Get the free The sales reported in this Form 4 were effected pursuant to a Rule 10b5-1 trading pl...

Show details

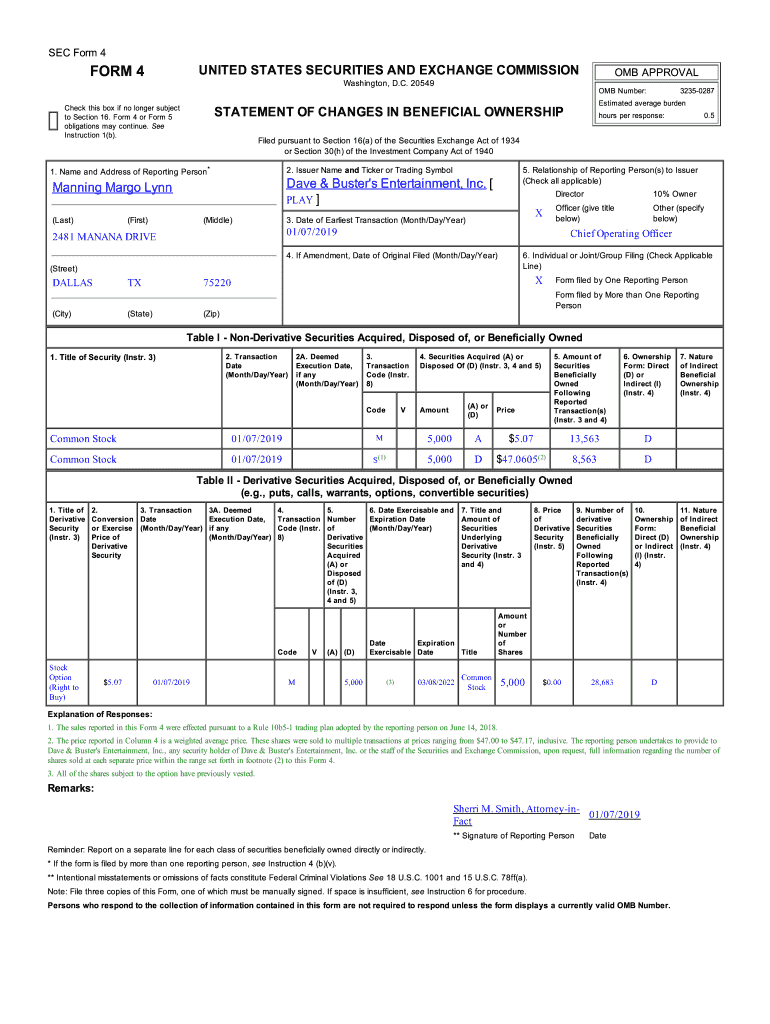

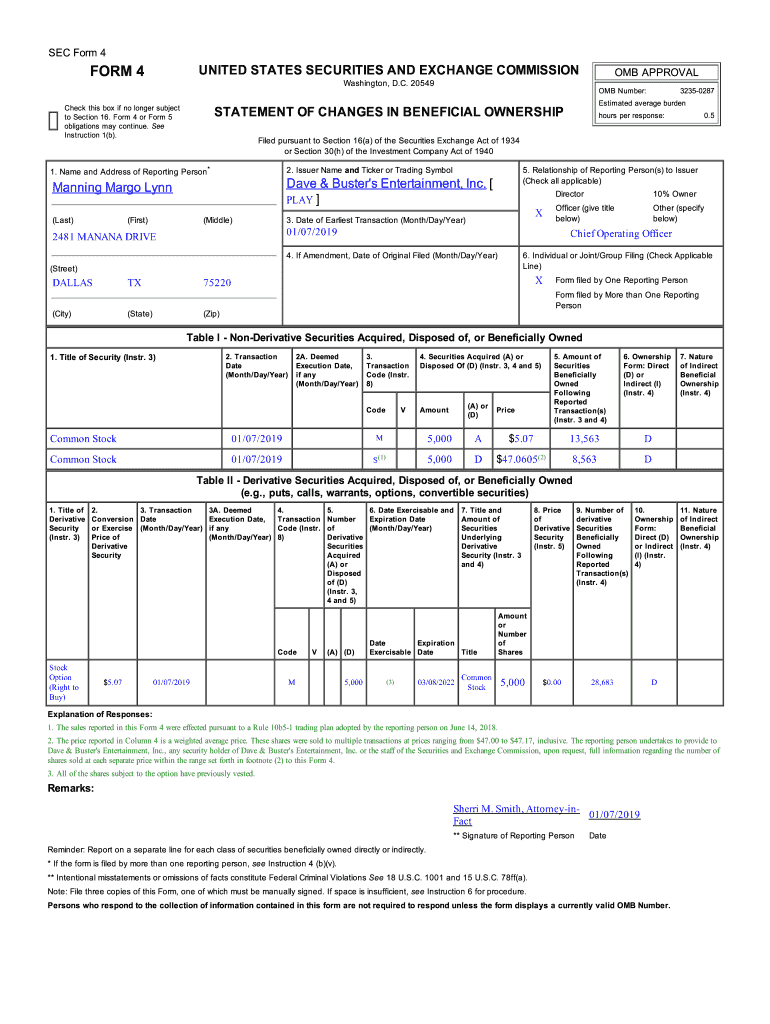

SEC Form 4UNITED STATES SECURITIES AND EXCHANGE COMMISSIONER 4 Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).OMB Number:(First)2.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign the sales reported in

Edit your the sales reported in form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your the sales reported in form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit the sales reported in online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit the sales reported in. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out the sales reported in

How to fill out the sales reported in

01

Start by collecting all the necessary information about the sales you want to report, such as the date of sale, product description, quantity sold, and the total amount.

02

Prepare a sales report form or template that includes fields for each of the collected information.

03

Fill out the date of sale in the designated field.

04

Provide a detailed description of the product that was sold.

05

Enter the quantity of the product that was sold.

06

Calculate the total amount of the sale and enter it in the appropriate field.

07

Double-check all the entered information for accuracy and completeness.

08

Submit the filled-out sales report to the appropriate department or person responsible for collecting sales data.

Who needs the sales reported in?

01

Sales reported in are needed by various stakeholders including:

02

- Business owners and managers to track sales performance and make informed decisions.

03

- Accounting and finance departments for financial reporting and analysis.

04

- Government agencies for taxation and regulatory purposes.

05

- Investors and shareholders to assess the financial health of the business.

06

- Sales and marketing teams to evaluate the effectiveness of their strategies and campaigns.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify the sales reported in without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including the sales reported in. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I sign the the sales reported in electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your the sales reported in in minutes.

Can I edit the sales reported in on an iOS device?

Create, modify, and share the sales reported in using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is the sales reported in?

The sales reported in refers to the total sales figures submitted to the relevant tax authority, often detailing gross sales, deductions, and net sales for a specific reporting period.

Who is required to file the sales reported in?

Business entities, including corporations, partnerships, and sole proprietorships, that make taxable sales are required to file the sales reported in.

How to fill out the sales reported in?

To fill out the sales reported in, businesses typically need to record their total sales, calculate any deductions (like returns and allowances), and accurately report the net sales figure on the designated form provided by the tax authority.

What is the purpose of the sales reported in?

The purpose of the sales reported in is to provide tax authorities with information about sales transactions to ensure compliance with tax regulations and to assess tax liability.

What information must be reported on the sales reported in?

The information that must be reported includes total gross sales, any returns or allowances, allowable deductions, and the net sales figure for the reporting period.

Fill out your the sales reported in online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

The Sales Reported In is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.