Get the free Policy on Fault Limits

Show details

A Licensed Event Titling Event w/Tournament Classes hosted by Red hot Rovers Being Held At: Argus Ranch Auburn, WA May 25 27, 2012 ClosingDate:Monday,May14,2012 SecondaryClosingDate:Monday,May21,2012

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign policy on fault limits

Edit your policy on fault limits form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your policy on fault limits form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit policy on fault limits online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit policy on fault limits. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out policy on fault limits

How to fill out a policy on fault limits:

01

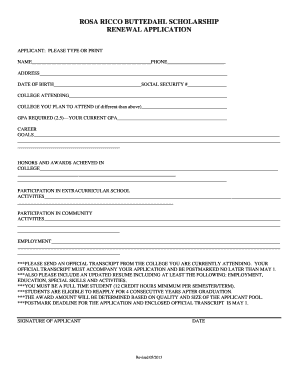

Start by gathering all relevant information about the policyholder, including their name, address, contact details, and any other necessary personal information.

02

Clearly state the purpose of the policy on fault limits. Describe what it covers, such as liability for property damage or bodily injury resulting from an employee's actions.

03

Specify the limits of liability coverage. Determine the maximum amount the insurance company will pay for any claims arising from the policyholder's fault.

04

Include any exclusions or exceptions to the policy. Outline situations or circumstances where the policy may not provide coverage.

05

Determine the premium amount for the policy. Consult with the policyholder or an insurance agent to calculate the cost based on factors such as the policyholder's business size, industry, and claims history.

06

Clearly state the policy period, which refers to the start and end dates of the coverage. It is important to specify the exact time frame during which the policy will be in effect.

07

Explain the claims process. Provide details on how to file a claim, including any necessary forms or documentation required.

08

Include any endorsements or additional coverage options available for the policyholder to consider. These may provide additional protection or customized coverage based on specific needs.

09

Review the completed policy document for accuracy and clarity. Ensure that all the information provided is consistent and understandable.

10

Obtain the necessary signatures. Have the policyholder sign the document to acknowledge their agreement to the terms and conditions outlined in the policy.

Who needs a policy on fault limits?

01

Businesses of all sizes and industries may require a policy on fault limits to protect themselves from liabilities arising from their employees' actions.

02

Professionals such as doctors, lawyers, architects, or engineers who provide services can benefit from this policy as it offers coverage against claims of professional negligence or errors.

03

Contractors and construction companies often need a policy on fault limits to protect against any damages or injuries that may occur during their work.

04

Manufacturers or sellers of products might need this policy to safeguard against liability claims resulting from any defect or harm caused by their products.

05

Service providers like restaurants, retail stores, or entertainment venues may also require this policy to cover any injuries or accidents that may happen on their premises.

06

Any individual or business that wants financial protection against potential legal claims filed by third parties due to their fault or negligence can benefit from this type of policy on fault limits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete policy on fault limits online?

Filling out and eSigning policy on fault limits is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I sign the policy on fault limits electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your policy on fault limits and you'll be done in minutes.

How can I edit policy on fault limits on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing policy on fault limits, you can start right away.

What is policy on fault limits?

The policy on fault limits refers to the maximum amount of coverage available for a particular type of insurance claim.

Who is required to file policy on fault limits?

Insurance companies and policyholders are required to file policy on fault limits.

How to fill out policy on fault limits?

Policy on fault limits can be filled out by providing detailed information about the coverage limits and terms of the insurance policy.

What is the purpose of policy on fault limits?

The purpose of policy on fault limits is to establish the maximum amount of coverage available for a claim and to ensure that policyholders are adequately protected.

What information must be reported on policy on fault limits?

Information such as coverage limits, policy terms, and contact information for the insurance company must be reported on policy on fault limits.

Fill out your policy on fault limits online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Policy On Fault Limits is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.