Get the free Iowa sales tax exemption certificate - Covetrus North America

Show details

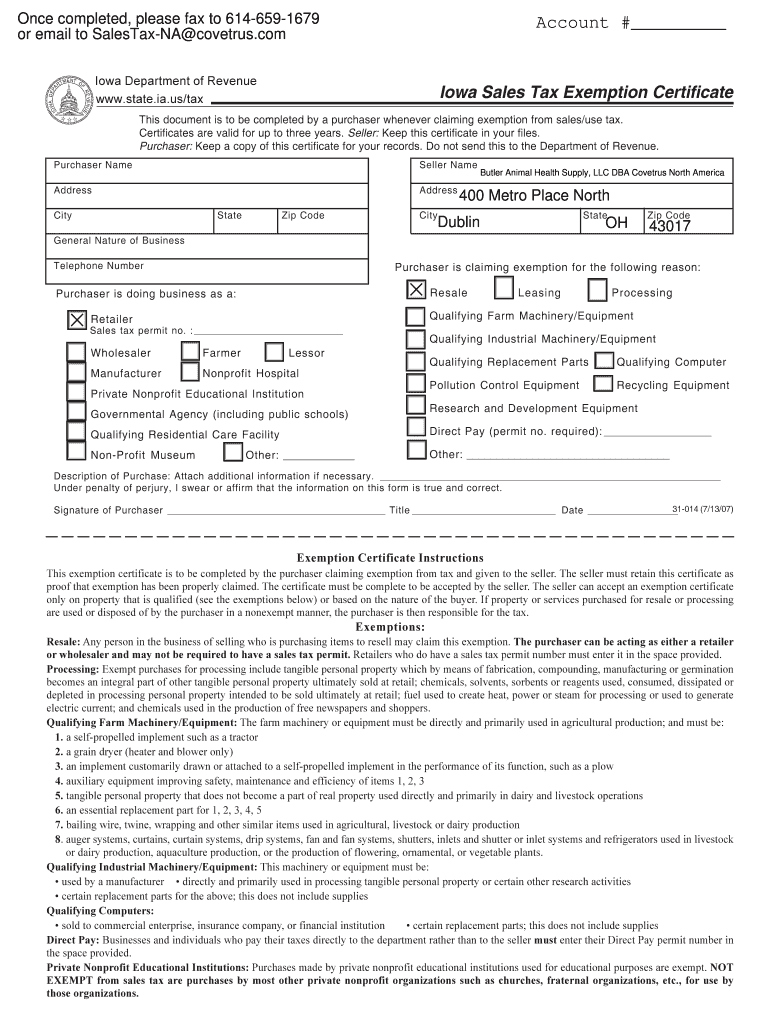

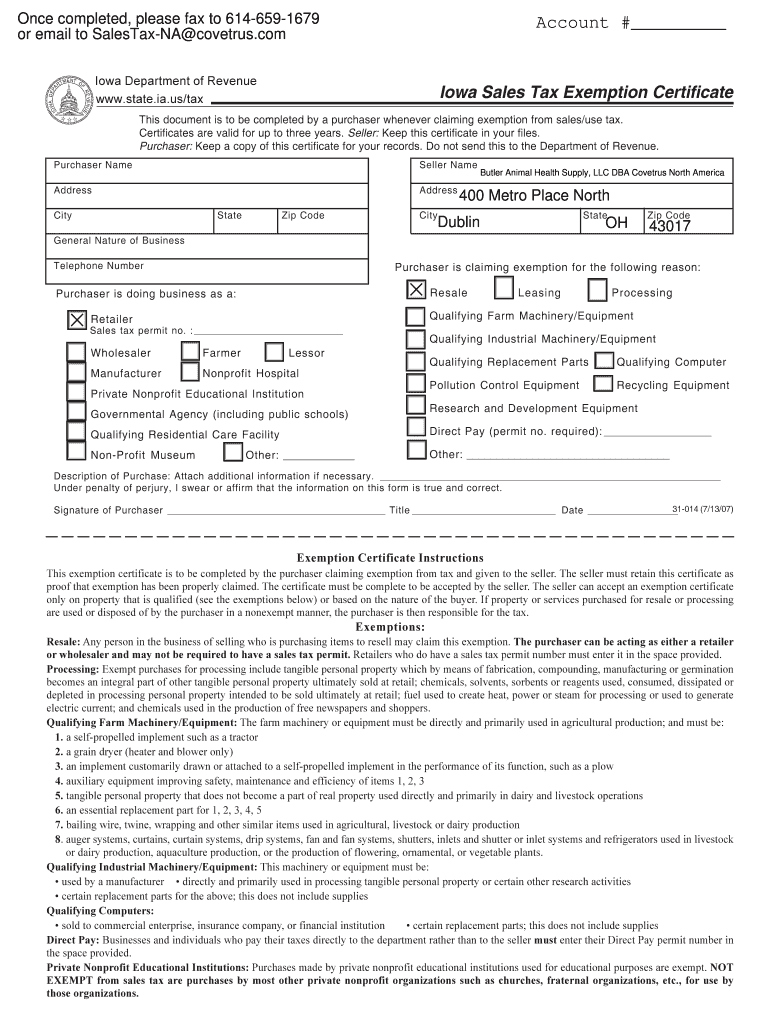

Once completed, please fax to 6146591679 or email to Salesman covetous. Account # Iowa Department of Revenue www.state.ia.us/taxIowa Sales Tax Exemption Certificates document is to be completed by

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign iowa sales tax exemption

Edit your iowa sales tax exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your iowa sales tax exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit iowa sales tax exemption online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit iowa sales tax exemption. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out iowa sales tax exemption

How to fill out iowa sales tax exemption

01

Obtain the necessary forms: Visit the Iowa Department of Revenue website to download the Iowa Sales Tax Exemption Certificate (Form 31-014) and other relevant forms.

02

Fill out the basic information: Provide your organization's name, address, and other contact details as requested on the form.

03

Specify the purpose of the exemption: Indicate the reason for seeking the sales tax exemption, such as being a charitable organization, reseller, or manufacturer.

04

Describe the items to be exempted: List or describe the types of goods or services that your organization intends to purchase without paying sales tax.

05

Attach supporting documents: Depending on the exemption category, you may need to include additional documents or proof, such as proof of non-profit status or resale certificates.

06

Sign and date the form: Ensure that the form is signed and dated by an authorized representative of your organization.

07

Submit the completed form: Send the filled-out form along with any required documents to the Iowa Department of Revenue either by mail or electronically, following the instructions provided.

08

Await approval: The Iowa Department of Revenue will review your application and notify you of the approval or any additional requirements.

Who needs iowa sales tax exemption?

01

Various entities may need an Iowa Sales Tax Exemption Certificate, including:

02

- Non-profit organizations: Non-profit organizations recognized as tax-exempt under Section 501(c)(3) of the Internal Revenue Code are generally eligible for sales tax exemptions on their purchases.

03

- Government agencies: Federal, state, and local government agencies may qualify for sales tax exemptions when acquiring goods or services for official purposes.

04

- Resellers: Businesses that plan to resell the purchased goods in the regular course of business without making any use of the items themselves can seek sales tax exemption on those items.

05

- Manufacturers: Manufacturers or processors of goods who will incorporate the purchased materials into their final products for sale can apply for sales tax exemptions.

06

- Agricultural producers: Certain items used exclusively in agricultural production, such as livestock, seed, and fertilizer, may qualify for sales tax exemption for eligible agricultural producers.

07

- Other eligible entities: Specific industries or situations may qualify for sales tax exemptions based on certain criteria. It is recommended to consult the Iowa Department of Revenue or a tax professional for detailed guidance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send iowa sales tax exemption to be eSigned by others?

To distribute your iowa sales tax exemption, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I complete iowa sales tax exemption online?

Completing and signing iowa sales tax exemption online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I create an electronic signature for the iowa sales tax exemption in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your iowa sales tax exemption in minutes.

What is iowa sales tax exemption?

Iowa sales tax exemption refers to specific circumstances under which certain sales transactions are not subject to the Iowa state sales tax, allowing qualifying entities to purchase goods and services without paying sales tax.

Who is required to file iowa sales tax exemption?

Entities such as non-profit organizations, government agencies, and certain businesses that qualify under Iowa tax law are required to file for sales tax exemption to exempt their purchases from sales tax.

How to fill out iowa sales tax exemption?

To fill out the Iowa sales tax exemption form, one must provide specific information including the name and address of the purchaser, the type of exemption, and details of the purchase. The appropriate form, typically the Iowa Sales Tax Exemption Certificate, must be completed and presented to the seller.

What is the purpose of iowa sales tax exemption?

The purpose of Iowa sales tax exemption is to relieve qualifying organizations and entities from the burden of sales tax on purchases that are necessary for their operations, thereby promoting charitable, governmental, or educational activities.

What information must be reported on iowa sales tax exemption?

The information that must be reported includes the purchaser's name, address, type of exemption, reason for the exemption, and details about the goods or services being purchased.

Fill out your iowa sales tax exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Iowa Sales Tax Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.