NJ W-9 2021 free printable template

Show details

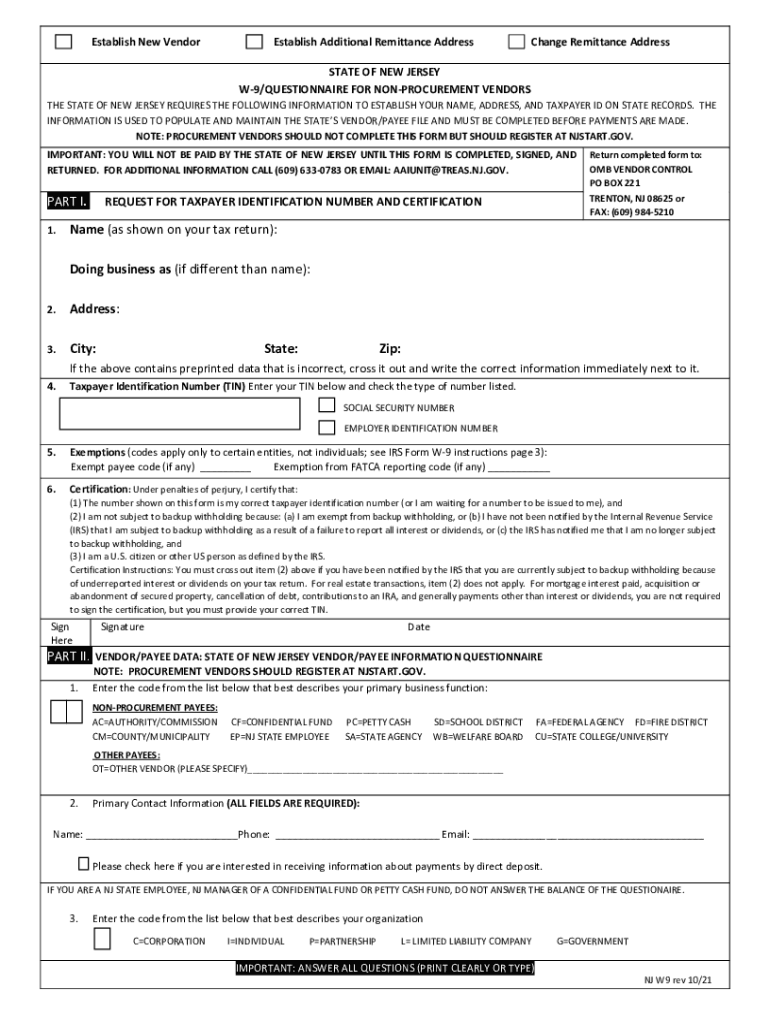

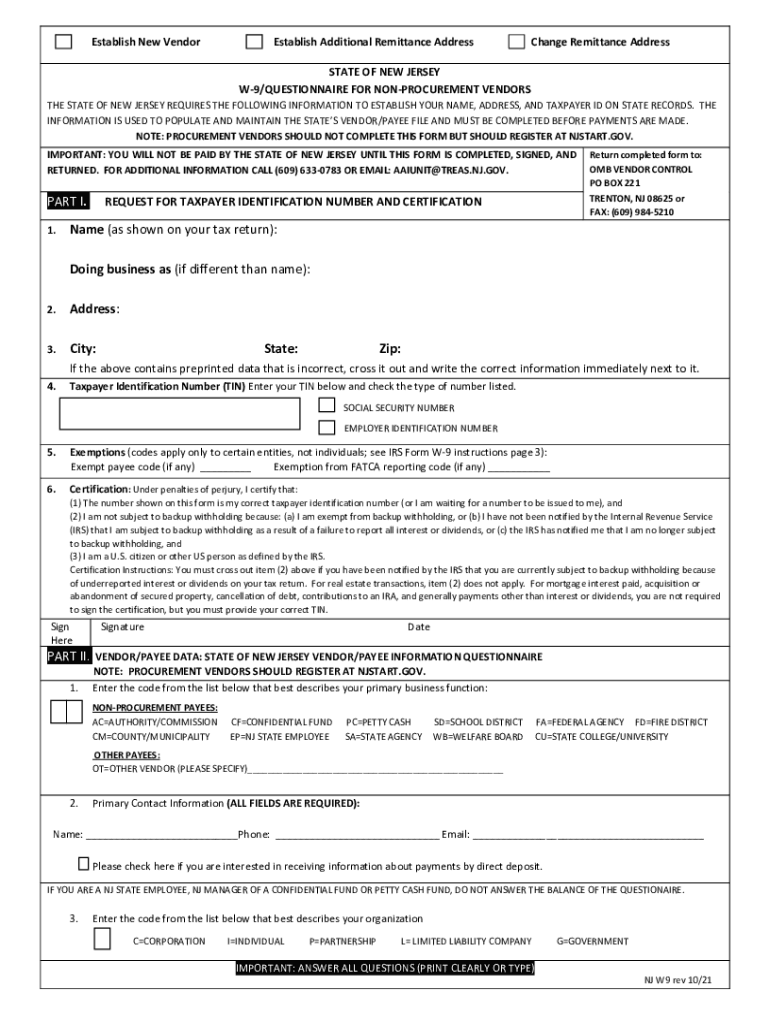

NJ W9 instr rev 10/21 Establish New Vendor Establish Additional Remittance Address Change Remittance Address STATE OF NEW JERSEY W-9/QUESTIONNAIRE FOR NON-PROCUREMENT VENDORS THE STATE OF NEW JERSEY REQUIRES THE FOLLOWING INFORMATION TO ESTABLISH YOUR NAME ADDRESS AND TAXPAYER ID ON STATE RECORDS. THE INFORMATION IS USED TO POPULATE AND MAINTAIN THE STATE S VENDOR/PAYEE FILE AND MUST BE COMPLETED BEFORE PAYMENTS ARE MADE. NOTE PROCUREMENT VENDORS SHOULD NOT COMPLETE THIS FORM BUT SHOULD...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ W-9

Edit your NJ W-9 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ W-9 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NJ W-9 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NJ W-9. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ W-9 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ W-9

How to fill out NJ W-9

01

Download the NJ W-9 form from the official New Jersey Division of Taxation website.

02

Fill in your name as it appears on your tax return in the designated field.

03

Provide your business name if applicable, in the next field.

04

Enter your address, including street, city, state, and ZIP code.

05

Indicate your taxpayer identification number (TIN), which can be your Social Security number (SSN) or Employer Identification Number (EIN).

06

Complete the 'Certification' section by signing and dating the form to confirm the information provided is accurate.

Who needs NJ W-9?

01

Individuals and entities that are required to provide a taxpayer identification number to payers for tax reporting purposes.

02

Businesses or freelancers who earn income in New Jersey and need to submit tax forms to the state.

03

Any individual or company receiving payments from New Jersey governmental entities may also be required to complete the NJ W-9.

Fill

form

: Try Risk Free

People Also Ask about

Is there a new 2021 w9 form?

As it was mentioned earlier, you can find the latest W-9 form 2021 fillable on the IRS website. Though, in most cases you'll get the blank from the requester. Note that some states may have form substitutes like the one in NY city. They'll look a bit different comparing to the conventional document.

How can I download my W9 form for free?

Commonly, the business or financial institutions will give you a blank W-9, and you can complete it directly. Or if you or your business is asked to provide a fillable w 9 form to independent contractors, you can download the w 9 form directly from the IRS website.

Can you download a w9 form?

The W-9 can be downloaded from the IRS website, and the business must then provide a completed W-9 to every employer it works for to verify its EIN for reporting purposes.

Can you print out a w9 form?

Send it via email, link, or fax. You can also download it, export it or print it out. Type text, add images, blackout confidential details, add comments, highlights and more. Draw your signature, type it, upload its image, or use your mobile device as a signature pad.

Can you print out a W9 form?

Send it via email, link, or fax. You can also download it, export it or print it out. Type text, add images, blackout confidential details, add comments, highlights and more. Draw your signature, type it, upload its image, or use your mobile device as a signature pad.

Is there an updated W9 form for 2021?

As it was mentioned earlier, you can find the latest W-9 form 2021 fillable on the IRS website. Though, in most cases you'll get the blank from the requester. Note that some states may have form substitutes like the one in NY city. They'll look a bit different comparing to the conventional document.

Can I print off a W 9 form?

Send it via email, link, or fax. You can also download it, export it or print it out. Type text, add images, blackout confidential details, add comments, highlights and more. Draw your signature, type it, upload its image, or use your mobile device as a signature pad.

How do I get a W9 form online?

Most employers will provide you with a blank W-9 as a part of standard onboarding. Visit the IRS website to download a free W-9 Form from IRS website if you haven't received your form.

What is a blank w9 form?

The W-9 is an official form furnished by the IRS for employers or other entities to verify the name, address, and tax identification number of an individual receiving income. The information taken from a W-9 form is often used to generate a 1099 tax form, which is required for income tax filing purposes.

How do I fill out a w9 for a new business?

How to fill out a W9 form Name. Line one requires the full legal name of the taxpayer. Business name. Line two is for a business name. Federal tax classification. Line three indicates the individual or business type. Exemptions. Individuals can skip this section. Address. Account numbers. Tax identification number.

How do you fill out a w9 step by step?

How to fill out a W-9 Enter your name. Write or type your full legal name as shown on your tax return. Enter your business name. Choose your federal tax classification. Choose your exemptions. Enter your street address. Enter the rest of your address. Enter your requester's information.

Do I put my name or company name on w9?

If you are a sole proprietor or single-member limited liability company (LLC), you should enter your own name on line 1 as well. Partnerships, multiple-member LLCs, C corporations, and S corporations should enter the entity's name as shown on the entity's tax return. The second line is for your business's name, if any.

How do I fill out a w9 paper?

How to fill out a W-9 Enter your name. Write or type your full legal name as shown on your tax return. Enter your business name. Choose your federal tax classification. Choose your exemptions. Enter your street address. Enter the rest of your address. Enter your requester's information.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NJ W-9 to be eSigned by others?

When you're ready to share your NJ W-9, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an electronic signature for the NJ W-9 in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your NJ W-9 in seconds.

Can I create an electronic signature for signing my NJ W-9 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your NJ W-9 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is NJ W-9?

The NJ W-9 is a form used by the state of New Jersey that allows individuals and businesses to provide their taxpayer identification information to another party for various tax purposes.

Who is required to file NJ W-9?

Individuals and entities that are required to provide their taxpayer identification information to another party, typically for payments or services rendered, are required to file a NJ W-9.

How to fill out NJ W-9?

To fill out the NJ W-9, individuals or businesses must provide their name, business name (if applicable), address, taxpayer identification number (TIN), and certification.

What is the purpose of NJ W-9?

The purpose of the NJ W-9 is to provide accurate taxpayer information for tax reporting purposes, ensuring that the correct information is reported to the IRS and the state of New Jersey.

What information must be reported on NJ W-9?

The information that must be reported on NJ W-9 includes the name, business name, address, taxpayer identification number (TIN), and the signature of the individual or authorized representative.

Fill out your NJ W-9 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ W-9 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.