Get the free meals tax comp

Show details

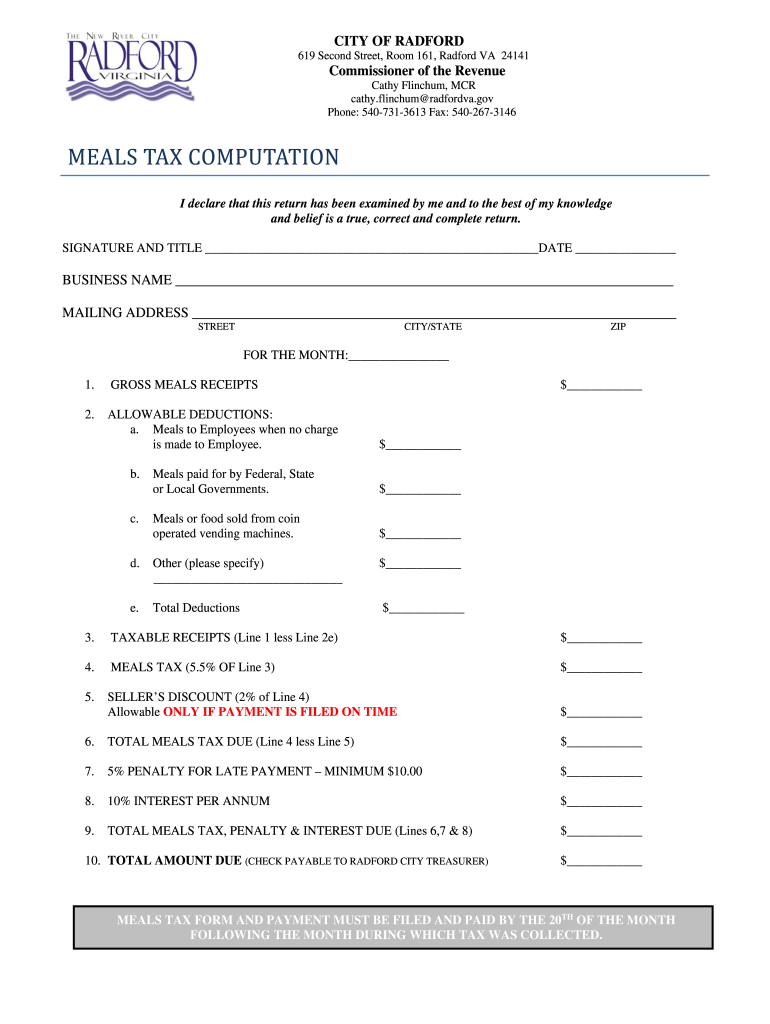

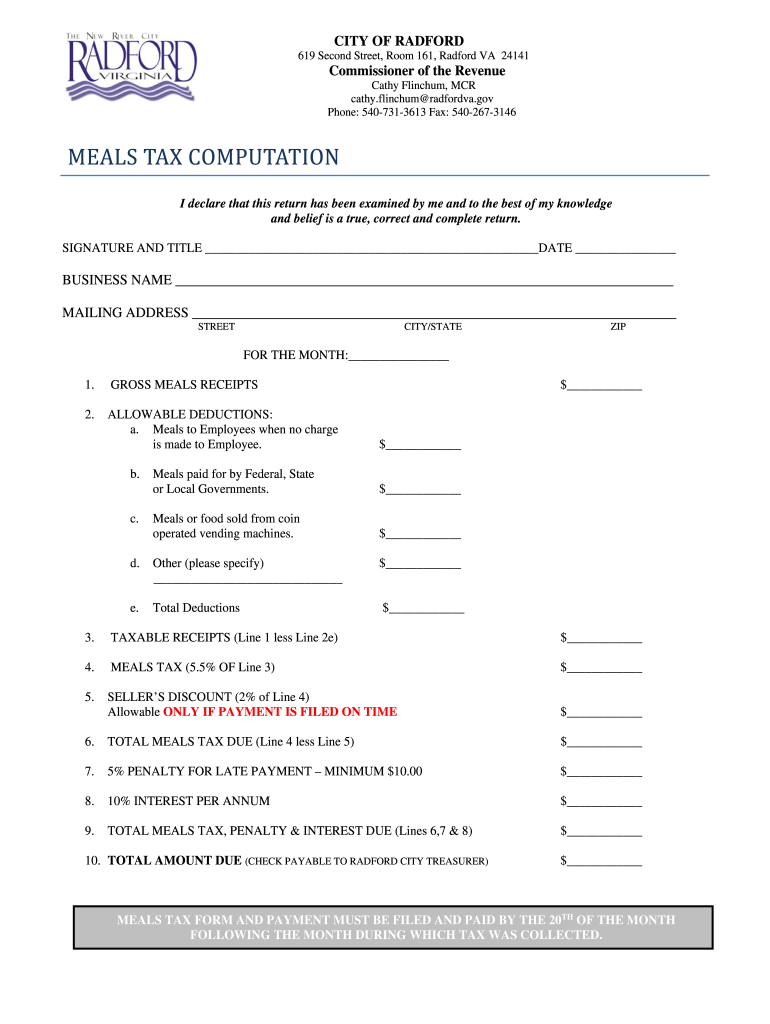

CITY OF BRADFORD 619 Second Street, Room 161, Bradford VA 24141Commissioner of the Revenue Cathy Flinchum, MCR Cathy.flinchum Bradford.gov Phone: 5407313613 Fax: 5402673146MEALS TAX COMPUTATION declare

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign meals tax comp

Edit your meals tax comp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your meals tax comp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit meals tax comp online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit meals tax comp. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out meals tax comp

How to fill out meals tax comp

01

To fill out meals tax comp, follow the steps below:

02

Gather all the necessary information, such as the total sales and the applicable tax rate.

03

Calculate the amount of meals tax owed for the given period.

04

Fill out the required forms or documents provided by the tax authority.

05

Clearly record the details of each meal sold, including the date, amount, and applicable tax.

06

Double-check all calculations and ensure accuracy.

07

Submit the completed meals tax comp on time according to the specified guidelines or deadlines.

08

Keep a copy of the filled-out comp for your records.

Who needs meals tax comp?

01

Anyone involved in the business of selling meals or operating a food establishment needs to fill out meals tax comp.

02

This includes restaurants, cafes, food trucks, catering businesses, and other similar establishments.

03

It is essential for these businesses to accurately report and pay the meals tax to comply with tax regulations and avoid any penalties or legal issues.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the meals tax comp electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your meals tax comp.

How do I edit meals tax comp on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign meals tax comp right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I fill out meals tax comp on an Android device?

On an Android device, use the pdfFiller mobile app to finish your meals tax comp. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is meals tax comp?

Meals tax comp refers to the compilation of tax information related to meals served in a particular jurisdiction, typically collected from establishments that sell prepared food and beverages.

Who is required to file meals tax comp?

Establishments that sell prepared food and beverages for consumption, such as restaurants, cafes, and catering services, are required to file meals tax comp.

How to fill out meals tax comp?

To fill out meals tax comp, one must gather sales data, calculate the total meals tax collected, and report this information on the designated form provided by the tax authority.

What is the purpose of meals tax comp?

The purpose of meals tax comp is to ensure that the correct amount of tax collected from meal sales is reported and remitted to the tax authorities for local funding and services.

What information must be reported on meals tax comp?

The meals tax comp must report total sales, total meals tax collected, and any adjustments or credits to be applied.

Fill out your meals tax comp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Meals Tax Comp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.