Get the free Instructions for Form 8609 (Rev. July 2018) - Internal Revenue ...

Show details

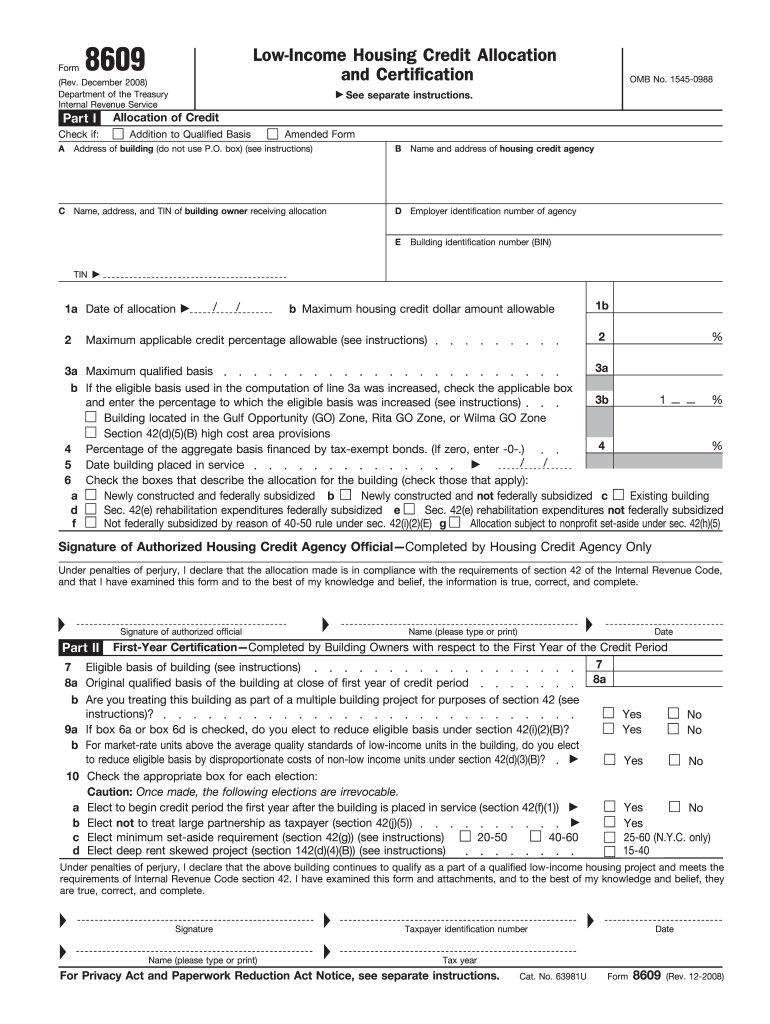

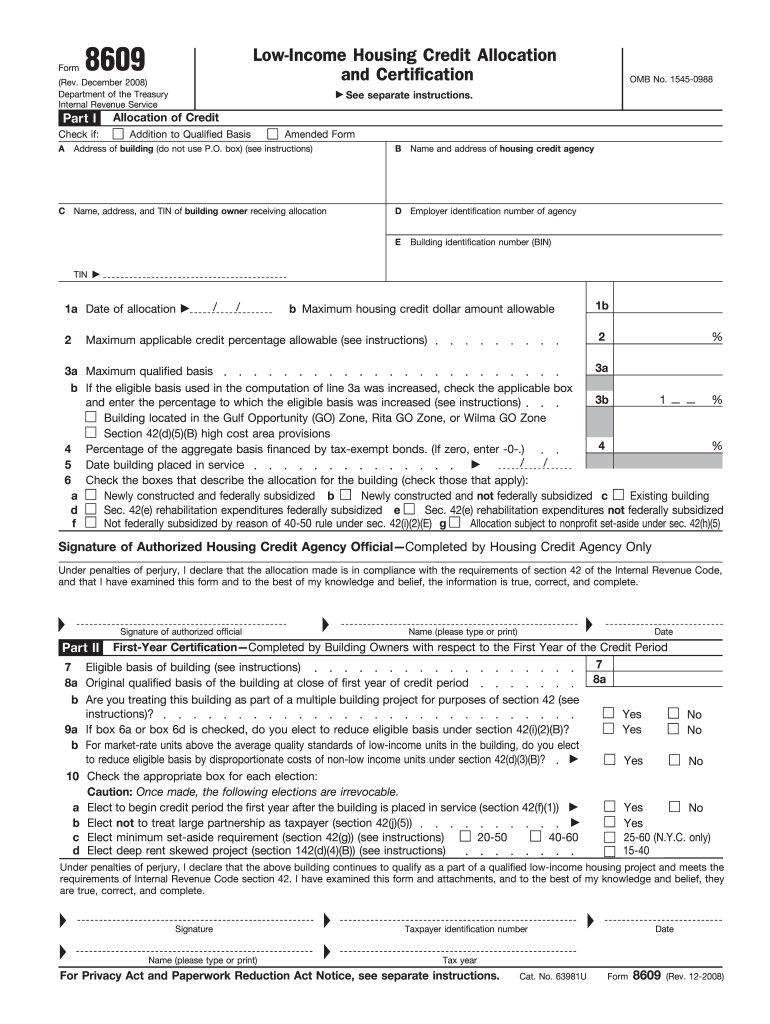

Form8609LowIncome Housing Credit Allocation

and Certification(Rev. December 2008)

Department of the Treasury

Internal Revenue Serviceman I

Check if:

BOMB No. 15450988See separate instructions. Allocation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign instructions for form 8609

Edit your instructions for form 8609 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your instructions for form 8609 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing instructions for form 8609 online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit instructions for form 8609. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out instructions for form 8609

How to fill out instructions for form 8609

01

Step 1: Gather all necessary information and documents needed to complete Form 8609, such as the property address, owner's name and address, and details of the low-income housing project.

02

Step 2: Begin by providing general information about the property and its use, including the building identification number, type of building, and the number of low-income units.

03

Step 3: Complete Part I of Form 8609, which requires you to provide information about the owner(s) of the property, including their names, addresses, and taxpayer identification numbers.

04

Step 4: Proceed to Part II and provide information about the low-income housing project itself, including the completion and placed-in-service dates, the number and type of units, and the percentage of units designated as low-income.

05

Step 5: If there are any special situations or adjustments related to the low-income housing project, such as transition rules or recertification, provide the necessary information in Part III.

06

Step 6: Review the completed form for accuracy and make any necessary corrections or revisions.

07

Step 7: Sign and date the form as the authorized individual or representative, certifying that the information provided is true and correct to the best of your knowledge.

08

Step 8: Submit the completed Form 8609 to the appropriate tax authority according to their guidelines and deadlines.

Who needs instructions for form 8609?

01

Property owners or developers who have low-income housing projects and are seeking tax credits for these projects need instructions for Form 8609.

02

Accountants or tax professionals who assist property owners or developers in completing and filing the Form 8609 may also need instructions to ensure accuracy and compliance with tax regulations.

03

Government agencies or organizations that oversee or administer low-income housing programs may require instructions for Form 8609 to properly review and process the applications.

04

Individuals or entities involved in the financing or investment of low-income housing projects, such as lenders or investors, may also benefit from understanding the instructions for Form 8609 to assess the potential tax benefits and implications of their involvement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify instructions for form 8609 without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your instructions for form 8609 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send instructions for form 8609 to be eSigned by others?

To distribute your instructions for form 8609, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Where do I find instructions for form 8609?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the instructions for form 8609 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

What is instructions for form 8609?

Instructions for Form 8609 provide guidance on how to complete the form, which is used to allocate and claim low-income housing tax credits.

Who is required to file instructions for form 8609?

Owners of low-income housing projects who are claiming tax credits are required to file instructions for Form 8609.

How to fill out instructions for form 8609?

To fill out Form 8609, follow the instructions provided in the form’s documentation, ensuring that all sections are completed with accurate project information and calculations.

What is the purpose of instructions for form 8609?

The purpose of instructions for Form 8609 is to ensure the correct completion of the form in order to claim low-income housing tax credits accurately.

What information must be reported on instructions for form 8609?

Information such as the project name, location, applicable credit percentage, and the number of qualified units must be reported on Form 8609.

Fill out your instructions for form 8609 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Instructions For Form 8609 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.