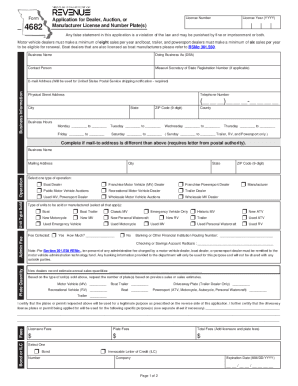

MO DoR 2519 2019 free printable template

Show details

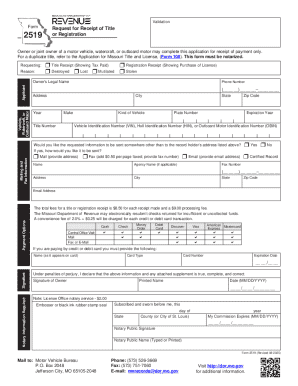

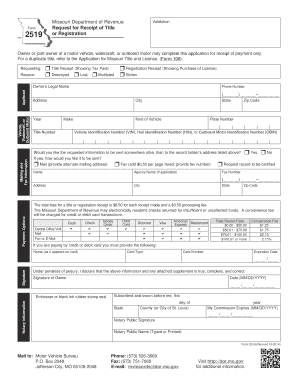

Reset Form Print Form Validation Form Request for Receipt of Title or Registration 2519 Owner or joint owner of a motor vehicle, watercraft, or outboard motor may complete this application for receipt

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO DoR 2519

Edit your MO DoR 2519 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO DoR 2519 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MO DoR 2519 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit MO DoR 2519. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO DoR 2519 Form Versions

Version

Form Popularity

Fillable & printabley

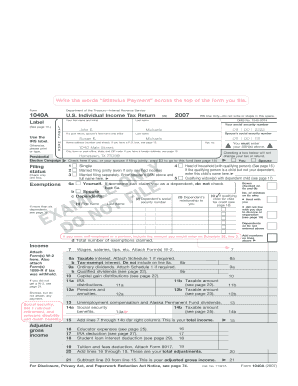

How to fill out MO DoR 2519

How to fill out MO DoR 2519

01

Obtain the MO DoR 2519 form from the Missouri Department of Revenue website or office.

02

Start by filling out your basic personal information at the top of the form, including your name, address, and contact details.

03

Provide your Social Security number or other identification number as required.

04

Fill in the tax year for which you are completing the form.

05

Follow the prompts on the form to input your income details, including wages, interest, dividends, and other income sources.

06

Deduct any allowable expenses and credits as listed in the instructions.

07

Review your entries for accuracy, ensuring all figures match your official tax documents.

08

Sign and date the form to certify that the information provided is true and correct.

09

Submit the completed form to the appropriate Missouri Department of Revenue address or via their online portal if available.

Who needs MO DoR 2519?

01

Individuals residing in Missouri who are required to report their income for tax purposes.

02

Residents who have taxable income and wish to claim deductions, credits, or report additional income categories.

03

Taxpayers seeking to fulfill their annual tax filing obligations in compliance with Missouri state laws.

Fill

form

: Try Risk Free

People Also Ask about

How much are property taxes in Missouri for vehicle?

Missouri's effective vehicle tax rate, ing to the study, is 2.72 percent, which means the owner of a new Toyota Camry LE four-door sedan — 2018's highest-selling car — valued at $24,350, as of February 2019, would pay $864 annually in taxation on the vehicle.

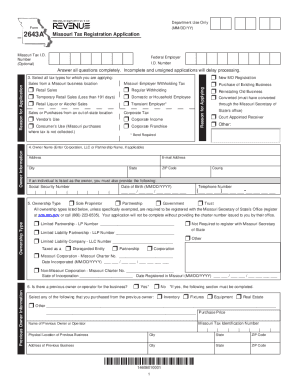

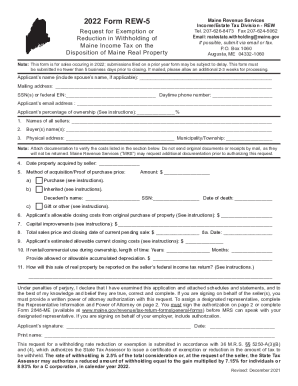

How much do you have to withhold taxes in Missouri?

Withholding Formula (Effective Pay Period 06, 2022) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $1,1211.5%Over $1,121 but not over $2,242$16.82 plus 2.0% of excess over $1,121Over $2,242 but not over $3,363$39.24 plus 2.5% of excess over $2,2426 more rows • 30 Mar 2022

How is Missouri new car tax calculated?

You can expect to pay: Missouri auto sales tax: 4.225% plus your county's sales tax rate. Registration fees: based on your vehicle's weight or total horsepower. Title fee.

How do I get a tax receipt in Missouri?

Personal property tax receipts are available online or in person at the Collector of Revenue's Office. An online tax receipt will be accepted at the Missouri Department of Revenue license offices when licensing your vehicle.

How do I pay withholding tax in Missouri?

If you are a registered MyTax Missouri user, please log in to your account to file your return. If you are not a registered MyTax Missouri user, you can file and pay the following Business taxes online using a credit card or E-Check (electronic bank draft).

What do I attach to my Missouri tax return?

Attach a copy of your federal return (pages 1 and 2) and Federal Form 8611. Include only Missouri withholding as shown on your Forms W-2, 1099, or 1099-R. Do not include withholding for federal taxes, local taxes, city earnings taxes, other state's withholding, or payments submitted with Form MO-2NR or Form MO-2ENT.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute MO DoR 2519 online?

pdfFiller makes it easy to finish and sign MO DoR 2519 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit MO DoR 2519 on an iOS device?

Create, modify, and share MO DoR 2519 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I fill out MO DoR 2519 on an Android device?

Use the pdfFiller mobile app and complete your MO DoR 2519 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is MO DoR 2519?

MO DoR 2519 is a form used by the Missouri Department of Revenue for specific tax reporting purposes.

Who is required to file MO DoR 2519?

Businesses and individuals who have specific tax obligations in Missouri are required to file MO DoR 2519.

How to fill out MO DoR 2519?

To fill out MO DoR 2519, you need to provide accurate information about your income, deductions, and other relevant tax details as specified in the form instructions.

What is the purpose of MO DoR 2519?

The purpose of MO DoR 2519 is to ensure compliance with Missouri tax regulations and to report taxable income.

What information must be reported on MO DoR 2519?

The information that must be reported on MO DoR 2519 includes personal identification details, income amounts, deduction claims, and any applicable credits.

Fill out your MO DoR 2519 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO DoR 2519 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.