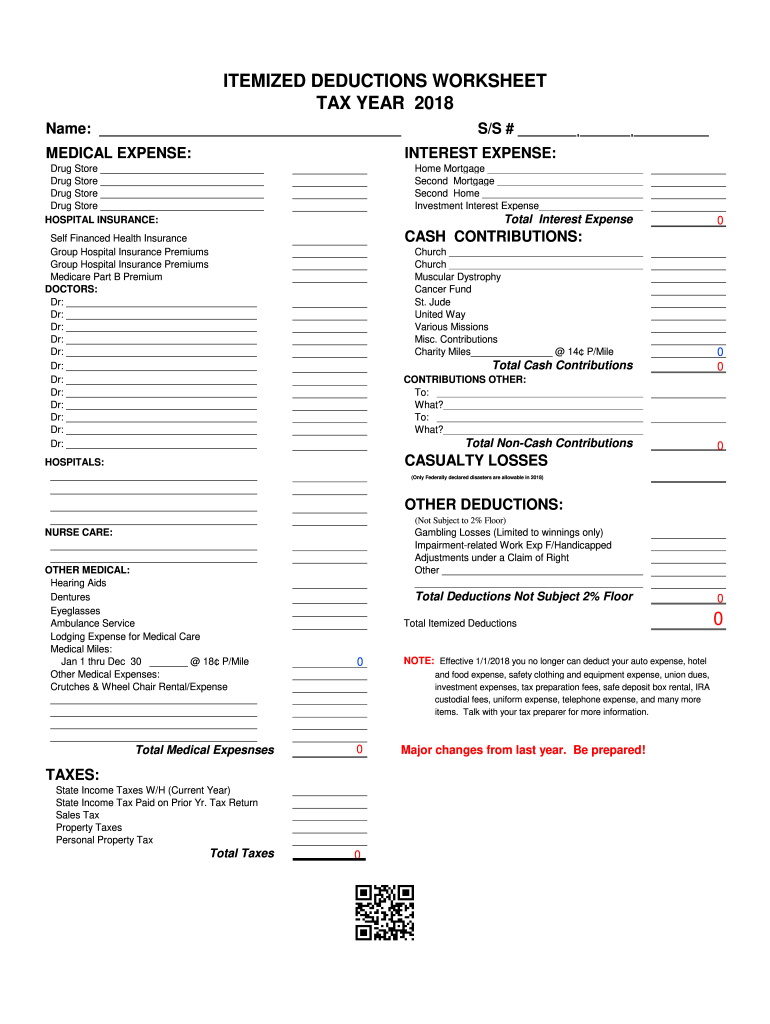

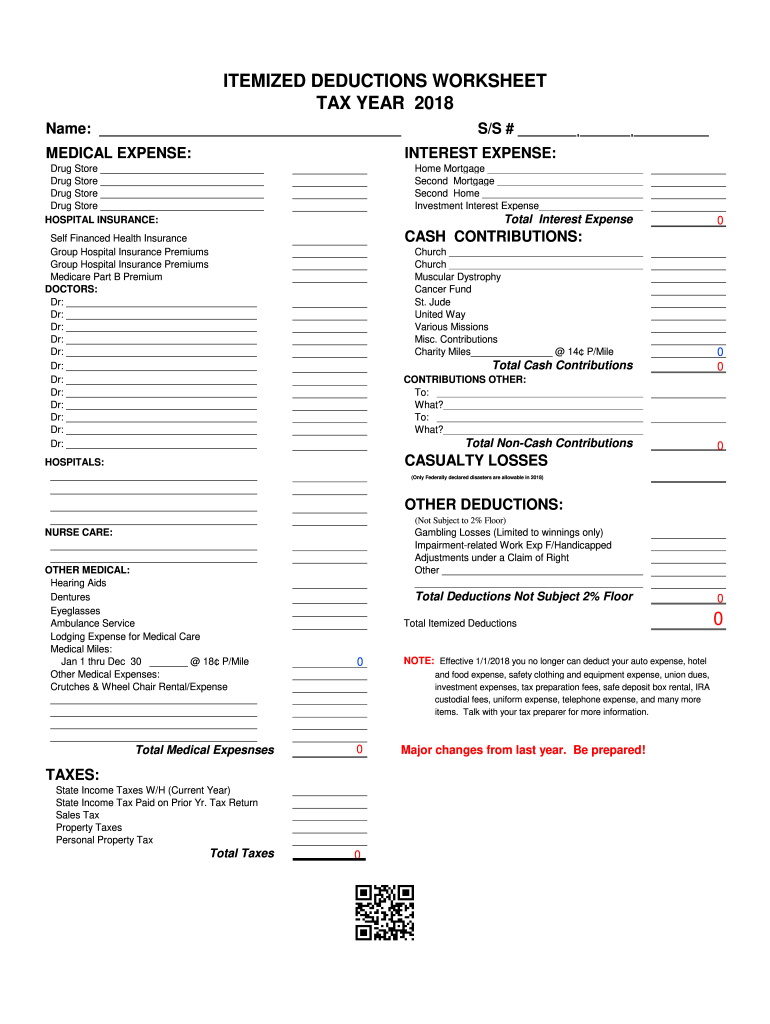

ITEMIZED DEDUCTIONS WORKSHEET TAX YEAR 2018 Name: MEDICAL EXPENSE’S/S # INTEREST EXPENSE:Drug Store HOSPITAL INSURANCE:Home Mortgage Second Home Investment Interest Expense Total Interest Expense

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign an overview of itemized

Edit your an overview of itemized form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your an overview of itemized form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit an overview of itemized online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit an overview of itemized. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out an overview of itemized

How to fill out an overview of itemized

01

To fill out an overview of itemized, follow these steps:

02

Start by gathering all the necessary information related to the itemized overview, such as item descriptions, quantities, and prices.

03

Create a clear and organized format for the overview, either using a spreadsheet program or a word processing software.

04

Begin entering the items one by one, including their descriptions, quantities, and prices.

05

Double-check the accuracy of the entered information to ensure there are no mistakes or typos.

06

If applicable, include any additional details or notes that might be relevant to the itemized overview.

07

Once all the items have been entered, review the overview to make sure it is complete and coherent.

08

Save the overview in a suitable format, such as PDF or Excel, depending on the intended use.

09

If required, print a hard copy of the overview or share it electronically with the relevant parties.

10

Periodically update the itemized overview as new items are added or changes occur.

Who needs an overview of itemized?

01

An overview of itemized is required by various individuals and organizations who need to keep track of detailed information about items or expenses.

02

Some common examples of those who may need an overview of itemized include:

03

- Business owners or managers who want to monitor their inventory or expenses in a detailed manner.

04

- Accountants or bookkeepers who need to maintain accurate records of all the items purchased or sold.

05

- Project managers who want to track the costs of individual components or materials.

06

- Individuals or households who wish to keep a detailed record of their expenses, such as for budgeting or tax purposes.

07

Overall, anyone who needs a comprehensive and organized overview of itemized information can benefit from creating and maintaining such a document.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my an overview of itemized in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your an overview of itemized and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I get an overview of itemized?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the an overview of itemized in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make edits in an overview of itemized without leaving Chrome?

an overview of itemized can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

What is an overview of itemized?

An overview of itemized refers to a breakdown of specific expenses or deductions that taxpayers can claim on their tax returns, as opposed to taking a standard deduction. It provides a detailed account of eligible expenses such as medical costs, mortgage interest, and charitable contributions.

Who is required to file an overview of itemized?

Taxpayers who wish to claim itemized deductions instead of the standard deduction are required to file an overview of itemized. This is often beneficial for those with significant deductible expenses.

How to fill out an overview of itemized?

To fill out an overview of itemized, taxpayers must complete Schedule A (Form 1040) and provide details of each deductible expense, total them, and then transfer that total to the main tax return form.

What is the purpose of an overview of itemized?

The purpose of an overview of itemized is to allow taxpayers to reduce their taxable income by reporting qualifying expenses, which can result in lower overall tax liability.

What information must be reported on an overview of itemized?

The information that must be reported includes qualifying medical expenses, state and local taxes, mortgage interest, charitable contributions, and unreimbursed business expenses, among others.

Fill out your an overview of itemized online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

An Overview Of Itemized is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.